Instant payments enable real-time fund transfers directly between bank accounts, offering immediate transaction confirmation and enhanced cash flow for businesses and consumers. Card payments rely on intermediaries and payment networks, which may cause delays due to processing times and settlement periods. Explore the advantages of each method and how they impact your financial transactions.

Why it is important

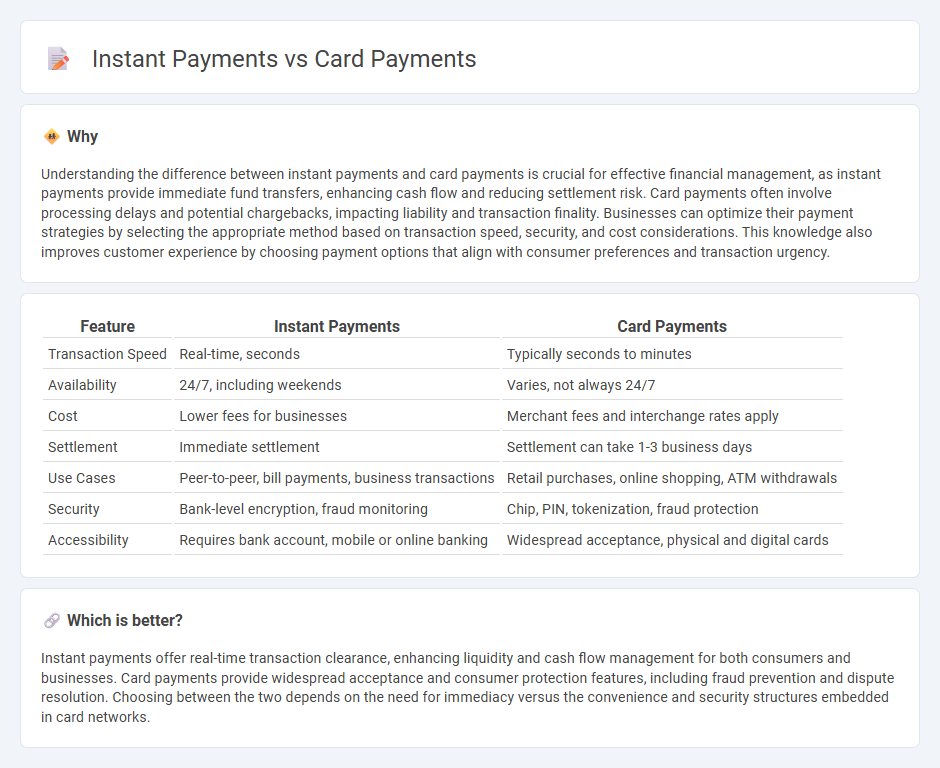

Understanding the difference between instant payments and card payments is crucial for effective financial management, as instant payments provide immediate fund transfers, enhancing cash flow and reducing settlement risk. Card payments often involve processing delays and potential chargebacks, impacting liability and transaction finality. Businesses can optimize their payment strategies by selecting the appropriate method based on transaction speed, security, and cost considerations. This knowledge also improves customer experience by choosing payment options that align with consumer preferences and transaction urgency.

Comparison Table

| Feature | Instant Payments | Card Payments |

|---|---|---|

| Transaction Speed | Real-time, seconds | Typically seconds to minutes |

| Availability | 24/7, including weekends | Varies, not always 24/7 |

| Cost | Lower fees for businesses | Merchant fees and interchange rates apply |

| Settlement | Immediate settlement | Settlement can take 1-3 business days |

| Use Cases | Peer-to-peer, bill payments, business transactions | Retail purchases, online shopping, ATM withdrawals |

| Security | Bank-level encryption, fraud monitoring | Chip, PIN, tokenization, fraud protection |

| Accessibility | Requires bank account, mobile or online banking | Widespread acceptance, physical and digital cards |

Which is better?

Instant payments offer real-time transaction clearance, enhancing liquidity and cash flow management for both consumers and businesses. Card payments provide widespread acceptance and consumer protection features, including fraud prevention and dispute resolution. Choosing between the two depends on the need for immediacy versus the convenience and security structures embedded in card networks.

Connection

Instant payments and card payments are interconnected through real-time processing technologies that enable immediate fund transfers and transaction approvals. Both systems leverage secure authentication protocols and digital payment networks to facilitate seamless and rapid financial exchanges. Integration of instant payment infrastructure with card payment platforms enhances transaction speed, reduces settlement times, and improves customer experience in banking services.

Key Terms

Authorization

Card payments rely on an authorization process where the card issuer evaluates fraud risks, available credit, and funds before approving a transaction. Instant payments bypass extensive authorization checks, enabling real-time fund transfers directly between payer and payee accounts. Explore the detailed differences in authorization protocols to optimize your payment strategy.

Settlement

Card payments typically involve batch processing with settlement times ranging from same-day to several days, depending on the card network and merchant agreements. Instant payments, on the other hand, enable immediate settlement of funds between banks, facilitating real-time availability for recipients and improving liquidity. Explore the key differences in settlement processes to understand how instant payments can enhance your transaction efficiency.

Clearing

Card payments rely on established clearing networks like Visa and Mastercard, which process transactions in batch cycles typically spanning hours to days. Instant payments, facilitated by real-time clearing systems such as RTP (Real-Time Payment) in the US or SEPA Instant Credit Transfer in Europe, enable funds to be transferred and cleared within seconds, enhancing liquidity management and reducing settlement risks. Explore the mechanics of clearing systems to understand how these payment methods impact financial efficiency and security.

Source and External Links

Card payments - Stripe - Card payments are a cashless method where customers pay via debit or credit cards at points of sale or online, offering convenience and speed for businesses and shoppers, including debit, credit, contactless, and mobile payments options.

How Do Online Payments via Credit or Debit Card Work? | GoCardless - Card payments involve clearing and settlement processes where transactions are authorized, funds transferred through acquiring banks, card associations, and issuing banks, providing near-instant confirmation despite settlement delays.

Payment card - Wikipedia - Payment cards, including debit, credit, and charge cards, are issued by financial institutions allowing direct fund withdrawal or deferred payments, widely used for in-person and online purchases with features like ATM cash withdrawals and cashback.

dowidth.com

dowidth.com