Predictive analytics in banking uses historical data to forecast customer behavior, enabling financial institutions to tailor services and manage risks effectively. Customer lifetime value (CLV) modeling quantifies the total worth of a customer over their entire relationship with the bank, guiding strategic decisions on acquisition and retention. Discover how integrating these powerful tools can optimize banking performance and customer experience.

Why it is important

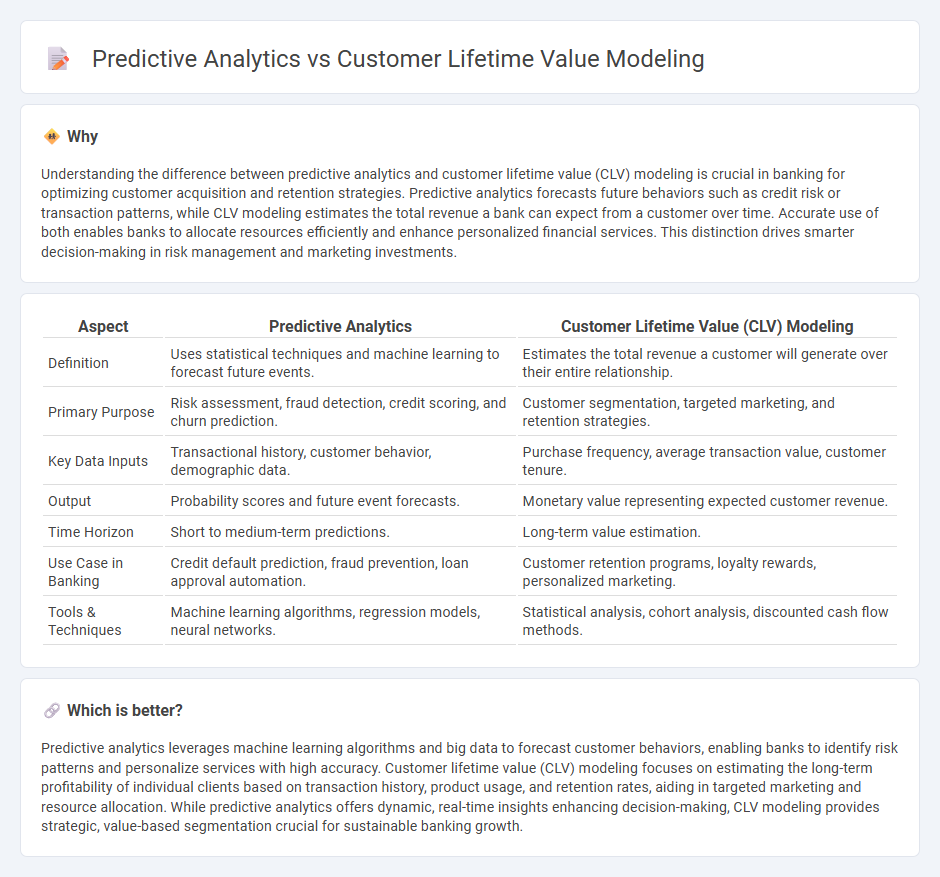

Understanding the difference between predictive analytics and customer lifetime value (CLV) modeling is crucial in banking for optimizing customer acquisition and retention strategies. Predictive analytics forecasts future behaviors such as credit risk or transaction patterns, while CLV modeling estimates the total revenue a bank can expect from a customer over time. Accurate use of both enables banks to allocate resources efficiently and enhance personalized financial services. This distinction drives smarter decision-making in risk management and marketing investments.

Comparison Table

| Aspect | Predictive Analytics | Customer Lifetime Value (CLV) Modeling |

|---|---|---|

| Definition | Uses statistical techniques and machine learning to forecast future events. | Estimates the total revenue a customer will generate over their entire relationship. |

| Primary Purpose | Risk assessment, fraud detection, credit scoring, and churn prediction. | Customer segmentation, targeted marketing, and retention strategies. |

| Key Data Inputs | Transactional history, customer behavior, demographic data. | Purchase frequency, average transaction value, customer tenure. |

| Output | Probability scores and future event forecasts. | Monetary value representing expected customer revenue. |

| Time Horizon | Short to medium-term predictions. | Long-term value estimation. |

| Use Case in Banking | Credit default prediction, fraud prevention, loan approval automation. | Customer retention programs, loyalty rewards, personalized marketing. |

| Tools & Techniques | Machine learning algorithms, regression models, neural networks. | Statistical analysis, cohort analysis, discounted cash flow methods. |

Which is better?

Predictive analytics leverages machine learning algorithms and big data to forecast customer behaviors, enabling banks to identify risk patterns and personalize services with high accuracy. Customer lifetime value (CLV) modeling focuses on estimating the long-term profitability of individual clients based on transaction history, product usage, and retention rates, aiding in targeted marketing and resource allocation. While predictive analytics offers dynamic, real-time insights enhancing decision-making, CLV modeling provides strategic, value-based segmentation crucial for sustainable banking growth.

Connection

Predictive analytics leverages historical banking data to forecast customer behaviors and financial trends, enabling precise customer lifetime value (CLV) modeling. By analyzing transaction patterns, credit scores, and engagement metrics, banks can identify high-value clients and tailor personalized financial products to enhance retention. This integration of predictive analytics with CLV modeling optimizes marketing strategies and profitability in the banking sector.

Key Terms

Customer Lifetime Value Modeling:

Customer Lifetime Value (CLV) modeling quantifies the total worth of a customer to a business over the entire relationship duration, enabling targeted marketing and strategic resource allocation. This model leverages transactional data, purchase frequency, and retention rates to forecast future revenue, crucial for maximizing profitability in sectors like e-commerce and subscription services. Explore deeper insights into CLV modeling techniques and applications to enhance your customer engagement strategy.

Retention Rate

Customer Lifetime Value (CLV) modeling quantifies the total revenue a customer generates over their relationship, with Retention Rate as a key driver in estimating long-term profitability. Predictive analytics utilizes historical retention data and behavioral patterns to forecast future customer churn, enabling targeted retention strategies. Explore how integrating CLV modeling and predictive analytics can optimize retention and maximize revenue growth.

Average Revenue per User (ARPU)

Customer lifetime value (CLV) modeling estimates the total revenue a business can expect from a single customer over their entire relationship, incorporating metrics like churn rate and purchase frequency. Predictive analytics uses historical data to forecast future metrics such as Average Revenue per User (ARPU), enabling targeted marketing and resource allocation. Explore further to understand how ARPU-driven insights enhance customer retention and profitability.

Source and External Links

Customer Lifetime Value models - Oracle Help Center - The Customer Lifetime Value model estimates a customer's value over time based on profile and transaction patterns to help optimize acquisition, retention, and personalized offers with customizable prediction periods like 3, 6, or 12 months.

Customer Lifetime Value (CLV) Models Explained - GetCensus - CLV models project the total revenue a customer will generate during their relationship, incorporating purchase frequency, average order value, retention rate, acquisition cost, and profit margin to support strategic business decisions.

Customer Lifetime Value (CLV): What Is It and How to Calculate It - CLV can be calculated by multiplying average order value, purchase frequency, gross margin, and the expected customer lifetime (inverse of churn rate), providing a practical formula to quantify customer worth for businesses.

dowidth.com

dowidth.com