Behavioral biometrics analyzes unique user patterns such as typing rhythm, mouse movement, and device interaction to enhance security in banking authentication. Smart card authentication relies on physical cards embedded with microchips to verify identity and grant access to accounts. Explore the advantages and limitations of these methods to understand their impact on banking security.

Why it is important

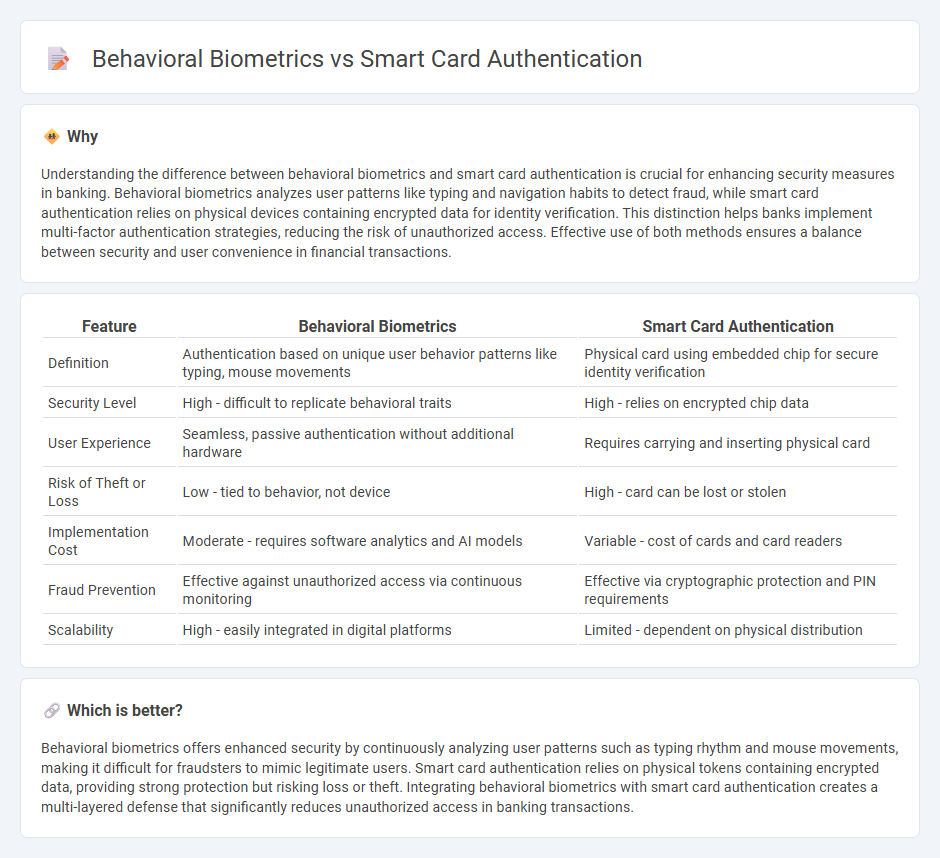

Understanding the difference between behavioral biometrics and smart card authentication is crucial for enhancing security measures in banking. Behavioral biometrics analyzes user patterns like typing and navigation habits to detect fraud, while smart card authentication relies on physical devices containing encrypted data for identity verification. This distinction helps banks implement multi-factor authentication strategies, reducing the risk of unauthorized access. Effective use of both methods ensures a balance between security and user convenience in financial transactions.

Comparison Table

| Feature | Behavioral Biometrics | Smart Card Authentication |

|---|---|---|

| Definition | Authentication based on unique user behavior patterns like typing, mouse movements | Physical card using embedded chip for secure identity verification |

| Security Level | High - difficult to replicate behavioral traits | High - relies on encrypted chip data |

| User Experience | Seamless, passive authentication without additional hardware | Requires carrying and inserting physical card |

| Risk of Theft or Loss | Low - tied to behavior, not device | High - card can be lost or stolen |

| Implementation Cost | Moderate - requires software analytics and AI models | Variable - cost of cards and card readers |

| Fraud Prevention | Effective against unauthorized access via continuous monitoring | Effective via cryptographic protection and PIN requirements |

| Scalability | High - easily integrated in digital platforms | Limited - dependent on physical distribution |

Which is better?

Behavioral biometrics offers enhanced security by continuously analyzing user patterns such as typing rhythm and mouse movements, making it difficult for fraudsters to mimic legitimate users. Smart card authentication relies on physical tokens containing encrypted data, providing strong protection but risking loss or theft. Integrating behavioral biometrics with smart card authentication creates a multi-layered defense that significantly reduces unauthorized access in banking transactions.

Connection

Behavioral biometrics analyze unique user patterns such as typing rhythm and mouse movement to enhance security in banking transactions. Smart card authentication leverages these biometric data to verify user identity dynamically, reducing fraud risk and unauthorized access. Combining both technologies strengthens multi-factor authentication frameworks in financial institutions.

Key Terms

EMV Chip

EMV Chip technology in smart card authentication provides a secure, tamper-resistant method for verifying cardholder identity through dynamic data generation during transactions, significantly reducing fraud compared to magnetic stripe cards. Behavioral biometrics analyzes unique user patterns such as typing rhythm, swipe gestures, and device interaction to continuously authenticate users beyond the initial EMV card verification, enhancing fraud prevention. Discover how integrating EMV Chip authentication with behavioral biometrics revolutionizes secure payment systems.

Keystroke Dynamics

Smart card authentication relies on hardware tokens to verify user identity, providing a physical layer of security, while behavioral biometrics, such as keystroke dynamics, analyze unique typing patterns to authenticate users continuously. Keystroke dynamics capture metrics like typing speed, dwell time, and flight time, enabling detection of anomalies indicative of unauthorized access. Explore further how integrating keystroke dynamics enhances security by complementing traditional smart card authentication methods.

Two-Factor Authentication

Smart card authentication leverages physical tokens embedded with encrypted data to verify user identity, enhancing security through possession-based factors. Behavioral biometrics analyze unique patterns such as typing rhythm, gait, or mouse movements, offering continuous and non-intrusive user verification. Explore in-depth comparisons and advantages of each method to strengthen your two-factor authentication strategy.

Source and External Links

Understanding Smart Card Authentication - 1Kosmos - Smart card authentication uses an embedded chip in the card to generate or store cryptographic data that verifies user identity through a challenge-response process, making it very secure and resistant to fraud.

Configure the Smart Card authenticator | Okta Identity Engine - Okta's Smart Card authenticator supports authentication using smart cards with options like PIN protection and hardware protection, providing phishing-resistant, device-bound user verification methods.

Understanding smart card authentication - Red Hat - Red Hat Enterprise Linux provides configurable smart card authentication options, including requiring smart card use exclusively for login and locking the system upon card removal to enhance security.

dowidth.com

dowidth.com