Loyalty fintech platforms leverage advanced data analytics and customer behavior insights to offer personalized financial rewards and enhance user engagement, distinguishing themselves from traditional microfinance institutions that primarily focus on providing small loans to underserved populations. These fintech innovations drive customer retention through seamless digital experiences and incentivized transactions, while microfinance institutions emphasize financial inclusion and grassroots economic development. Explore how the evolving banking landscape balances technology-driven loyalty programs with foundational microfinance services.

Why it is important

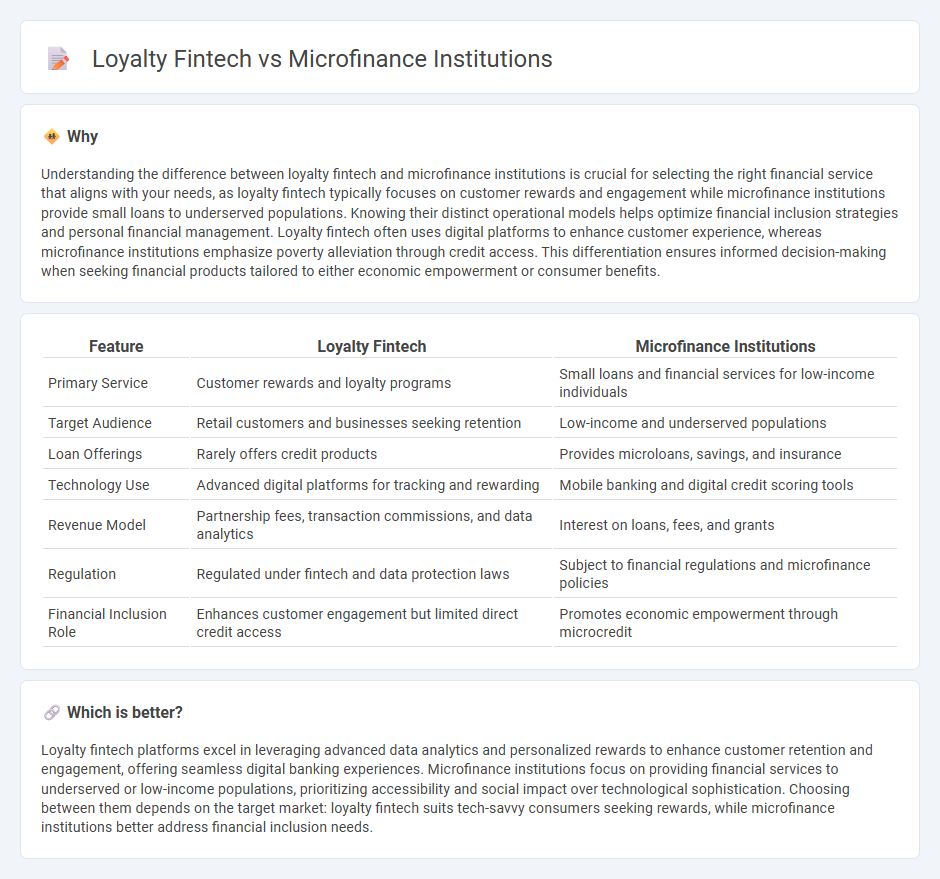

Understanding the difference between loyalty fintech and microfinance institutions is crucial for selecting the right financial service that aligns with your needs, as loyalty fintech typically focuses on customer rewards and engagement while microfinance institutions provide small loans to underserved populations. Knowing their distinct operational models helps optimize financial inclusion strategies and personal financial management. Loyalty fintech often uses digital platforms to enhance customer experience, whereas microfinance institutions emphasize poverty alleviation through credit access. This differentiation ensures informed decision-making when seeking financial products tailored to either economic empowerment or consumer benefits.

Comparison Table

| Feature | Loyalty Fintech | Microfinance Institutions |

|---|---|---|

| Primary Service | Customer rewards and loyalty programs | Small loans and financial services for low-income individuals |

| Target Audience | Retail customers and businesses seeking retention | Low-income and underserved populations |

| Loan Offerings | Rarely offers credit products | Provides microloans, savings, and insurance |

| Technology Use | Advanced digital platforms for tracking and rewarding | Mobile banking and digital credit scoring tools |

| Revenue Model | Partnership fees, transaction commissions, and data analytics | Interest on loans, fees, and grants |

| Regulation | Regulated under fintech and data protection laws | Subject to financial regulations and microfinance policies |

| Financial Inclusion Role | Enhances customer engagement but limited direct credit access | Promotes economic empowerment through microcredit |

Which is better?

Loyalty fintech platforms excel in leveraging advanced data analytics and personalized rewards to enhance customer retention and engagement, offering seamless digital banking experiences. Microfinance institutions focus on providing financial services to underserved or low-income populations, prioritizing accessibility and social impact over technological sophistication. Choosing between them depends on the target market: loyalty fintech suits tech-savvy consumers seeking rewards, while microfinance institutions better address financial inclusion needs.

Connection

Loyalty fintech platforms leverage data analytics to enhance customer retention for microfinance institutions by offering personalized financial products and reward programs. Microfinance institutions rely on fintech innovations to streamline loan disbursement, improve credit scoring, and increase accessibility for underserved populations. The integration of loyalty programs within fintech services fosters trust and engagement, driving sustainable growth in microfinance banking sectors.

Key Terms

**Microfinance Institutions:**

Microfinance institutions provide small loans, savings, and financial services to underserved populations, focusing on poverty alleviation and financial inclusion. These institutions often rely on group lending models and close community relationships to mitigate risk and enhance repayment rates. Discover how microfinance institutions transform communities through targeted financial empowerment and sustainable development.

Microloans

Microfinance institutions primarily target underserved populations by providing small, unsecured microloans to promote financial inclusion and economic development. Loyalty fintech platforms integrate rewards and incentives with microloan products, enhancing customer retention and engagement through personalized benefits and seamless digital experiences. Explore detailed insights on how these models reshape access to affordable credit and foster financial empowerment.

Financial Inclusion

Microfinance institutions provide small loans and financial services to underserved populations, aiming to increase financial inclusion by empowering low-income individuals and micro-entrepreneurs. Loyalty fintech platforms enhance financial inclusion by rewarding customer engagement and spending behaviors with digital incentives, promoting access to financial products through technology-driven loyalty programs. Explore how these innovative approaches are transforming access to finance and driving inclusion worldwide.

Source and External Links

Microfinance 101: All you need to know - Kiva - Microfinance involves providing small loans and financial services to individuals and businesses that lack access to traditional banking, aiming to alleviate poverty and promote economic development.

Microfinance Institutions - Interest Rate & Eligibility - Groww - Microfinance institutions (MFIs) offer loans, savings, and insurance products to underserved populations, especially in rural and semi-urban areas, to foster entrepreneurship, financial inclusion, and poverty reduction.

Microfinancing Basics - My Own Business Institute - MFIs can be client-centered, focusing on borrower welfare and business growth, or institution-centered, prioritizing scale and profitability, with the former often providing additional support like financial education and business training.

dowidth.com

dowidth.com