Negative interest rates occur when banks charge depositors for holding funds, encouraging spending and lending, whereas fixed interest rates provide stability by locking in a consistent borrowing cost over the loan term. Negative rates can stimulate economic activity during downturns but may erode savings, while fixed rates offer predictability and protection from market fluctuations. Explore the impact of these interest rate strategies on your financial decisions and investment plans.

Why it is important

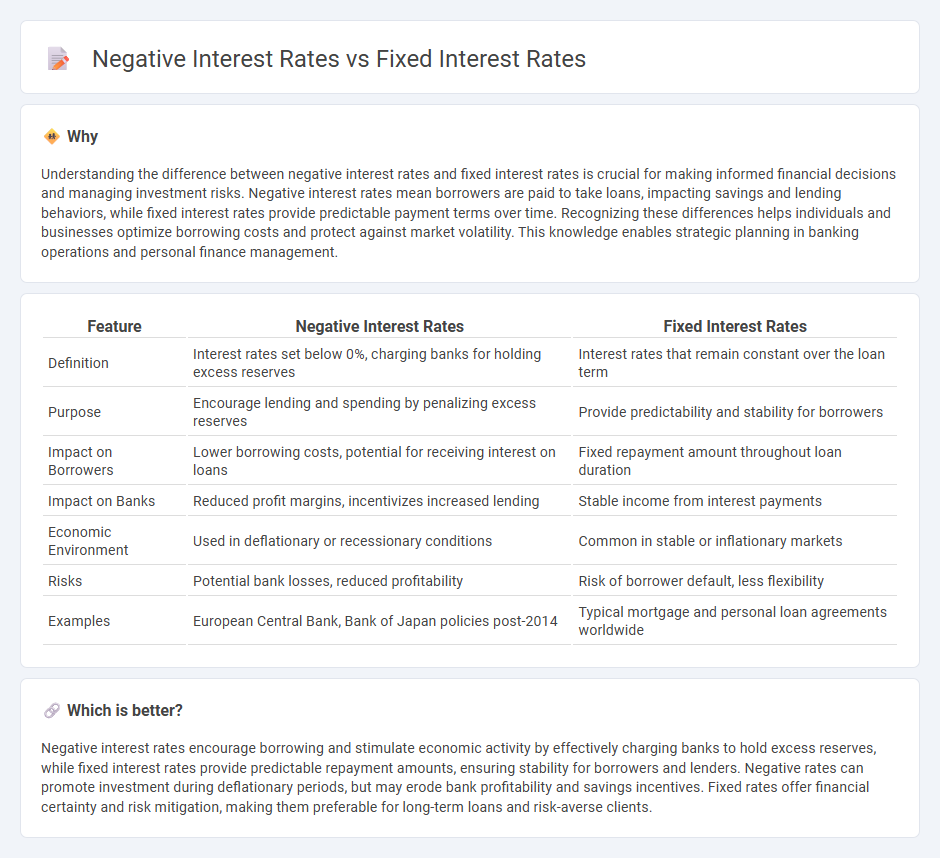

Understanding the difference between negative interest rates and fixed interest rates is crucial for making informed financial decisions and managing investment risks. Negative interest rates mean borrowers are paid to take loans, impacting savings and lending behaviors, while fixed interest rates provide predictable payment terms over time. Recognizing these differences helps individuals and businesses optimize borrowing costs and protect against market volatility. This knowledge enables strategic planning in banking operations and personal finance management.

Comparison Table

| Feature | Negative Interest Rates | Fixed Interest Rates |

|---|---|---|

| Definition | Interest rates set below 0%, charging banks for holding excess reserves | Interest rates that remain constant over the loan term |

| Purpose | Encourage lending and spending by penalizing excess reserves | Provide predictability and stability for borrowers |

| Impact on Borrowers | Lower borrowing costs, potential for receiving interest on loans | Fixed repayment amount throughout loan duration |

| Impact on Banks | Reduced profit margins, incentivizes increased lending | Stable income from interest payments |

| Economic Environment | Used in deflationary or recessionary conditions | Common in stable or inflationary markets |

| Risks | Potential bank losses, reduced profitability | Risk of borrower default, less flexibility |

| Examples | European Central Bank, Bank of Japan policies post-2014 | Typical mortgage and personal loan agreements worldwide |

Which is better?

Negative interest rates encourage borrowing and stimulate economic activity by effectively charging banks to hold excess reserves, while fixed interest rates provide predictable repayment amounts, ensuring stability for borrowers and lenders. Negative rates can promote investment during deflationary periods, but may erode bank profitability and savings incentives. Fixed rates offer financial certainty and risk mitigation, making them preferable for long-term loans and risk-averse clients.

Connection

Negative interest rates influence fixed interest rates by compelling banks to adjust their lending and deposit strategies to maintain profitability. Fixed interest rates often reflect market expectations of future central bank policies, including negative rate environments, which increase demand for securing stable returns. This interconnected dynamic shapes consumer borrowing costs and the overall credit market landscape.

Key Terms

Loan Agreements

Fixed interest rates in loan agreements provide borrowers with predictable repayment amounts, safeguarding against market fluctuations and ensuring budget stability. Negative interest rates, although rare in loan agreements, imply that lenders effectively pay borrowers, potentially reducing debt burden but also introducing complexity in contract terms and financial projections. Explore detailed insights on how these interest structures impact loan agreements and borrower-lender relations.

Monetary Policy

Fixed interest rates provide predictable borrowing costs, enabling stable financial planning for consumers and businesses, while negative interest rates are unconventional monetary policy tools used by central banks to stimulate economic activity by encouraging lending and spending. Central banks implement fixed interest rates mainly to control inflation and support growth, whereas negative rates aim to combat deflation and sluggish demand during economic downturns. Explore the impact of these contrasting interest rate policies on global economies and financial markets to better understand monetary policy strategies.

Deposit Returns

Fixed interest rates guarantee a predetermined return on deposits, providing stability and predictability for investors seeking steady income. Negative interest rates, on the other hand, effectively charge depositors for holding funds, often resulting in reduced or even negative returns on savings. Explore detailed comparisons and strategies to optimize your deposit returns under varying interest rate environments.

Source and External Links

I bonds interest rates - TreasuryDirect - I Bonds offer a fixed interest rate component (currently 1.10%) that does not change for the life of the bond, combined with a semiannual inflation adjustment for a composite rate.

Fixed-Rate Mortgage Loans and Rates at Bank of America - With a fixed-rate mortgage, the interest rate and monthly payment remain constant for the entire loan term.

Current Mortgage Rates & Options | Navy Federal Credit Union - A fixed-rate mortgage keeps the same interest rate throughout the life of the loan, unlike adjustable-rate mortgages which can change over time.

dowidth.com

dowidth.com