Alternative credit data includes non-traditional financial information such as utility payments, rental history, and mobile phone bills, providing a broader view of creditworthiness compared to traditional credit data, which relies mainly on loan and credit card repayment records. This expanded dataset improves access to credit for underbanked consumers and enhances risk assessment for lenders by incorporating diverse financial behaviors. Explore how integrating alternative credit data can revolutionize lending decisions and financial inclusion.

Why it is important

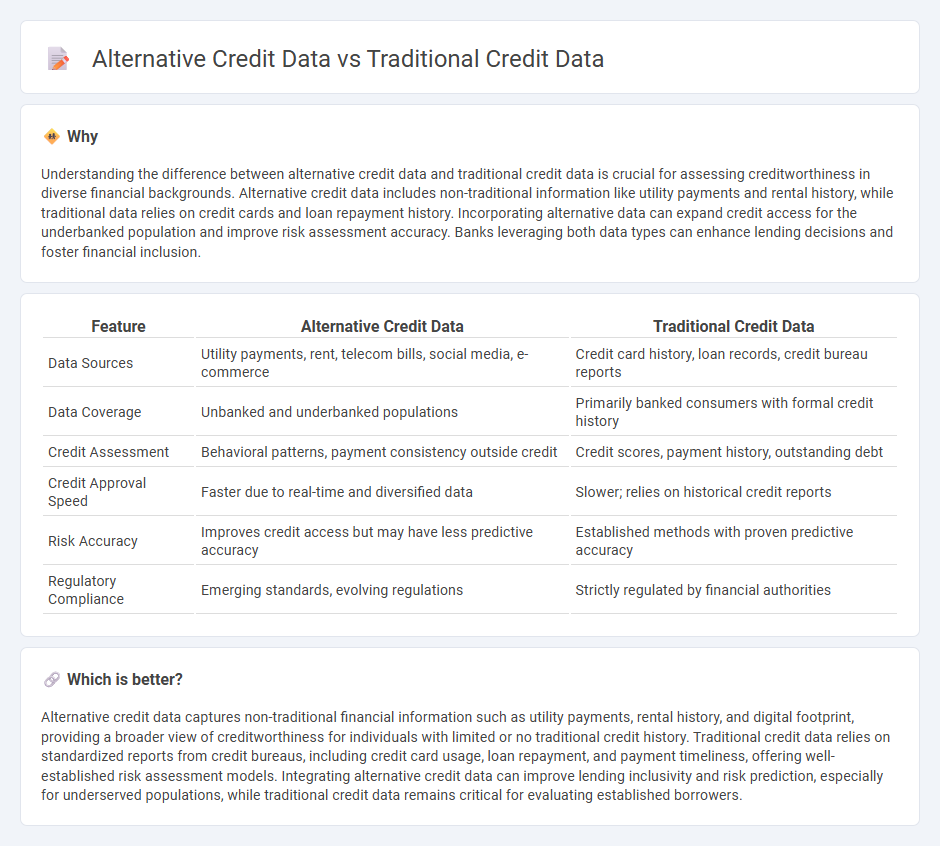

Understanding the difference between alternative credit data and traditional credit data is crucial for assessing creditworthiness in diverse financial backgrounds. Alternative credit data includes non-traditional information like utility payments and rental history, while traditional data relies on credit cards and loan repayment history. Incorporating alternative data can expand credit access for the underbanked population and improve risk assessment accuracy. Banks leveraging both data types can enhance lending decisions and foster financial inclusion.

Comparison Table

| Feature | Alternative Credit Data | Traditional Credit Data |

|---|---|---|

| Data Sources | Utility payments, rent, telecom bills, social media, e-commerce | Credit card history, loan records, credit bureau reports |

| Data Coverage | Unbanked and underbanked populations | Primarily banked consumers with formal credit history |

| Credit Assessment | Behavioral patterns, payment consistency outside credit | Credit scores, payment history, outstanding debt |

| Credit Approval Speed | Faster due to real-time and diversified data | Slower; relies on historical credit reports |

| Risk Accuracy | Improves credit access but may have less predictive accuracy | Established methods with proven predictive accuracy |

| Regulatory Compliance | Emerging standards, evolving regulations | Strictly regulated by financial authorities |

Which is better?

Alternative credit data captures non-traditional financial information such as utility payments, rental history, and digital footprint, providing a broader view of creditworthiness for individuals with limited or no traditional credit history. Traditional credit data relies on standardized reports from credit bureaus, including credit card usage, loan repayment, and payment timeliness, offering well-established risk assessment models. Integrating alternative credit data can improve lending inclusivity and risk prediction, especially for underserved populations, while traditional credit data remains critical for evaluating established borrowers.

Connection

Alternative credit data, including utility payments, rental history, and social media activity, complements traditional credit data such as credit card payments and loan histories to provide a more comprehensive risk assessment for banks. Financial institutions integrate these diverse data sources using advanced algorithms and machine learning models to enhance credit scoring accuracy and reduce default rates. This connection enables lenders to extend credit access to underserved populations while maintaining effective risk management strategies.

Key Terms

Credit Score

Traditional credit data relies on payment history, credit utilization, and length of credit history to calculate credit scores, often excluding individuals with limited credit activity. Alternative credit data includes utility payments, rent, and mobile phone bills, offering a more comprehensive view of creditworthiness for those with thin or no credit files. Explore how integrating alternative credit data can redefine credit scoring models and improve financial inclusion.

Financial Transactions

Traditional credit data primarily relies on historical loan repayments, credit card usage, and bank statements to assess creditworthiness, while alternative credit data includes a broader range of financial transactions such as utility payments, rental history, and digital payment activities. Incorporating alternative credit data provides a more comprehensive view of an individual's financial behavior, especially for those with limited credit history. Discover how integrating these diverse data sources can enhance credit assessments and financial inclusion.

Social Media Data

Traditional credit data relies heavily on financial history, payment records, and credit scores from established credit bureaus, providing a conventional metric of creditworthiness. Alternative credit data, such as social media data, analyzes online behavior, social interactions, and digital footprints to assess risk and credit potential, especially for individuals lacking formal credit histories. Explore how social media data is transforming credit evaluations by offering deeper insights into consumer reliability beyond traditional reports.

Source and External Links

Traditional Vs. Alternative Credit Scoring: Differences and ... - Traditional credit data typically includes factors such as payment history, amounts owed, length of credit history, credit mix, and new credit, which together form the basis of classic credit scoring models like FICO.

How Alternative and Traditional Data Work Better Together - Traditional credit data consists of well-established metrics such as credit scores, loan histories, and credit card repayment records, which lenders have used for decades to assess borrower risk.

Traditional Vs. Alternative Credit Scoring Methods - Traditional credit data is limited to information on payment history, outstanding debt, length of credit history, and similar factors reported to major credit bureaus.

dowidth.com

dowidth.com