Alternative data lending utilizes non-traditional financial information such as utility payments, social media activity, and transaction history to assess creditworthiness, enabling broader access to credit for underserved populations. Peer-to-peer lending connects individual borrowers directly with investors through online platforms, bypassing traditional financial institutions and often offering more competitive rates. Explore the benefits and differences of these innovative lending models to understand their impact on the future of banking.

Why it is important

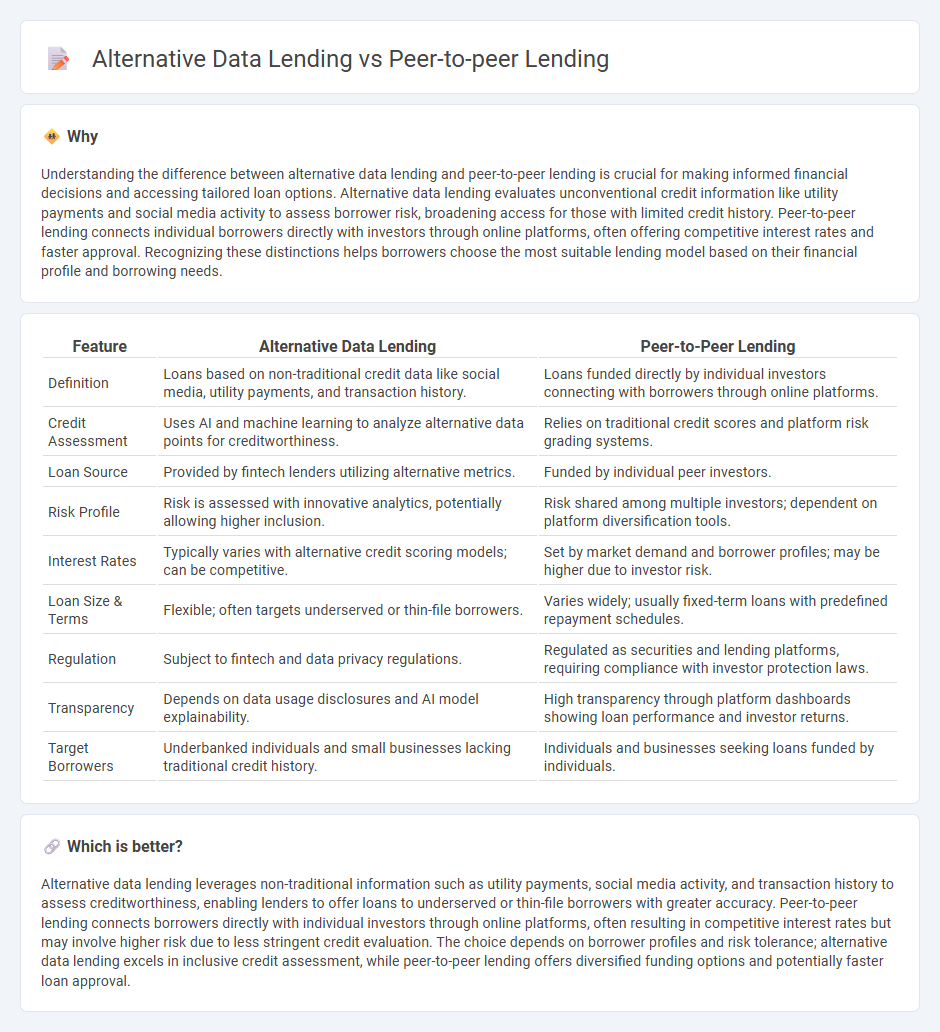

Understanding the difference between alternative data lending and peer-to-peer lending is crucial for making informed financial decisions and accessing tailored loan options. Alternative data lending evaluates unconventional credit information like utility payments and social media activity to assess borrower risk, broadening access for those with limited credit history. Peer-to-peer lending connects individual borrowers directly with investors through online platforms, often offering competitive interest rates and faster approval. Recognizing these distinctions helps borrowers choose the most suitable lending model based on their financial profile and borrowing needs.

Comparison Table

| Feature | Alternative Data Lending | Peer-to-Peer Lending |

|---|---|---|

| Definition | Loans based on non-traditional credit data like social media, utility payments, and transaction history. | Loans funded directly by individual investors connecting with borrowers through online platforms. |

| Credit Assessment | Uses AI and machine learning to analyze alternative data points for creditworthiness. | Relies on traditional credit scores and platform risk grading systems. |

| Loan Source | Provided by fintech lenders utilizing alternative metrics. | Funded by individual peer investors. |

| Risk Profile | Risk is assessed with innovative analytics, potentially allowing higher inclusion. | Risk shared among multiple investors; dependent on platform diversification tools. |

| Interest Rates | Typically varies with alternative credit scoring models; can be competitive. | Set by market demand and borrower profiles; may be higher due to investor risk. |

| Loan Size & Terms | Flexible; often targets underserved or thin-file borrowers. | Varies widely; usually fixed-term loans with predefined repayment schedules. |

| Regulation | Subject to fintech and data privacy regulations. | Regulated as securities and lending platforms, requiring compliance with investor protection laws. |

| Transparency | Depends on data usage disclosures and AI model explainability. | High transparency through platform dashboards showing loan performance and investor returns. |

| Target Borrowers | Underbanked individuals and small businesses lacking traditional credit history. | Individuals and businesses seeking loans funded by individuals. |

Which is better?

Alternative data lending leverages non-traditional information such as utility payments, social media activity, and transaction history to assess creditworthiness, enabling lenders to offer loans to underserved or thin-file borrowers with greater accuracy. Peer-to-peer lending connects borrowers directly with individual investors through online platforms, often resulting in competitive interest rates but may involve higher risk due to less stringent credit evaluation. The choice depends on borrower profiles and risk tolerance; alternative data lending excels in inclusive credit assessment, while peer-to-peer lending offers diversified funding options and potentially faster loan approval.

Connection

Alternative data lending and peer-to-peer lending are connected through their reliance on non-traditional credit information and decentralized financial platforms to expand access to credit. Alternative data, such as social media activity, utility payments, and digital footprints, enhances credit risk assessment in peer-to-peer lending networks. This synergy enables lending to underserved populations by reducing dependency on traditional credit scores and banking institutions.

Key Terms

Peer-to-Peer Lending:

Peer-to-peer lending connects individual borrowers directly with investors through online platforms, bypassing traditional financial institutions and enabling competitive interest rates and faster loan approvals. This lending model often relies on conventional credit scores and financial histories, contrasting with alternative data lending, which evaluates unconventional data sources like social media activity or utility payments to assess creditworthiness. Explore the evolving landscape of peer-to-peer lending to understand its benefits and potential risks in modern finance.

Marketplace platform

Peer-to-peer lending platforms connect individual borrowers directly with investors, leveraging social trust and credit scoring to facilitate loans without traditional financial intermediaries. Alternative data lending on marketplace platforms utilizes non-traditional data sources such as utility payments, online behavior, and social media activity to assess creditworthiness, enabling broader access for underserved borrowers. Discover how marketplace platforms innovate lending with peer-to-peer models and alternative data to expand financial inclusion and optimize risk assessment.

Investor-lender

Peer-to-peer lending connects investor-lenders directly with borrowers, leveraging traditional credit assessments and personal risk evaluation, while alternative data lending incorporates non-traditional data sources like social media activity, utility payments, and behavioral patterns to assess borrower creditworthiness more inclusively. Investor-lenders in peer-to-peer platforms benefit from transparent loan listings and historical platform data for informed decision-making, whereas alternative data lending widens investment opportunities by enabling access to underserved markets with predictive analytics. Explore how combining these approaches can optimize your investment strategy and risk management in lending.

Source and External Links

Peer-to-peer lending - Wikipedia - Peer-to-peer lending (P2P) is the practice of lending money to individuals or businesses through online platforms that match lenders with borrowers, bypassing traditional financial institutions and often allowing lenders to choose which loans to fund, though these loans typically carry more risk and lack government insurance.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending websites act as marketplaces connecting people or businesses seeking loans with those willing to lend, offering higher interest rates than traditional savings accounts but with greater risk, and the process can be either automatic or allow lenders to select specific borrowers.

PEER-TO-PEER LENDING - Peer-to-peer lending enables individuals and small businesses to obtain unsecured loans funded by other individuals via internet-based platforms, providing access to credit that may be difficult or costly to secure from traditional banks, especially during economic downturns.

dowidth.com

dowidth.com