Sustainable banking prioritizes environmental, social, and governance (ESG) criteria by funding projects that promote renewable energy, social equity, and ethical governance, contrasting with traditional banking's focus on maximizing short-term profits through financing conventional industries. It integrates impact investing and green financing to reduce carbon footprints and support community development, whereas traditional banks often rely heavily on fossil fuel investments and high-risk lending. Explore how sustainable banking reshapes the financial ecosystem and drives long-term value beyond conventional profit metrics.

Why it is important

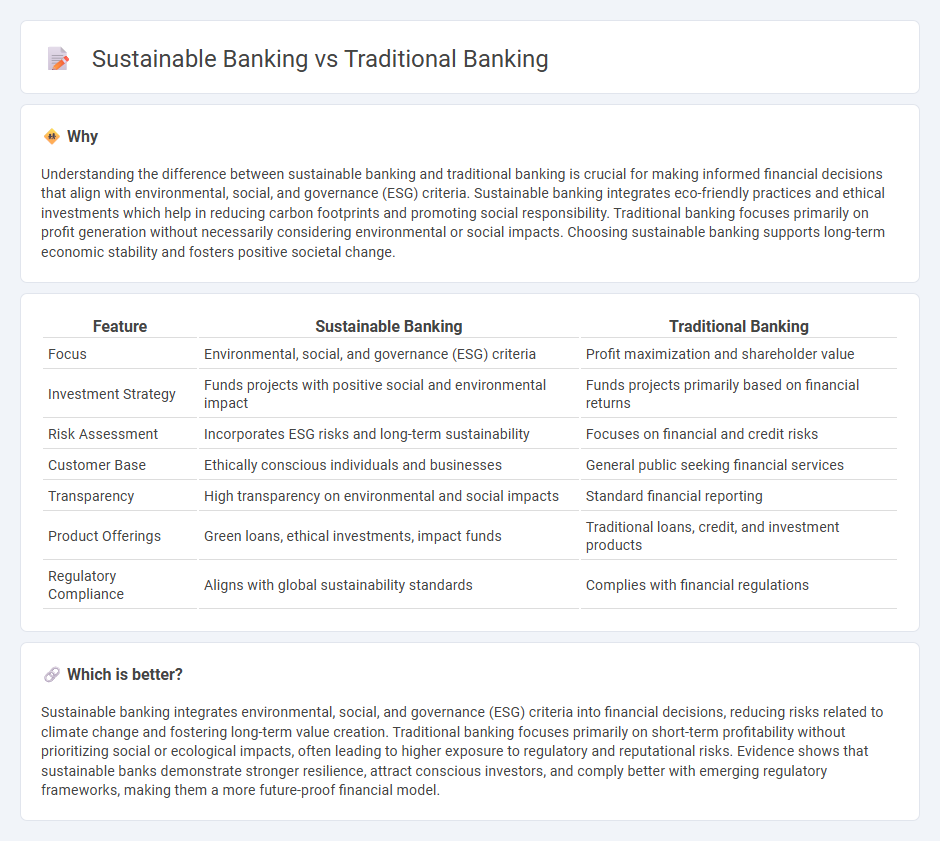

Understanding the difference between sustainable banking and traditional banking is crucial for making informed financial decisions that align with environmental, social, and governance (ESG) criteria. Sustainable banking integrates eco-friendly practices and ethical investments which help in reducing carbon footprints and promoting social responsibility. Traditional banking focuses primarily on profit generation without necessarily considering environmental or social impacts. Choosing sustainable banking supports long-term economic stability and fosters positive societal change.

Comparison Table

| Feature | Sustainable Banking | Traditional Banking |

|---|---|---|

| Focus | Environmental, social, and governance (ESG) criteria | Profit maximization and shareholder value |

| Investment Strategy | Funds projects with positive social and environmental impact | Funds projects primarily based on financial returns |

| Risk Assessment | Incorporates ESG risks and long-term sustainability | Focuses on financial and credit risks |

| Customer Base | Ethically conscious individuals and businesses | General public seeking financial services |

| Transparency | High transparency on environmental and social impacts | Standard financial reporting |

| Product Offerings | Green loans, ethical investments, impact funds | Traditional loans, credit, and investment products |

| Regulatory Compliance | Aligns with global sustainability standards | Complies with financial regulations |

Which is better?

Sustainable banking integrates environmental, social, and governance (ESG) criteria into financial decisions, reducing risks related to climate change and fostering long-term value creation. Traditional banking focuses primarily on short-term profitability without prioritizing social or ecological impacts, often leading to higher exposure to regulatory and reputational risks. Evidence shows that sustainable banks demonstrate stronger resilience, attract conscious investors, and comply better with emerging regulatory frameworks, making them a more future-proof financial model.

Connection

Sustainable banking integrates environmental, social, and governance (ESG) criteria into traditional banking practices to promote responsible investment and risk management. Traditional banks adopt sustainable banking principles to enhance long-term financial performance while addressing climate change and social impact. This connection drives innovation in green finance products and supports regulatory compliance in evolving global markets.

Key Terms

Lending practices

Traditional banking lending practices prioritize profitability, often extending credit to industries regardless of environmental or social impact, with a focus on creditworthiness and risk assessment based primarily on financial metrics. Sustainable banking integrates environmental, social, and governance (ESG) criteria into lending decisions, favoring projects that promote renewable energy, social equity, and sustainable development while reducing funding for fossil fuels and environmentally harmful practices. Explore how sustainable lending reshapes financial markets and drives positive global change.

Environmental, Social, and Governance (ESG)

Traditional banking prioritizes financial returns and risk management, often overlooking Environmental, Social, and Governance (ESG) criteria. Sustainable banking integrates ESG principles into lending and investment decisions, promoting eco-friendly projects, social equity, and corporate governance transparency. Explore how adopting sustainable banking practices can align financial growth with responsible stewardship.

Risk assessment

Traditional banking risk assessment primarily relies on financial metrics, credit scores, and historical data to evaluate borrower creditworthiness and predict default probability. Sustainable banking integrates environmental, social, and governance (ESG) criteria into risk models, accounting for long-term impacts such as climate change, regulatory shifts, and social responsibility that may affect financial stability. Discover how sustainable banking transforms risk assessment frameworks to promote resilience and ethical investment.

Source and External Links

Traditional Banking and Mobile Banking: Differences, Pros, and Cons - Traditional banking is defined by physical branches where customers can access a wide range of financial services in person, offering face-to-face interaction, security, and personalized support.

Online Banking vs. Traditional Banking - Chase.com - Traditional banks provide a broad array of services including cash deposits, extensive ATM networks, and in-person customer service, allowing customers to build relationships with bank staff and access specialized financial products.

Traditional vs. Online Banking | Citi.com - Traditional banking combines the convenience of physical branches for complex transactions and cash deposits with the flexibility of digital platforms for everyday banking needs, often supported by large ATM networks.

dowidth.com

dowidth.com