Predictive analytics in banking leverages data models and machine learning algorithms to forecast future trends, customer behaviors, and potential credit defaults, enhancing decision-making accuracy. Operational risk management focuses on identifying, assessing, and mitigating risks arising from internal processes, people, systems, or external events to safeguard financial stability. Discover how integrating predictive analytics with operational risk management transforms banking resilience and performance.

Why it is important

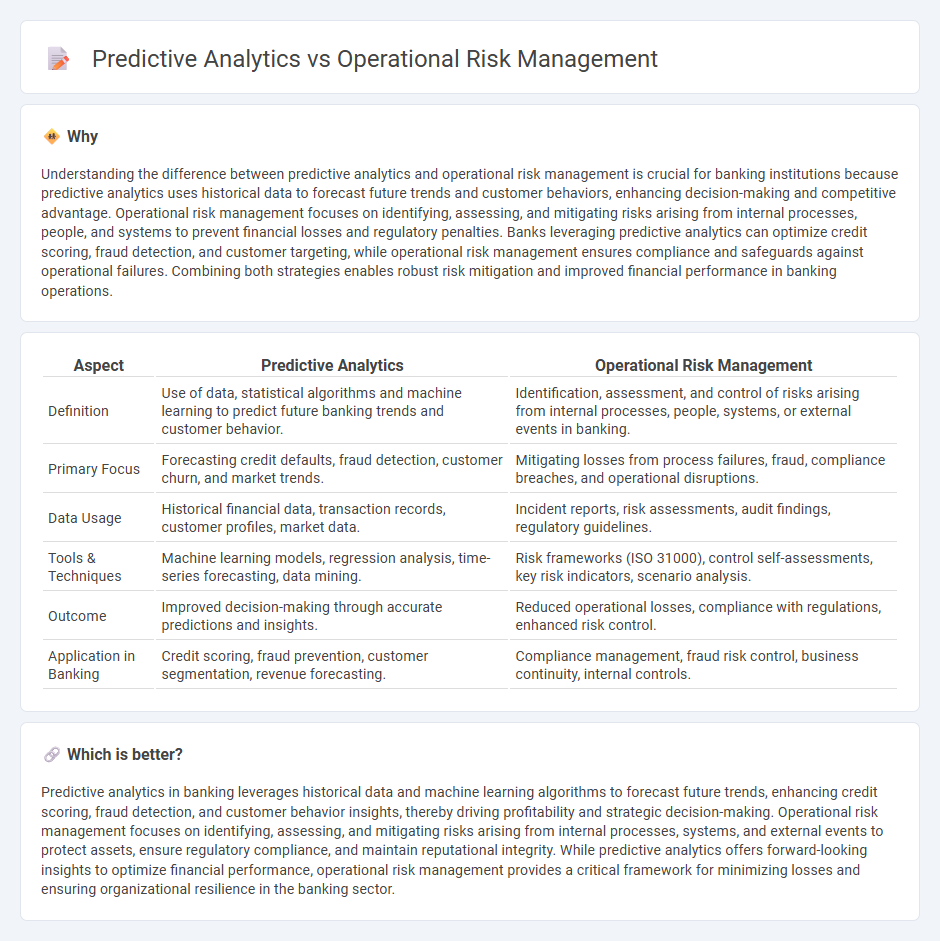

Understanding the difference between predictive analytics and operational risk management is crucial for banking institutions because predictive analytics uses historical data to forecast future trends and customer behaviors, enhancing decision-making and competitive advantage. Operational risk management focuses on identifying, assessing, and mitigating risks arising from internal processes, people, and systems to prevent financial losses and regulatory penalties. Banks leveraging predictive analytics can optimize credit scoring, fraud detection, and customer targeting, while operational risk management ensures compliance and safeguards against operational failures. Combining both strategies enables robust risk mitigation and improved financial performance in banking operations.

Comparison Table

| Aspect | Predictive Analytics | Operational Risk Management |

|---|---|---|

| Definition | Use of data, statistical algorithms and machine learning to predict future banking trends and customer behavior. | Identification, assessment, and control of risks arising from internal processes, people, systems, or external events in banking. |

| Primary Focus | Forecasting credit defaults, fraud detection, customer churn, and market trends. | Mitigating losses from process failures, fraud, compliance breaches, and operational disruptions. |

| Data Usage | Historical financial data, transaction records, customer profiles, market data. | Incident reports, risk assessments, audit findings, regulatory guidelines. |

| Tools & Techniques | Machine learning models, regression analysis, time-series forecasting, data mining. | Risk frameworks (ISO 31000), control self-assessments, key risk indicators, scenario analysis. |

| Outcome | Improved decision-making through accurate predictions and insights. | Reduced operational losses, compliance with regulations, enhanced risk control. |

| Application in Banking | Credit scoring, fraud prevention, customer segmentation, revenue forecasting. | Compliance management, fraud risk control, business continuity, internal controls. |

Which is better?

Predictive analytics in banking leverages historical data and machine learning algorithms to forecast future trends, enhancing credit scoring, fraud detection, and customer behavior insights, thereby driving profitability and strategic decision-making. Operational risk management focuses on identifying, assessing, and mitigating risks arising from internal processes, systems, and external events to protect assets, ensure regulatory compliance, and maintain reputational integrity. While predictive analytics offers forward-looking insights to optimize financial performance, operational risk management provides a critical framework for minimizing losses and ensuring organizational resilience in the banking sector.

Connection

Predictive analytics enhances operational risk management in banking by identifying potential threats through data-driven insights, enabling proactive mitigation of credit defaults, fraud, and compliance breaches. Leveraging machine learning algorithms, banks analyze vast datasets to forecast risk patterns and optimize capital allocation for risk controls. This integration improves decision-making accuracy, reduces financial losses, and ensures regulatory adherence.

Key Terms

**Operational Risk Management:**

Operational Risk Management (ORM) centers on identifying, assessing, and mitigating risks that arise from internal processes, people, systems, or external events. Techniques such as risk assessments, control frameworks, and incident tracking ensure organizations minimize potential losses and comply with regulations. Explore how integrating predictive analytics can enhance your ORM strategies for proactive risk mitigation.

Internal Controls

Operational risk management centers on identifying, assessing, and mitigating risks to ensure robust internal controls that safeguard organizational assets and processes. Predictive analytics enhances this by leveraging data-driven models to forecast potential control failures and operational disruptions before they occur. Explore how integrating predictive analytics can revolutionize internal control frameworks for proactive risk mitigation.

Risk Assessment

Operational risk management focuses on identifying, measuring, and mitigating risks through structured risk assessment frameworks that analyze historical data and internal controls. Predictive analytics enhances risk assessment by using advanced algorithms and machine learning models to forecast potential risk events and quantify their impact proactively. Explore how integrating predictive analytics can transform your operational risk assessment for improved decision-making and risk mitigation.

Source and External Links

Operational Risk Management: Overview and Guide - Operational risk management (ORM) involves a linear process of identifying, assessing, measuring, mitigating, monitoring, and reporting risks to reduce operational disruptions to an acceptable level, guided by principles such as accepting risk when benefits outweigh costs and making risk decisions at the right level.

Why Operational Risk Management is Crucial for Business - ORM is a structured framework using tools like bow-tie analysis and process mapping to identify risks in categories such as people, process, systems, and external factors, and applies both quantitative and qualitative assessment techniques to prioritize and mitigate those risks.

Operational Risk Management: The Ultimate Guide - ORM proactively identifies hidden risks, enhances risk awareness through employee education, strengthens internal controls, mitigates operational losses, and promotes risk-driven decision making to maintain operational stability and resilience.

dowidth.com

dowidth.com