Social trading leverages collective market insights by allowing investors to follow and replicate the trades of experienced traders, enhancing decision-making through community interaction. Auto trading employs sophisticated algorithms and AI to execute trades automatically based on pre-set criteria, aiming to maximize efficiency and reduce human error. Explore the unique advantages and strategies behind social trading and auto trading to optimize your banking investments.

Why it is important

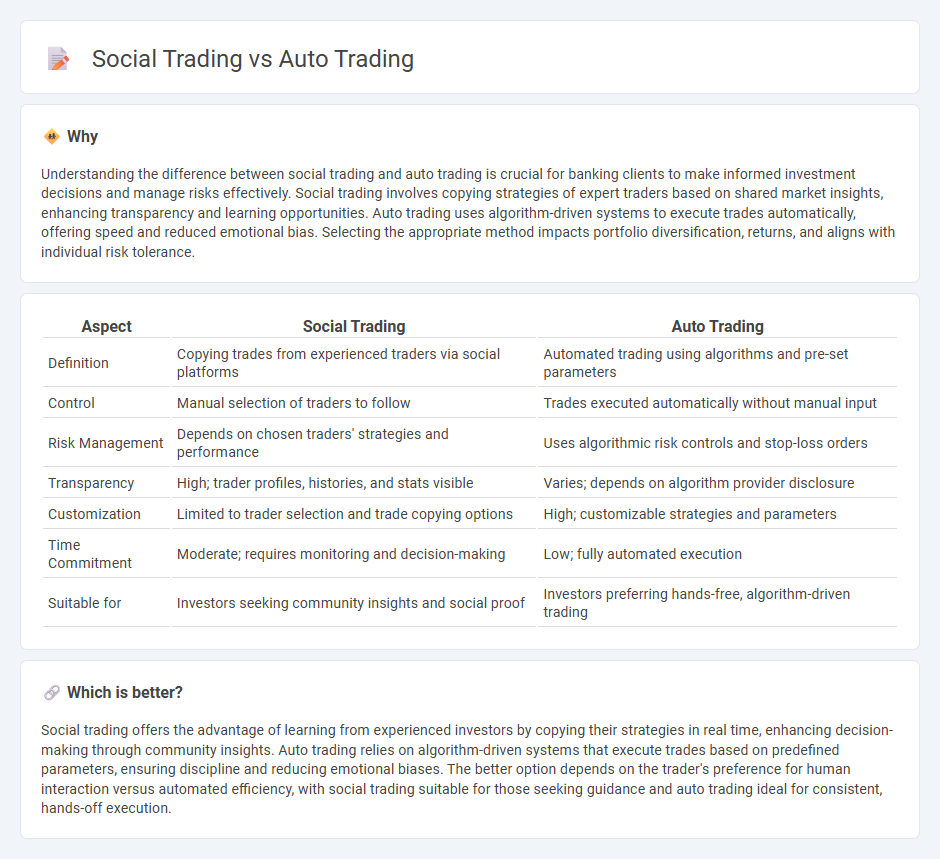

Understanding the difference between social trading and auto trading is crucial for banking clients to make informed investment decisions and manage risks effectively. Social trading involves copying strategies of expert traders based on shared market insights, enhancing transparency and learning opportunities. Auto trading uses algorithm-driven systems to execute trades automatically, offering speed and reduced emotional bias. Selecting the appropriate method impacts portfolio diversification, returns, and aligns with individual risk tolerance.

Comparison Table

| Aspect | Social Trading | Auto Trading |

|---|---|---|

| Definition | Copying trades from experienced traders via social platforms | Automated trading using algorithms and pre-set parameters |

| Control | Manual selection of traders to follow | Trades executed automatically without manual input |

| Risk Management | Depends on chosen traders' strategies and performance | Uses algorithmic risk controls and stop-loss orders |

| Transparency | High; trader profiles, histories, and stats visible | Varies; depends on algorithm provider disclosure |

| Customization | Limited to trader selection and trade copying options | High; customizable strategies and parameters |

| Time Commitment | Moderate; requires monitoring and decision-making | Low; fully automated execution |

| Suitable for | Investors seeking community insights and social proof | Investors preferring hands-free, algorithm-driven trading |

Which is better?

Social trading offers the advantage of learning from experienced investors by copying their strategies in real time, enhancing decision-making through community insights. Auto trading relies on algorithm-driven systems that execute trades based on predefined parameters, ensuring discipline and reducing emotional biases. The better option depends on the trader's preference for human interaction versus automated efficiency, with social trading suitable for those seeking guidance and auto trading ideal for consistent, hands-off execution.

Connection

Social trading and auto trading intersect through their reliance on technology-enabled platforms that facilitate seamless copy trading and automated execution of predefined strategies. Social trading platforms amplify investment transparency by allowing users to replicate expert traders' moves, while auto trading employs algorithmic systems to execute trades based on set parameters without manual intervention. This synergy enhances portfolio diversification and maximizes trading efficiency by combining community-driven insights with algorithmic precision.

Key Terms

Algorithmic Trading

Algorithmic trading utilizes advanced computer algorithms to execute trades based on predefined criteria, offering precision and speed unattainable by manual methods. Social trading, by contrast, allows investors to mirror strategies of experienced traders, fostering community-driven investment decisions. Discover the nuances and benefits of algorithmic trading to enhance your investment strategy.

Copy Trading

Copy trading enables investors to automatically replicate the trades of experienced traders, providing a hands-off approach similar to auto trading but with social interaction and shared strategies. Unlike traditional auto trading systems that rely solely on algorithms, copy trading combines human insight and real-time decision-making, potentially enhancing performance through community-driven expertise. Explore more about how copy trading blends automation with social elements to optimize your investment strategy.

Signal Providers

Auto trading enables investors to automate trades based on algorithms and pre-set strategies, minimizing emotional decision-making and maximizing efficiency. Social trading emphasizes interaction with signal providers who share real-time trade signals, allowing followers to replicate or adapt strategies from experienced traders. Explore how signal providers impact profitability and risk management in both trading models by learning more.

Source and External Links

Automated Trading Platforms | Autotrading Software - AvaTrade - Auto trading lets you automate your trades using bots or copy/mirror successful traders' strategies in real time, with options to create, buy, or rent customized trading algorithms or use social copy-trading platforms.

What is Automated Trading and How Do You Get Started? - IG - Automated trading uses computer programs to execute trades based on preset rules and conditions, allowing for rapid, emotion-free trade execution and less manual monitoring of positions.

Automated trading system - Wikipedia - An automated trading system (ATS) is a computer program that automatically submits buy and sell orders, and has evolved to include copy and mirror trading, where users can replicate the trades and strategies of others without needing to code their own algorithms.

dowidth.com

dowidth.com