Digital wealth management leverages AI-driven platforms and automated financial advice to offer personalized investment strategies with lower fees and greater accessibility. Private banking provides tailored wealth solutions through dedicated advisors focusing on high-net-worth clients, emphasizing personalized service and exclusive benefits. Explore the distinctions between these approaches to optimize your financial growth.

Why it is important

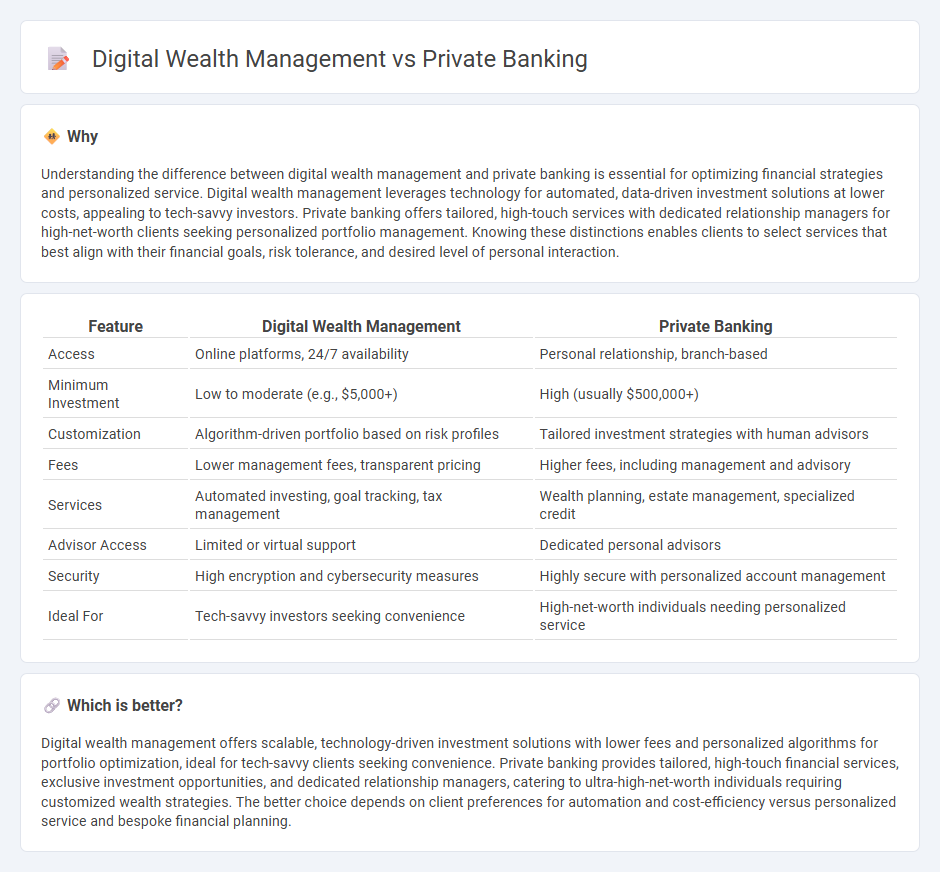

Understanding the difference between digital wealth management and private banking is essential for optimizing financial strategies and personalized service. Digital wealth management leverages technology for automated, data-driven investment solutions at lower costs, appealing to tech-savvy investors. Private banking offers tailored, high-touch services with dedicated relationship managers for high-net-worth clients seeking personalized portfolio management. Knowing these distinctions enables clients to select services that best align with their financial goals, risk tolerance, and desired level of personal interaction.

Comparison Table

| Feature | Digital Wealth Management | Private Banking |

|---|---|---|

| Access | Online platforms, 24/7 availability | Personal relationship, branch-based |

| Minimum Investment | Low to moderate (e.g., $5,000+) | High (usually $500,000+) |

| Customization | Algorithm-driven portfolio based on risk profiles | Tailored investment strategies with human advisors |

| Fees | Lower management fees, transparent pricing | Higher fees, including management and advisory |

| Services | Automated investing, goal tracking, tax management | Wealth planning, estate management, specialized credit |

| Advisor Access | Limited or virtual support | Dedicated personal advisors |

| Security | High encryption and cybersecurity measures | Highly secure with personalized account management |

| Ideal For | Tech-savvy investors seeking convenience | High-net-worth individuals needing personalized service |

Which is better?

Digital wealth management offers scalable, technology-driven investment solutions with lower fees and personalized algorithms for portfolio optimization, ideal for tech-savvy clients seeking convenience. Private banking provides tailored, high-touch financial services, exclusive investment opportunities, and dedicated relationship managers, catering to ultra-high-net-worth individuals requiring customized wealth strategies. The better choice depends on client preferences for automation and cost-efficiency versus personalized service and bespoke financial planning.

Connection

Digital wealth management integrates advanced technology platforms to enhance the personalized services traditionally offered by private banking, enabling seamless portfolio management and real-time financial insights. Private banking leverages digital tools to deliver tailored investment strategies, risk assessments, and customer relationship management, improving client engagement and operational efficiency. The convergence of these services drives innovation in asset management, wealth advisory, and secure digital transactions, ensuring clients receive comprehensive, data-driven financial solutions.

Key Terms

Personalized Advisory

Private banking offers highly personalized advisory services through direct access to dedicated financial advisors who tailor wealth strategies to individual client profiles. Digital wealth management leverages AI-driven algorithms and data analytics to provide scalable, personalized investment recommendations with real-time portfolio monitoring. Explore in-depth comparisons to understand which advisory approach aligns best with your financial goals.

Automation & Robo-advisors

Private banking traditionally offers personalized wealth management through human advisors, emphasizing bespoke financial strategies and relationship-driven services. Digital wealth management leverages automation and robo-advisors to deliver cost-effective, algorithm-based portfolio management and investment recommendations with minimal human intervention. Explore the evolving landscape of wealth management to understand how automation reshapes client experiences and investment outcomes.

Client Onboarding

Private banking offers personalized client onboarding with dedicated relationship managers who tailor services to high-net-worth individuals, ensuring a comprehensive understanding of clients' financial goals and risk profiles. Digital wealth management platforms streamline onboarding through AI-driven questionnaires and automated KYC processes, enabling faster account setup and real-time portfolio customization. Discover how these contrasting approaches can enhance your wealth management experience by exploring detailed client onboarding strategies.

Source and External Links

Private banking - Wikipedia - Private banking offers tailored financial, investment, and banking services primarily to high-net-worth individuals (HNWIs), typically requiring minimum investable assets ranging from $500,000 to $1 million, and provides access to exclusive products, expert advice, and personalized asset management.

Private Banking and Wealth Management | First National Bank - First National Bank's private banking delivers customized solutions through dedicated bankers, offering feature-rich checking, savings, mortgages, loans, and lines of credit designed for financially successful individuals and families who qualify for these specialized services.

Private Banking | Cambridge Trust - Cambridge Trust provides a personalized private banking experience with a dedicated relationship manager, addressing both personal and professional financial needs through responsive, custom banking solutions tailored to each client's unique situation.

dowidth.com

dowidth.com