Digital onboarding streamlines banking services by allowing customers to verify identities and submit documents online, enhancing convenience and reducing branch visits. Remote account opening leverages secure technology to enable users to open new accounts from any location, ensuring swift access to financial products without physical presence. Discover how these innovations transform customer experience and operational efficiency in banking.

Why it is important

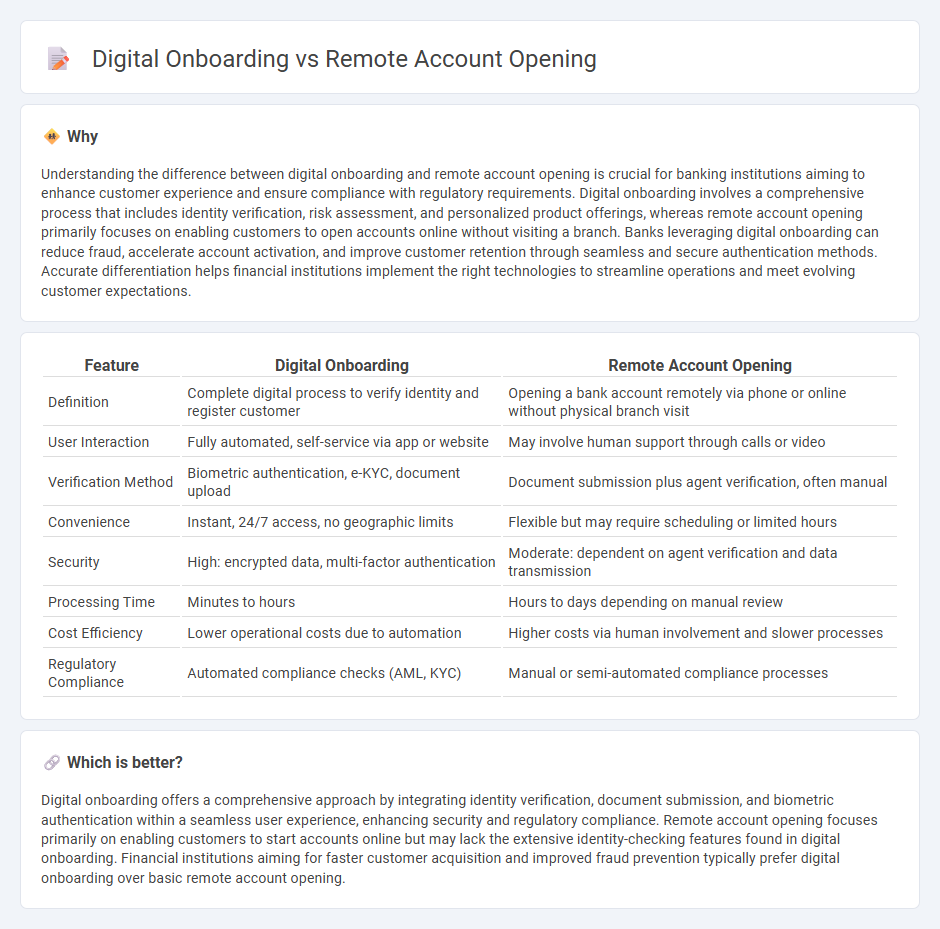

Understanding the difference between digital onboarding and remote account opening is crucial for banking institutions aiming to enhance customer experience and ensure compliance with regulatory requirements. Digital onboarding involves a comprehensive process that includes identity verification, risk assessment, and personalized product offerings, whereas remote account opening primarily focuses on enabling customers to open accounts online without visiting a branch. Banks leveraging digital onboarding can reduce fraud, accelerate account activation, and improve customer retention through seamless and secure authentication methods. Accurate differentiation helps financial institutions implement the right technologies to streamline operations and meet evolving customer expectations.

Comparison Table

| Feature | Digital Onboarding | Remote Account Opening |

|---|---|---|

| Definition | Complete digital process to verify identity and register customer | Opening a bank account remotely via phone or online without physical branch visit |

| User Interaction | Fully automated, self-service via app or website | May involve human support through calls or video |

| Verification Method | Biometric authentication, e-KYC, document upload | Document submission plus agent verification, often manual |

| Convenience | Instant, 24/7 access, no geographic limits | Flexible but may require scheduling or limited hours |

| Security | High: encrypted data, multi-factor authentication | Moderate: dependent on agent verification and data transmission |

| Processing Time | Minutes to hours | Hours to days depending on manual review |

| Cost Efficiency | Lower operational costs due to automation | Higher costs via human involvement and slower processes |

| Regulatory Compliance | Automated compliance checks (AML, KYC) | Manual or semi-automated compliance processes |

Which is better?

Digital onboarding offers a comprehensive approach by integrating identity verification, document submission, and biometric authentication within a seamless user experience, enhancing security and regulatory compliance. Remote account opening focuses primarily on enabling customers to start accounts online but may lack the extensive identity-checking features found in digital onboarding. Financial institutions aiming for faster customer acquisition and improved fraud prevention typically prefer digital onboarding over basic remote account opening.

Connection

Digital onboarding streamlines remote account opening by enabling customers to submit identification documents and complete verification processes online without visiting a branch. Advanced technologies such as biometric authentication, AI-driven identity verification, and electronic signatures ensure security and compliance with KYC regulations. This seamless integration reduces onboarding time, enhances customer experience, and lowers operational costs for banks.

Key Terms

Remote Account Opening:

Remote account opening enables customers to create bank accounts online without visiting a branch, leveraging biometric verification and real-time document uploads to expedite the process. This method enhances user convenience and reduces operational costs for financial institutions while ensuring compliance with KYC and AML regulations. Explore how remote account opening transforms banking experiences and drives digital innovation.

eKYC

Remote account opening involves the process of creating financial accounts without physical branch visits, utilizing online platforms. Digital onboarding, incorporating electronic Know Your Customer (eKYC) protocols, verifies identities through biometric data, document scanning, and AI-driven authentication to ensure compliance and reduce fraud. Explore the advantages of eKYC in streamlining secure, efficient customer acquisition.

Digital Identity Verification

Digital Identity Verification plays a crucial role in both remote account opening and digital onboarding by ensuring secure and accurate user authentication. Remote account opening primarily uses identity verification to confirm new customers' identities quickly, while digital onboarding integrates this process with continuous compliance checks and user experience optimization. Explore the advancements in Digital Identity Verification to enhance security and streamline client acquisition.

Source and External Links

Remote Account Opening [2025 Guide] - GlobalBanks - Remote account opening allows individuals to open bank accounts without visiting branches physically, primarily through online applications that require identity verification and meeting KYC/AML criteria, though full remote opening can be difficult for non-residents with limited regional ties.

Remote account opening: The rise of the virtual bank branch - Remote account opening increasingly relies on video-enabled platforms to simulate in-person banking, offering co-browsing and real-time collaboration, strong identity verification, and legally binding e-signatures to provide a secure and interactive customer experience.

Bank accounts and payment services - Clevver.io - Clevver provides 100% online remote account opening including for non-US residents, requiring submission of ID documents and company details digitally, with virtual and physical debit/credit cards and services focused on both personal and business banking.

dowidth.com

dowidth.com