Central bank digital currency (CBDC) represents a digital form of a nation's official currency issued and regulated by the central bank, ensuring stability and trust in the monetary system. Commercial bank money, in contrast, consists of digital deposits created by private banks through lending activities, which serve as the primary medium for everyday transactions. Explore the distinct characteristics and impacts of CBDC versus commercial bank money to understand the future landscape of digital finance.

Why it is important

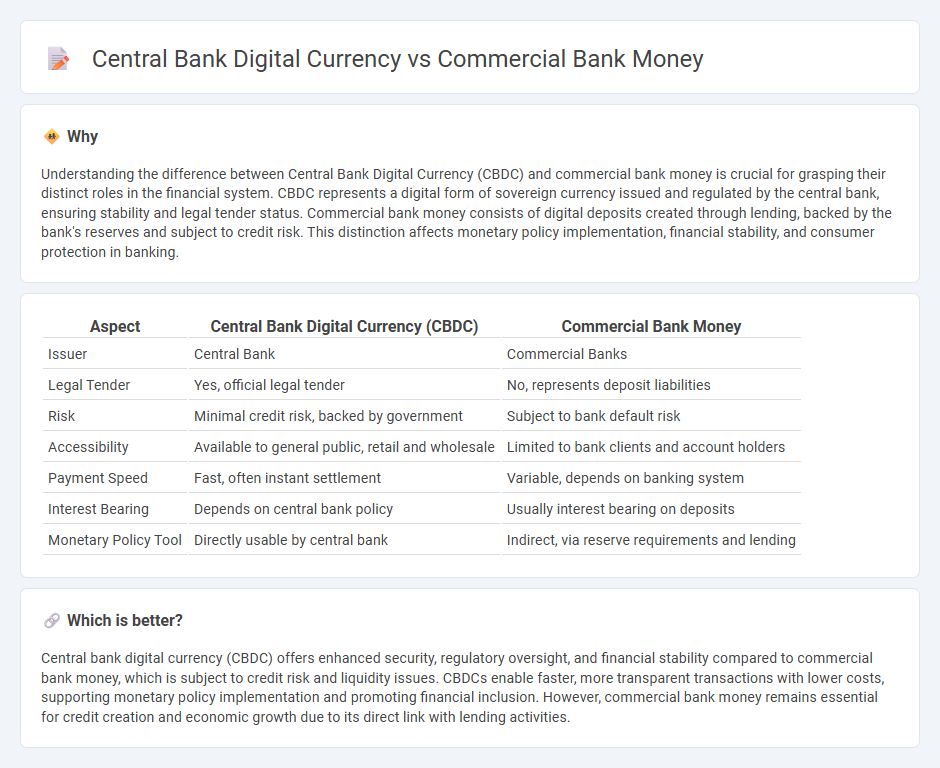

Understanding the difference between Central Bank Digital Currency (CBDC) and commercial bank money is crucial for grasping their distinct roles in the financial system. CBDC represents a digital form of sovereign currency issued and regulated by the central bank, ensuring stability and legal tender status. Commercial bank money consists of digital deposits created through lending, backed by the bank's reserves and subject to credit risk. This distinction affects monetary policy implementation, financial stability, and consumer protection in banking.

Comparison Table

| Aspect | Central Bank Digital Currency (CBDC) | Commercial Bank Money |

|---|---|---|

| Issuer | Central Bank | Commercial Banks |

| Legal Tender | Yes, official legal tender | No, represents deposit liabilities |

| Risk | Minimal credit risk, backed by government | Subject to bank default risk |

| Accessibility | Available to general public, retail and wholesale | Limited to bank clients and account holders |

| Payment Speed | Fast, often instant settlement | Variable, depends on banking system |

| Interest Bearing | Depends on central bank policy | Usually interest bearing on deposits |

| Monetary Policy Tool | Directly usable by central bank | Indirect, via reserve requirements and lending |

Which is better?

Central bank digital currency (CBDC) offers enhanced security, regulatory oversight, and financial stability compared to commercial bank money, which is subject to credit risk and liquidity issues. CBDCs enable faster, more transparent transactions with lower costs, supporting monetary policy implementation and promoting financial inclusion. However, commercial bank money remains essential for credit creation and economic growth due to its direct link with lending activities.

Connection

Central bank digital currency (CBDC) and commercial bank money are interconnected through the financial system's payment infrastructure, where CBDCs represent a digital form of a state's sovereign currency issued by the central bank, while commercial bank money consists of digital deposits created by commercial banks. The integration of CBDCs can influence commercial banks' reserve management, liquidity, and the overall monetary policy transmission by altering the demand for reserves and potentially reshaping the credit creation process. This connection underpins the dual money supply mechanism, ensuring stability and efficiency in payment systems, financial intermediation, and economic activities.

Key Terms

Fractional Reserve Banking

Commercial bank money is created through the process of fractional reserve banking, where banks hold a fraction of deposits as reserves and lend out the remainder, effectively multiplying money supply in the economy. Central bank digital currency (CBDC), issued directly by the central bank, represents a digital form of base money that does not depend on fractional reserve banking for its creation. Explore further to understand the implications of these monetary systems on financial stability and policy.

Fiat Currency

Commercial bank money, primarily created through loans and deposits within the banking system, represents a significant portion of the fiat currency circulating in the economy. Central bank digital currency (CBDC) is a government-issued digital form of fiat currency designed to enhance payment efficiency, security, and financial inclusion by offering a direct digital claim on the central bank. Explore the differences, benefits, and implications of these two forms of fiat currency to understand their impact on modern financial systems.

Digital Ledger

Commercial bank money operates as digital deposits recorded in private digital ledgers managed by individual banks, enabling seamless transactions and credit creation. Central bank digital currency (CBDC) is a state-backed digital asset maintained on a centralized or distributed digital ledger that ensures secure and transparent money issuance directly by the central authority. Explore the differences and implications of these digital ledger systems to understand their impact on the future of digital finance.

Source and External Links

Bank money - Commercial bank money consists mainly of deposit balances and checks that function as IOUs from the bank, redeemable on demand in base money such as fiat currency.

What Is a Commercial Bank? - Commercial banks accept deposits and provide loans, with most of the money people use for daily transactions existing as electronic records in their accounts rather than physical cash.

What is money? - Most of the money in modern economies is commercial bank money, created when banks extend loans and maintain deposit balances, and it is backed by the assets of commercial banks.

dowidth.com

dowidth.com