Account aggregation consolidates financial data from multiple accounts into a single view, enhancing user convenience and financial management. Data enrichment adds contextual information to raw financial data, improving insights for personalized banking services and decision-making. Explore the differences and benefits of account aggregation and data enrichment to optimize your financial strategy.

Why it is important

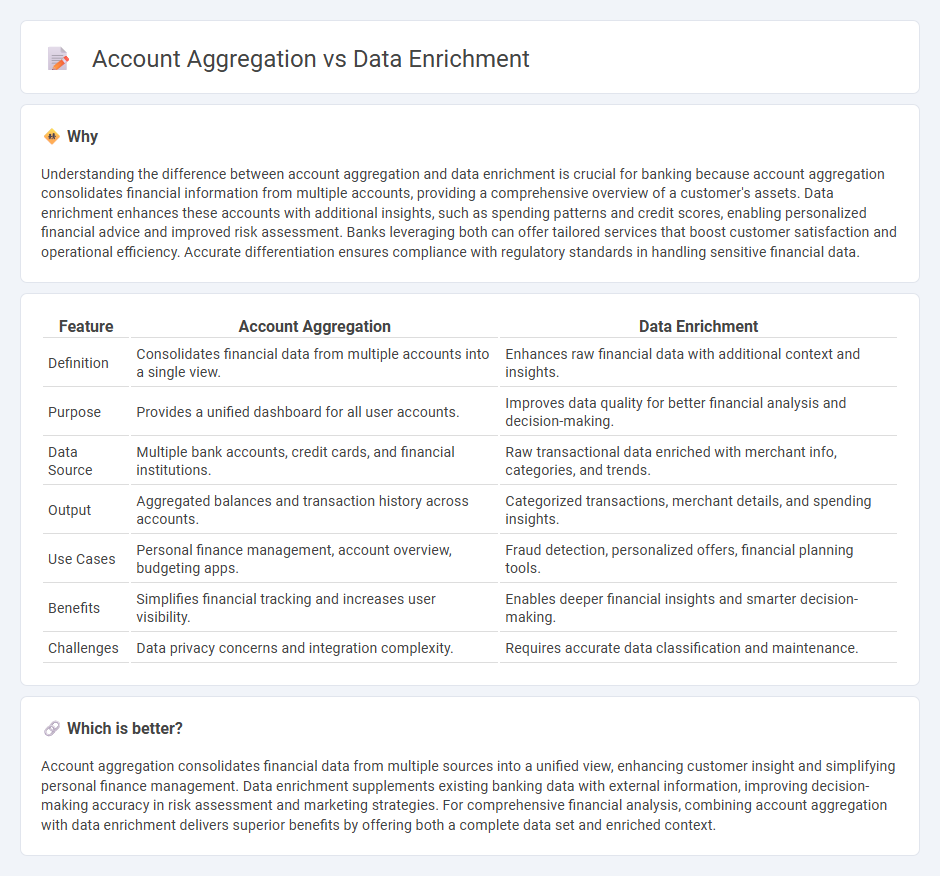

Understanding the difference between account aggregation and data enrichment is crucial for banking because account aggregation consolidates financial information from multiple accounts, providing a comprehensive overview of a customer's assets. Data enrichment enhances these accounts with additional insights, such as spending patterns and credit scores, enabling personalized financial advice and improved risk assessment. Banks leveraging both can offer tailored services that boost customer satisfaction and operational efficiency. Accurate differentiation ensures compliance with regulatory standards in handling sensitive financial data.

Comparison Table

| Feature | Account Aggregation | Data Enrichment |

|---|---|---|

| Definition | Consolidates financial data from multiple accounts into a single view. | Enhances raw financial data with additional context and insights. |

| Purpose | Provides a unified dashboard for all user accounts. | Improves data quality for better financial analysis and decision-making. |

| Data Source | Multiple bank accounts, credit cards, and financial institutions. | Raw transactional data enriched with merchant info, categories, and trends. |

| Output | Aggregated balances and transaction history across accounts. | Categorized transactions, merchant details, and spending insights. |

| Use Cases | Personal finance management, account overview, budgeting apps. | Fraud detection, personalized offers, financial planning tools. |

| Benefits | Simplifies financial tracking and increases user visibility. | Enables deeper financial insights and smarter decision-making. |

| Challenges | Data privacy concerns and integration complexity. | Requires accurate data classification and maintenance. |

Which is better?

Account aggregation consolidates financial data from multiple sources into a unified view, enhancing customer insight and simplifying personal finance management. Data enrichment supplements existing banking data with external information, improving decision-making accuracy in risk assessment and marketing strategies. For comprehensive financial analysis, combining account aggregation with data enrichment delivers superior benefits by offering both a complete data set and enriched context.

Connection

Account aggregation consolidates financial data from multiple banking sources into a single view, enabling comprehensive analysis. Data enrichment enhances this aggregated information by appending additional insights such as transaction categorization, spending patterns, and credit risk scores. The integration of account aggregation with data enrichment empowers banks to deliver personalized financial services and improve decision-making processes.

Key Terms

Transaction Categorization

Data enrichment enhances transaction categorization by appending detailed merchant information, spending behavior, and contextual metadata to each transaction, enabling more accurate and granular insights. Account aggregation collects transaction data from multiple financial accounts but relies on basic classification algorithms that often result in broad or inconsistent categories. Explore how advanced data enrichment techniques outperform standard aggregation models in delivering precise transaction categorization.

Data Normalization

Data enrichment enhances raw data by adding context and detail, improving accuracy and usability, whereas account aggregation consolidates financial data from multiple sources into a unified view. Data normalization plays a crucial role in both processes by standardizing diverse data formats, enabling seamless integration and analysis. Explore deeper insights on how data normalization optimizes data enrichment and account aggregation.

Multi-Bank Integration

Data enrichment enhances raw financial data by appending contextual information such as spending categories and merchant details, improving transaction insights. Account aggregation consolidates multiple bank accounts into a single interface, enabling comprehensive financial management through Multi-Bank Integration. Explore the benefits and technical aspects of these solutions to optimize your financial data strategy.

Source and External Links

Data Enrichment: What It Is, Steps, Benefits & Best Practices - Matillion - Data enrichment is the process of enhancing raw data by merging external data with an existing dataset to improve its accuracy, richness, and utility, often used to add context like demographics or behavior to customer profiles for better business decisions.

What is Data Enrichment? Benefits of enhanced data - Experian - The data enrichment process involves defining needs, evaluating existing data quality, purchasing relevant data sets, and maintaining data management to ensure data remains valuable and up to date.

What is Data Enrichment? Everything You Need to Know - HubSpot - Data enrichment improves the accuracy and reliability of customer data by adding new, verified information from third-party sources to better understand and personalize interactions with customers.

dowidth.com

dowidth.com