Banking as a Service (BaaS) delivers banking functions through digital platforms, enabling seamless integration with fintech and non-bank companies, unlike traditional banking which relies on physical branches and direct customer relationships. This modern approach leverages APIs to offer customizable financial services, improving speed and accessibility for users. Explore how BaaS is transforming financial ecosystems and redefining customer experiences.

Why it is important

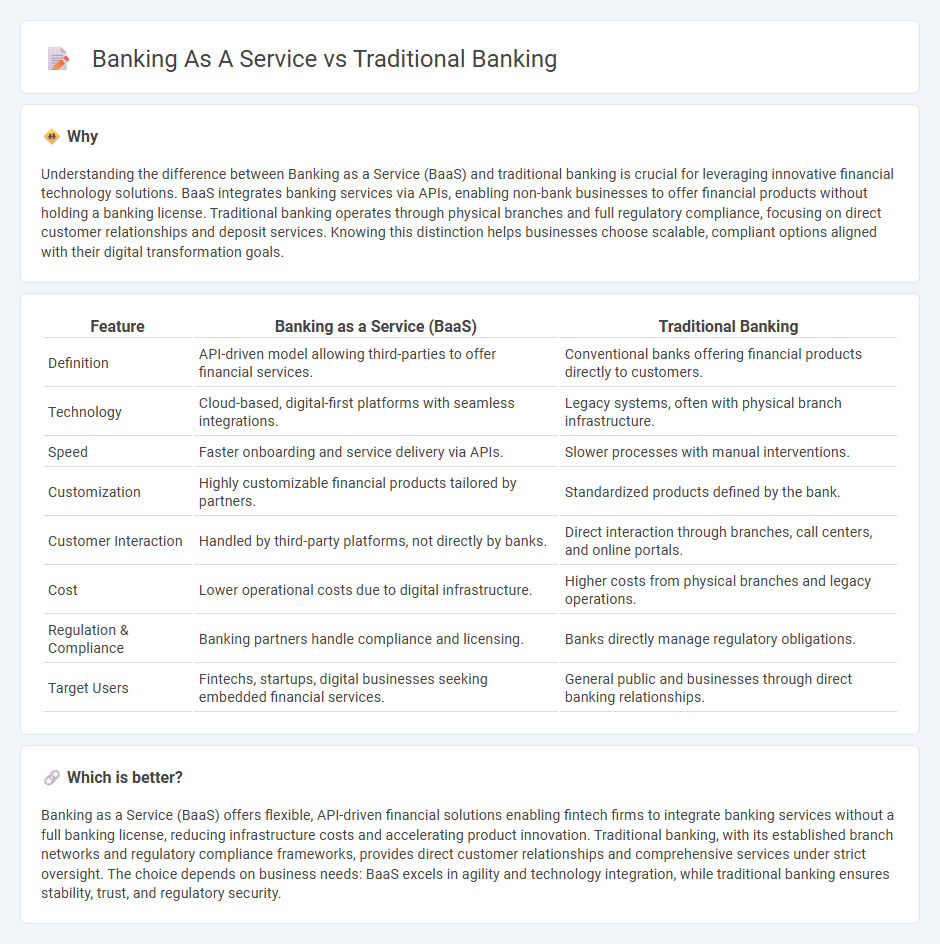

Understanding the difference between Banking as a Service (BaaS) and traditional banking is crucial for leveraging innovative financial technology solutions. BaaS integrates banking services via APIs, enabling non-bank businesses to offer financial products without holding a banking license. Traditional banking operates through physical branches and full regulatory compliance, focusing on direct customer relationships and deposit services. Knowing this distinction helps businesses choose scalable, compliant options aligned with their digital transformation goals.

Comparison Table

| Feature | Banking as a Service (BaaS) | Traditional Banking |

|---|---|---|

| Definition | API-driven model allowing third-parties to offer financial services. | Conventional banks offering financial products directly to customers. |

| Technology | Cloud-based, digital-first platforms with seamless integrations. | Legacy systems, often with physical branch infrastructure. |

| Speed | Faster onboarding and service delivery via APIs. | Slower processes with manual interventions. |

| Customization | Highly customizable financial products tailored by partners. | Standardized products defined by the bank. |

| Customer Interaction | Handled by third-party platforms, not directly by banks. | Direct interaction through branches, call centers, and online portals. |

| Cost | Lower operational costs due to digital infrastructure. | Higher costs from physical branches and legacy operations. |

| Regulation & Compliance | Banking partners handle compliance and licensing. | Banks directly manage regulatory obligations. |

| Target Users | Fintechs, startups, digital businesses seeking embedded financial services. | General public and businesses through direct banking relationships. |

Which is better?

Banking as a Service (BaaS) offers flexible, API-driven financial solutions enabling fintech firms to integrate banking services without a full banking license, reducing infrastructure costs and accelerating product innovation. Traditional banking, with its established branch networks and regulatory compliance frameworks, provides direct customer relationships and comprehensive services under strict oversight. The choice depends on business needs: BaaS excels in agility and technology integration, while traditional banking ensures stability, trust, and regulatory security.

Connection

Banking as a Service (BaaS) integrates modern fintech platforms with traditional banking infrastructure by leveraging licensed banks' APIs to offer banking products seamlessly. Traditional banks provide the regulatory framework, compliance expertise, and core banking systems that BaaS platforms utilize to deliver digital financial services. This connection enables faster innovation, personalized customer experiences, and expanded access to banking through third-party providers.

Key Terms

Core Banking System

Traditional banking relies on legacy Core Banking Systems designed for internal operations, often leading to slower innovation and limited flexibility. Banking as a Service (BaaS) integrates modern, API-driven Core Banking Systems that enable seamless third-party partnerships and real-time financial services. Explore how evolving Core Banking Systems transform the future of banking and customer experience.

API Integration

Traditional banking relies on legacy systems with limited API integration, resulting in slower digital transformation and reduced flexibility for customers and businesses. Banking as a Service (BaaS) platforms utilize robust API ecosystems, enabling seamless connectivity, real-time data exchange, and the rapid deployment of innovative financial products. Explore how API integration in BaaS reshapes the financial landscape for enhanced efficiency and customer experience.

White-Label Solutions

Traditional banking relies on established financial institutions managing customer accounts and services directly, whereas banking as a service (BaaS) integrates financial products via APIs, enabling third parties to offer white-label banking solutions under their own brand. White-label solutions empower non-bank companies to provide fully compliant banking features such as payments, loans, and account management without building infrastructure from scratch. Explore how white-label solutions in BaaS can transform your financial offerings and drive innovation in your business.

Source and External Links

Online Banking vs. Traditional Banking - Chase.com - Traditional banking involves physical branches offering a wider range of services including cash deposits, ATM access, and in-person customer service, with the benefit of developing personal relationships with bank staff, though it can require inconvenient branch visits and service quality may vary.

Traditional vs. Online Banking | Citi.com - Traditional banks have brick-and-mortar locations combined with digital platforms, providing face-to-face service, easier cash deposits, extensive ATM networks, and more comprehensive financial products compared to online-only banks.

Online vs Traditional Banks: Pros, Cons, and More Explained - Traditional banks offer physical locations and in-person banking relationships which suit customers with complex needs, provide more banking services including professional advice and cash deposits, though they may have limited hours and higher fees than online banks.

dowidth.com

dowidth.com