Hyperpersonalization in banking leverages real-time data analytics and AI to deliver individualized financial products and services tailored to each customer's unique behaviors and preferences, surpassing traditional segmentation methods that group customers into broad categories based on demographics or transaction history. By using hyperpersonalization, banks can enhance customer experiences, increase engagement, and drive loyalty through highly relevant, dynamic interactions. Discover how embracing hyperpersonalization can revolutionize your banking strategy and customer relationships.

Why it is important

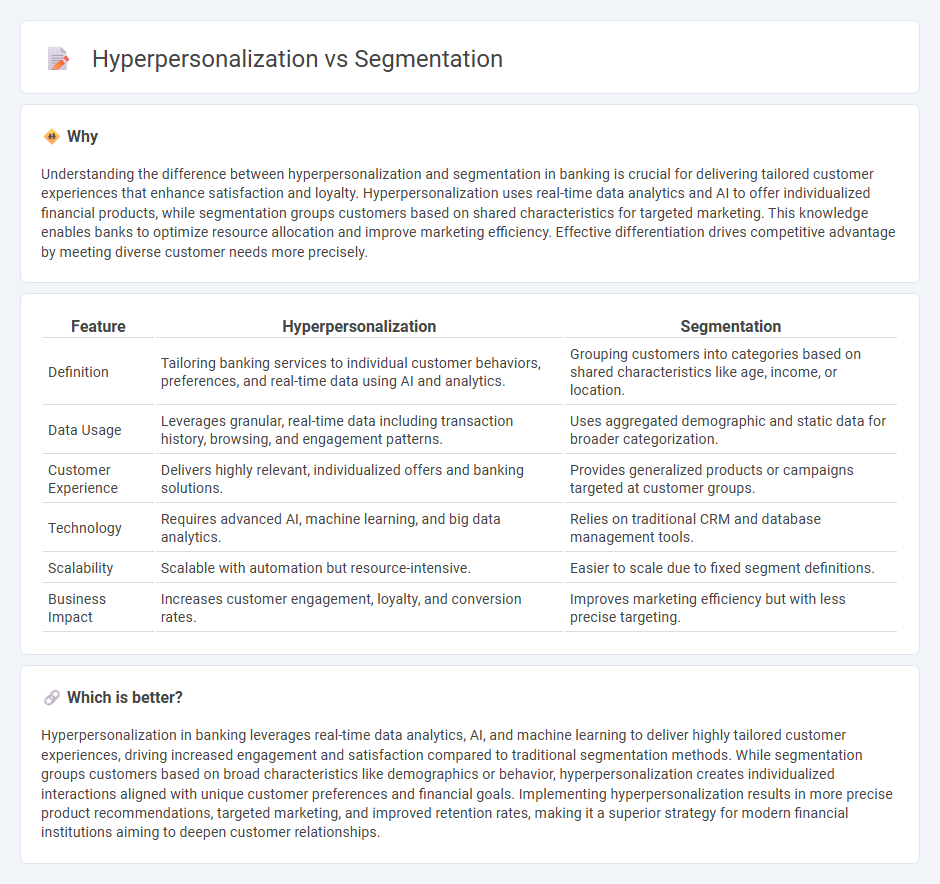

Understanding the difference between hyperpersonalization and segmentation in banking is crucial for delivering tailored customer experiences that enhance satisfaction and loyalty. Hyperpersonalization uses real-time data analytics and AI to offer individualized financial products, while segmentation groups customers based on shared characteristics for targeted marketing. This knowledge enables banks to optimize resource allocation and improve marketing efficiency. Effective differentiation drives competitive advantage by meeting diverse customer needs more precisely.

Comparison Table

| Feature | Hyperpersonalization | Segmentation |

|---|---|---|

| Definition | Tailoring banking services to individual customer behaviors, preferences, and real-time data using AI and analytics. | Grouping customers into categories based on shared characteristics like age, income, or location. |

| Data Usage | Leverages granular, real-time data including transaction history, browsing, and engagement patterns. | Uses aggregated demographic and static data for broader categorization. |

| Customer Experience | Delivers highly relevant, individualized offers and banking solutions. | Provides generalized products or campaigns targeted at customer groups. |

| Technology | Requires advanced AI, machine learning, and big data analytics. | Relies on traditional CRM and database management tools. |

| Scalability | Scalable with automation but resource-intensive. | Easier to scale due to fixed segment definitions. |

| Business Impact | Increases customer engagement, loyalty, and conversion rates. | Improves marketing efficiency but with less precise targeting. |

Which is better?

Hyperpersonalization in banking leverages real-time data analytics, AI, and machine learning to deliver highly tailored customer experiences, driving increased engagement and satisfaction compared to traditional segmentation methods. While segmentation groups customers based on broad characteristics like demographics or behavior, hyperpersonalization creates individualized interactions aligned with unique customer preferences and financial goals. Implementing hyperpersonalization results in more precise product recommendations, targeted marketing, and improved retention rates, making it a superior strategy for modern financial institutions aiming to deepen customer relationships.

Connection

Hyperpersonalization in banking relies on advanced segmentation techniques that analyze customer data such as spending habits, financial goals, and risk profiles to deliver tailored financial products and services. By leveraging machine learning algorithms and real-time data, banks can create highly specific customer segments, enabling customized marketing strategies and personalized customer experiences. This connection enhances customer engagement, increases retention rates, and drives revenue growth through targeted offerings.

Key Terms

Segmentation:

Segmentation divides a broad audience into distinct groups based on shared characteristics such as demographics, behavior, or geographic location, enabling targeted marketing strategies. This method improves campaign efficiency by tailoring messages to audience clusters, increasing relevance and engagement rates. Explore more to understand how segmentation can revolutionize your marketing efforts.

Demographics

Segmentation divides audiences into broad demographic groups based on age, gender, income, or location, enabling targeted marketing campaigns with generalized messaging. Hyperpersonalization goes beyond by leveraging real-time data and AI to craft individualized experiences tailored to each customer's specific preferences and behaviors within those demographic parameters. Explore how leveraging hyperpersonalization can transform your marketing strategy and boost customer engagement.

Customer Clusters

Customer segmentation divides audiences into distinct clusters based on shared characteristics such as demographics, purchasing behavior, and preferences to tailor marketing strategies effectively. Hyperpersonalization uses real-time data and AI to deliver individualized experiences at a granular level, surpassing traditional segmentation by considering context, intent, and micro-moments. Discover how leveraging customer clusters with hyperpersonalization can optimize engagement and drive higher ROI.

Source and External Links

Market segmentation - The process of dividing a market into distinct groups of consumers with similar characteristics, needs, or behaviors for targeted marketing strategies.

Market Segmentation: Definition, Types, Benefits, & Best Practices - Market segmentation involves splitting a target market into approachable subgroups based on demographics, interests, or behaviors to better understand and engage specific audiences.

Image segmentation - The process of partitioning a digital image into multiple segments or regions, each representing a different object or part of the scene, often using computer vision or AI techniques.

dowidth.com

dowidth.com