Synthetic identity fraud involves criminals creating entirely fake identities by combining real and fabricated information to open new accounts and manipulate credit systems. Account takeover fraud occurs when fraudsters gain unauthorized access to an existing legitimate customer's account, enabling them to carry out unauthorized transactions or steal funds. Explore more to understand the key differences and detection strategies between these emerging banking threats.

Why it is important

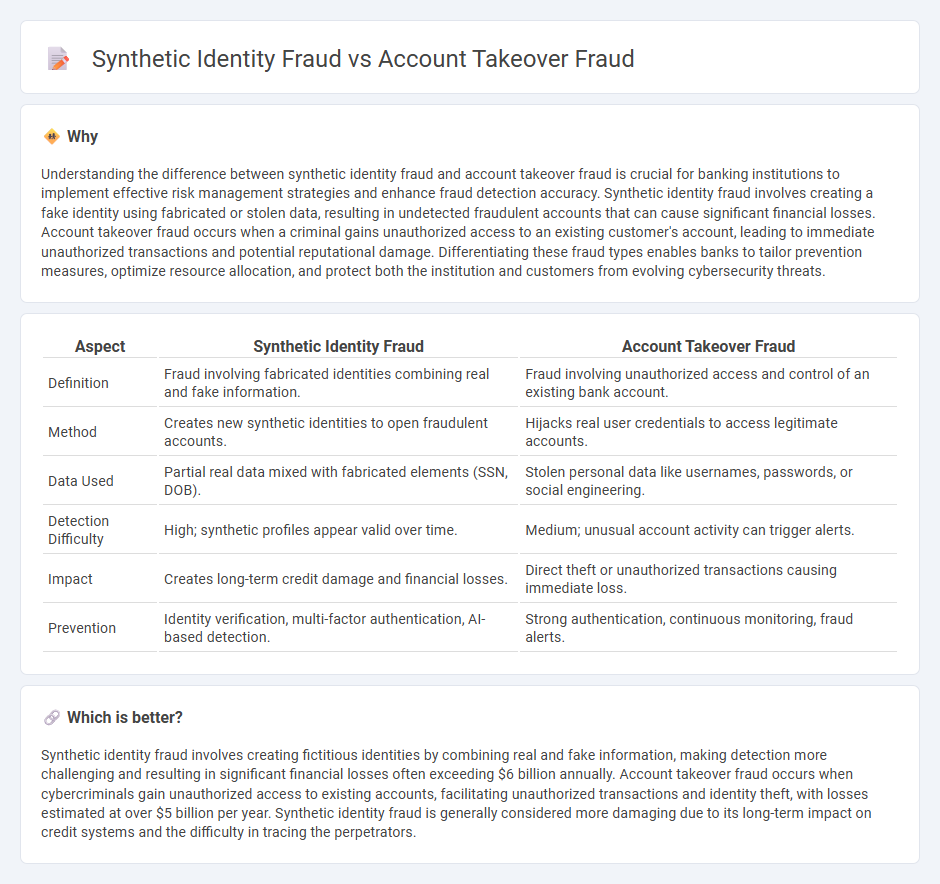

Understanding the difference between synthetic identity fraud and account takeover fraud is crucial for banking institutions to implement effective risk management strategies and enhance fraud detection accuracy. Synthetic identity fraud involves creating a fake identity using fabricated or stolen data, resulting in undetected fraudulent accounts that can cause significant financial losses. Account takeover fraud occurs when a criminal gains unauthorized access to an existing customer's account, leading to immediate unauthorized transactions and potential reputational damage. Differentiating these fraud types enables banks to tailor prevention measures, optimize resource allocation, and protect both the institution and customers from evolving cybersecurity threats.

Comparison Table

| Aspect | Synthetic Identity Fraud | Account Takeover Fraud |

|---|---|---|

| Definition | Fraud involving fabricated identities combining real and fake information. | Fraud involving unauthorized access and control of an existing bank account. |

| Method | Creates new synthetic identities to open fraudulent accounts. | Hijacks real user credentials to access legitimate accounts. |

| Data Used | Partial real data mixed with fabricated elements (SSN, DOB). | Stolen personal data like usernames, passwords, or social engineering. |

| Detection Difficulty | High; synthetic profiles appear valid over time. | Medium; unusual account activity can trigger alerts. |

| Impact | Creates long-term credit damage and financial losses. | Direct theft or unauthorized transactions causing immediate loss. |

| Prevention | Identity verification, multi-factor authentication, AI-based detection. | Strong authentication, continuous monitoring, fraud alerts. |

Which is better?

Synthetic identity fraud involves creating fictitious identities by combining real and fake information, making detection more challenging and resulting in significant financial losses often exceeding $6 billion annually. Account takeover fraud occurs when cybercriminals gain unauthorized access to existing accounts, facilitating unauthorized transactions and identity theft, with losses estimated at over $5 billion per year. Synthetic identity fraud is generally considered more damaging due to its long-term impact on credit systems and the difficulty in tracing the perpetrators.

Connection

Synthetic identity fraud and account takeover fraud are interconnected through their exploitation of compromised personal information to create or access fraudulent accounts. Fraudsters often combine real and fabricated data in synthetic identity fraud to establish new credit profiles, which can later be targeted or leveraged in account takeover schemes. Both types of fraud threaten banking security by manipulating identity verification processes and bypassing authentication measures.

Key Terms

**Account Takeover Fraud:**

Account Takeover Fraud (ATO) involves cybercriminals gaining unauthorized access to legitimate user accounts through methods like phishing, credential stuffing, or social engineering, leading to fraudulent transactions and identity misuse. This type of fraud significantly impacts financial institutions and e-commerce platforms by exploiting stolen credentials to manipulate existing accounts. Discover more about prevention strategies and the latest detection technologies in Account Takeover Fraud.

Credential Theft

Account takeover fraud exploits stolen credentials to gain unauthorized access to legitimate user accounts, often through phishing or data breaches. Synthetic identity fraud involves creating fictitious identities by combining real and fabricated information to open fraudulent accounts, but can also include stolen credentials to enhance authenticity. Explore further to understand how credential theft plays a pivotal role in both fraud types and the best prevention strategies.

Unauthorized Transactions

Account takeover fraud involves cybercriminals gaining unauthorized access to existing accounts to conduct fraudulent transactions, often exploiting stolen credentials or phishing attacks. Synthetic identity fraud, by contrast, uses fabricated identities combining real and fake information to create new accounts, enabling unauthorized transactions that are harder to detect by traditional verification methods. Explore deeper strategies to identify and prevent unauthorized transactions in both fraud types for enhanced security.

Source and External Links

The Comprehensive Guide to Account Takeover Fraud Prevention and Detection - Account takeover fraud is a cybercrime where unauthorized individuals gain control of someone else's online accounts, often to steal funds or personal information, and can occur through phishing, malware, social engineering, or data breaches.

Account Takeover Fraud (ATO) - ATO involves cybercriminals deliberately accessing a victim's online accounts--such as bank, payroll, or social media--using methods like brute force, phishing, social engineering, data breaches, or malware, with the goal of stealing money or sensitive information.

What is account takeover? An overview - ATO is a form of identity fraud where fraudsters use stolen credentials to take control of financial, credit, or email accounts, commonly through phishing attacks that trick victims into revealing their login details.

dowidth.com

dowidth.com