Credit builder cards are specifically designed to help individuals with no or poor credit history establish or improve their credit score through responsible use and regular reporting to credit bureaus. Unsecured credit cards, unlike secured or credit builder cards, do not require a security deposit, making them accessible to consumers with fair to excellent credit profiles. Explore detailed comparisons and benefits to determine which card best suits your financial goals.

Why it is important

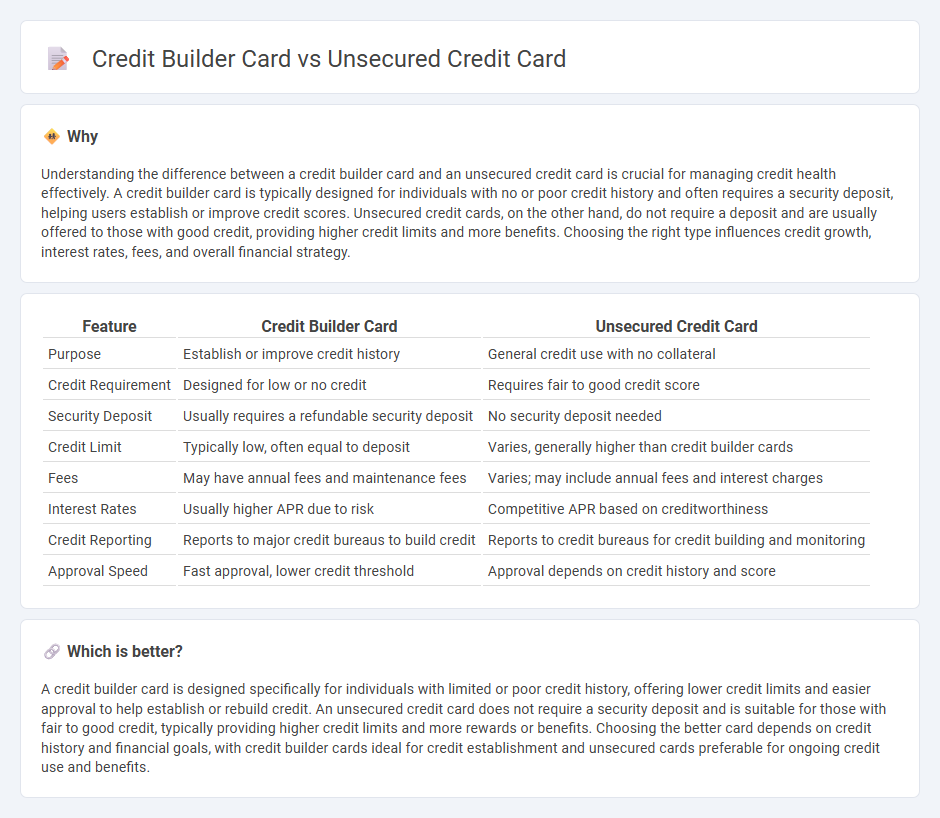

Understanding the difference between a credit builder card and an unsecured credit card is crucial for managing credit health effectively. A credit builder card is typically designed for individuals with no or poor credit history and often requires a security deposit, helping users establish or improve credit scores. Unsecured credit cards, on the other hand, do not require a deposit and are usually offered to those with good credit, providing higher credit limits and more benefits. Choosing the right type influences credit growth, interest rates, fees, and overall financial strategy.

Comparison Table

| Feature | Credit Builder Card | Unsecured Credit Card |

|---|---|---|

| Purpose | Establish or improve credit history | General credit use with no collateral |

| Credit Requirement | Designed for low or no credit | Requires fair to good credit score |

| Security Deposit | Usually requires a refundable security deposit | No security deposit needed |

| Credit Limit | Typically low, often equal to deposit | Varies, generally higher than credit builder cards |

| Fees | May have annual fees and maintenance fees | Varies; may include annual fees and interest charges |

| Interest Rates | Usually higher APR due to risk | Competitive APR based on creditworthiness |

| Credit Reporting | Reports to major credit bureaus to build credit | Reports to credit bureaus for credit building and monitoring |

| Approval Speed | Fast approval, lower credit threshold | Approval depends on credit history and score |

Which is better?

A credit builder card is designed specifically for individuals with limited or poor credit history, offering lower credit limits and easier approval to help establish or rebuild credit. An unsecured credit card does not require a security deposit and is suitable for those with fair to good credit, typically providing higher credit limits and more rewards or benefits. Choosing the better card depends on credit history and financial goals, with credit builder cards ideal for credit establishment and unsecured cards preferable for ongoing credit use and benefits.

Connection

A credit builder card is a type of unsecured credit card designed to help individuals establish or improve their credit by reporting payment history to credit bureaus without requiring collateral. Both credit builder cards and unsecured credit cards allow users to build credit profiles through responsible use, such as timely payments and low credit utilization. Financial institutions use these cards to assess credit risk, enabling users with limited or no credit history to access credit and improve their credit scores over time.

Key Terms

Credit Limit

Unsecured credit cards typically offer higher credit limits based on creditworthiness, while credit builder cards often start with lower limits designed to minimize risk and help establish credit history. Credit builder cards usually increase limits gradually as responsible usage is demonstrated, promoting steady credit growth. Explore comprehensive comparisons to understand which card aligns best with your financial goals.

Security Deposit

Unsecured credit cards do not require a security deposit, making them accessible to individuals with good or excellent credit, while credit builder cards typically mandate a refundable security deposit to mitigate lender risk for those with limited or poor credit history. The security deposit on credit builder cards often determines the card's credit limit and is held as collateral until the cardholder demonstrates responsible use and timely payments. Explore detailed comparisons to understand which card aligns best with your financial goals and credit-building needs.

Credit History

Unsecured credit cards typically require a good credit history, allowing users to build or maintain credit with responsible use, while credit builder cards are designed specifically for individuals with little to no credit history, providing a secured pathway to establish credit. Credit builder cards often require a refundable security deposit, which serves as the credit limit and minimizes risk for issuers. Explore more to understand which option can best support your credit history goals.

Source and External Links

What is an Unsecured Credit Card - This webpage explains that unsecured credit cards are revolving credit lines that do not require collateral and are granted based on factors like credit history and income.

What Is an Unsecured Credit Card? - This page describes unsecured credit cards as revolving lines of credit that offer spending up to a certain limit, established based on creditworthiness and debt-to-income ratio.

5 Best Unsecured Credit Cards for Bad Credit 2025 - This article highlights unsecured credit cards suitable for individuals with poor credit, offering insights into how to apply and maintain them effectively.

dowidth.com

dowidth.com