Credit builder cards report your payment history to major credit bureaus, helping establish or improve your credit score by demonstrating responsible borrowing. Debit cards provide direct access to your checking account funds, allowing convenient everyday spending without impacting your credit history. Explore the key differences and benefits of credit builder cards versus debit cards to choose the best financial tool for your needs.

Why it is important

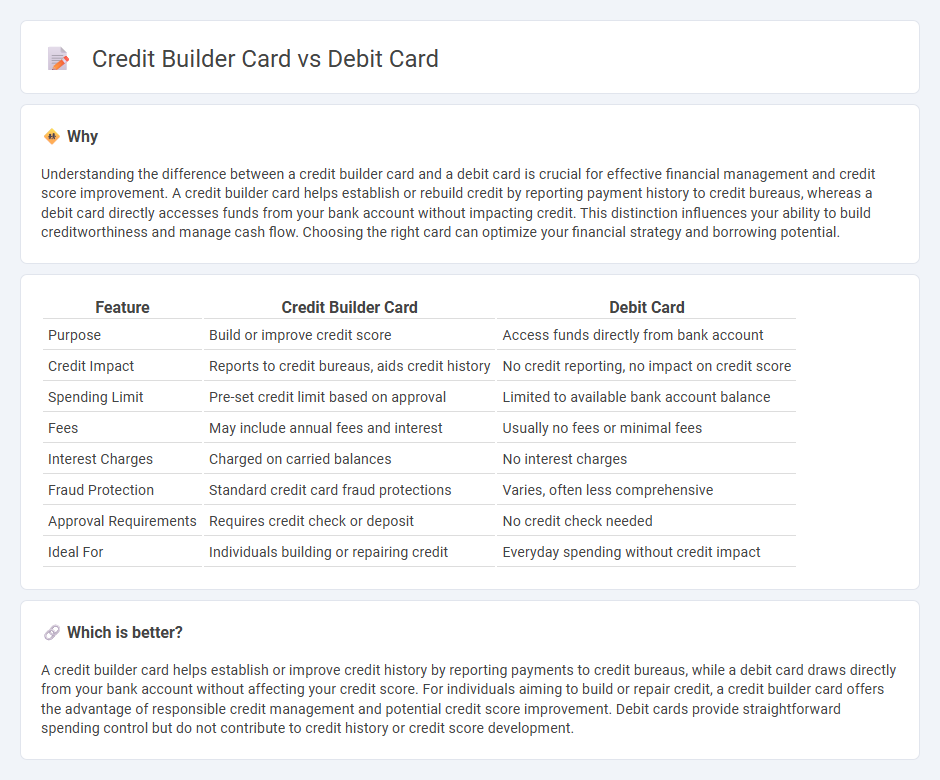

Understanding the difference between a credit builder card and a debit card is crucial for effective financial management and credit score improvement. A credit builder card helps establish or rebuild credit by reporting payment history to credit bureaus, whereas a debit card directly accesses funds from your bank account without impacting credit. This distinction influences your ability to build creditworthiness and manage cash flow. Choosing the right card can optimize your financial strategy and borrowing potential.

Comparison Table

| Feature | Credit Builder Card | Debit Card |

|---|---|---|

| Purpose | Build or improve credit score | Access funds directly from bank account |

| Credit Impact | Reports to credit bureaus, aids credit history | No credit reporting, no impact on credit score |

| Spending Limit | Pre-set credit limit based on approval | Limited to available bank account balance |

| Fees | May include annual fees and interest | Usually no fees or minimal fees |

| Interest Charges | Charged on carried balances | No interest charges |

| Fraud Protection | Standard credit card fraud protections | Varies, often less comprehensive |

| Approval Requirements | Requires credit check or deposit | No credit check needed |

| Ideal For | Individuals building or repairing credit | Everyday spending without credit impact |

Which is better?

A credit builder card helps establish or improve credit history by reporting payments to credit bureaus, while a debit card draws directly from your bank account without affecting your credit score. For individuals aiming to build or repair credit, a credit builder card offers the advantage of responsible credit management and potential credit score improvement. Debit cards provide straightforward spending control but do not contribute to credit history or credit score development.

Connection

Credit builder cards and debit cards are connected through their role in managing personal finances and establishing credit history. Debit cards provide direct access to funds in checking accounts, while credit builder cards offer a way to build or improve credit scores by reporting on-time payments to credit bureaus. Both cards are essential tools for financial inclusion and responsible money management within the banking ecosystem.

Key Terms

Spending limit

Debit cards have a spending limit based on the available balance in the linked bank account, ensuring users cannot exceed their funds. Credit builder cards offer a preset credit limit determined by the issuer, designed to help build credit history through responsible use and timely payments. Explore detailed comparisons and tips to choose the right card for your financial goals.

Credit history

Debit cards do not impact credit history since transactions are funded directly from the user's bank account, offering no credit reporting. Credit builder cards report on-time payments and credit usage to major credit bureaus, helping users establish or improve their credit scores efficiently. Explore more about how credit builder cards can strategically enhance your credit profile with consistent usage.

Immediate deduction

Debit cards provide immediate deduction from your checking account for each purchase, ensuring you only spend available funds without accruing debt or interest. Credit builder cards, on the other hand, may require upfront deposits or have billing cycles that delay payment settlements, which helps in building credit history but does not deduct funds instantly. Explore more about how these card types impact your financial management and credit score.

Source and External Links

Using Debit Cards - A debit card allows you to pay using money in your checking account immediately without incurring interest or building credit, and can be used for purchases, ATM withdrawals, and cash back, unlike credit cards which borrow money and involve billing and interest.

Debit cards - better than cash | Apply online - A debit card lets you easily access your checking account funds for everyday purchases, online shopping, bill payments, and ATM withdrawals, with money deducted instantly and secured by PIN and CVV codes for safety.

Debit card - A debit card is a payment card used instead of cash to make purchases that can be processed in various ways such as EFTPOS or signature debit, and comes with different networks like Visa, Mastercard, and others for local and international use.

dowidth.com

dowidth.com