Pay by bank enables direct online payments from a customer's bank account to a merchant without using cards, enhancing security and reducing transaction fees. Standing orders automate fixed regular payments from an account, ideal for recurring bills like rent or subscriptions. Discover the advantages of each method to optimize your payment strategy.

Why it is important

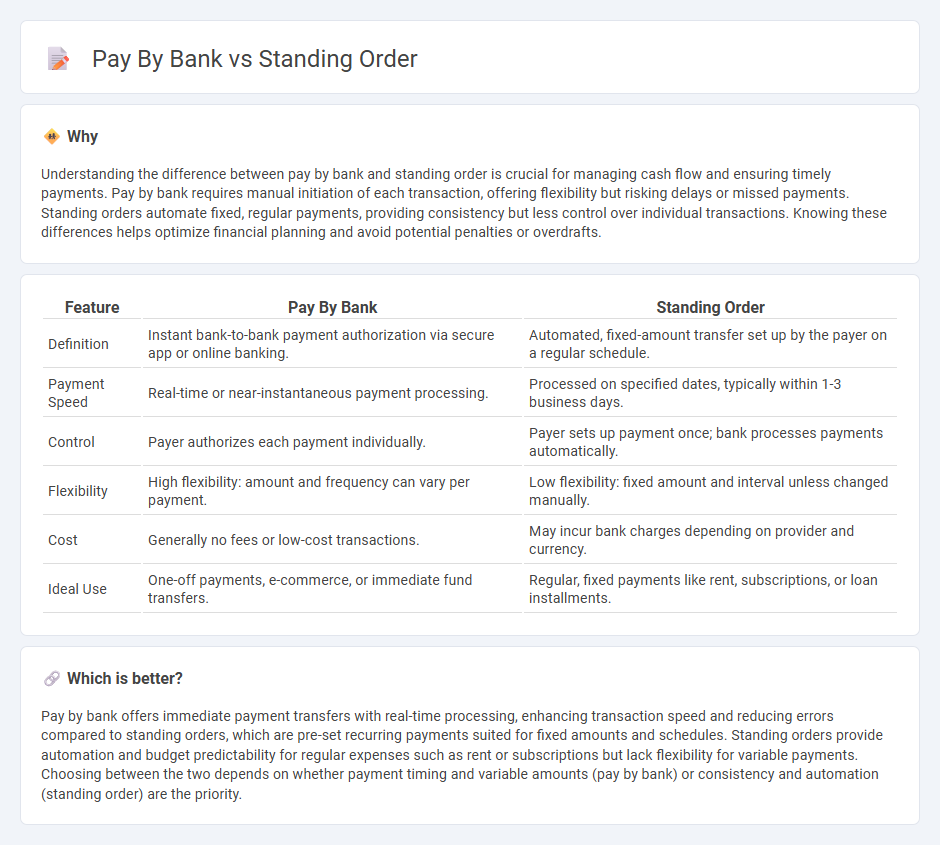

Understanding the difference between pay by bank and standing order is crucial for managing cash flow and ensuring timely payments. Pay by bank requires manual initiation of each transaction, offering flexibility but risking delays or missed payments. Standing orders automate fixed, regular payments, providing consistency but less control over individual transactions. Knowing these differences helps optimize financial planning and avoid potential penalties or overdrafts.

Comparison Table

| Feature | Pay By Bank | Standing Order |

|---|---|---|

| Definition | Instant bank-to-bank payment authorization via secure app or online banking. | Automated, fixed-amount transfer set up by the payer on a regular schedule. |

| Payment Speed | Real-time or near-instantaneous payment processing. | Processed on specified dates, typically within 1-3 business days. |

| Control | Payer authorizes each payment individually. | Payer sets up payment once; bank processes payments automatically. |

| Flexibility | High flexibility: amount and frequency can vary per payment. | Low flexibility: fixed amount and interval unless changed manually. |

| Cost | Generally no fees or low-cost transactions. | May incur bank charges depending on provider and currency. |

| Ideal Use | One-off payments, e-commerce, or immediate fund transfers. | Regular, fixed payments like rent, subscriptions, or loan installments. |

Which is better?

Pay by bank offers immediate payment transfers with real-time processing, enhancing transaction speed and reducing errors compared to standing orders, which are pre-set recurring payments suited for fixed amounts and schedules. Standing orders provide automation and budget predictability for regular expenses such as rent or subscriptions but lack flexibility for variable payments. Choosing between the two depends on whether payment timing and variable amounts (pay by bank) or consistency and automation (standing order) are the priority.

Connection

Pay by bank and standing order are connected through their use of direct bank-to-bank transactions for seamless payment processing. Pay by bank enables customers to authorize payments directly from their bank accounts, while standing orders automate recurring payments of fixed amounts at regular intervals. Both methods reduce reliance on physical cash and enhance financial efficiency by facilitating secure, scheduled transfers.

Key Terms

Automated Payment Instruction

Standing orders allow customers to automate fixed-amount payments at regular intervals directly from their bank accounts, ensuring consistent and timely transfers without manual intervention. Pay by bank, an Automated Payment Instruction (API) method, enables real-time authorization of payments via secure bank-to-bank communication, enhancing transaction speed and reducing reliance on card networks. Explore further to understand how these payment automation methods optimize financial management.

Account-to-Account Transfer

Standing orders automate fixed regular payments from one bank account to another, ideal for predictable expenses like rent or subscriptions. Pay by bank enables real-time, account-to-account transfers with variable amounts, enhancing payment flexibility and security for both consumers and merchants. Explore the detailed differences and benefits of these payment methods to optimize your financial transactions.

Payment Authorization

Standing orders authorize banks to execute fixed payments at regular intervals without requiring repeated approval, ensuring automated and consistent fund transfers. Pay by bank payments require real-time authorization for each transaction, enhancing security by confirming user consent before every payment. Explore the differences in payment authorization mechanisms to determine the best method suited for your financial needs.

Source and External Links

Standing order (banking) - Wikipedia - A standing order is an instruction given by a bank account holder to their bank to automatically pay a fixed amount at regular intervals to another account, commonly used for regular payments like rent or subscriptions.

What is a standing order? | Lloyds Bank - A standing order is a recurring payment of the same amount made on a specified date, which can be easily set up, changed, or canceled through online banking or at a branch.

Standing Orders | Washington State Department of Health - In healthcare, a standing order is a protocol approved by a qualified provider that allows patients to receive certain tests, vaccines, or services without an individual prescription, streamlining access to care.

dowidth.com

dowidth.com