Finfluencers leverage social media platforms to share accessible, real-time financial advice and investment tips, appealing primarily to younger, tech-savvy audiences. Wealth managers provide personalized, comprehensive financial planning and asset management services, catering to high-net-worth clients seeking tailored strategies and risk management. Explore the distinct roles and benefits of finfluencers and wealth managers to decide which financial guidance suits your needs.

Why it is important

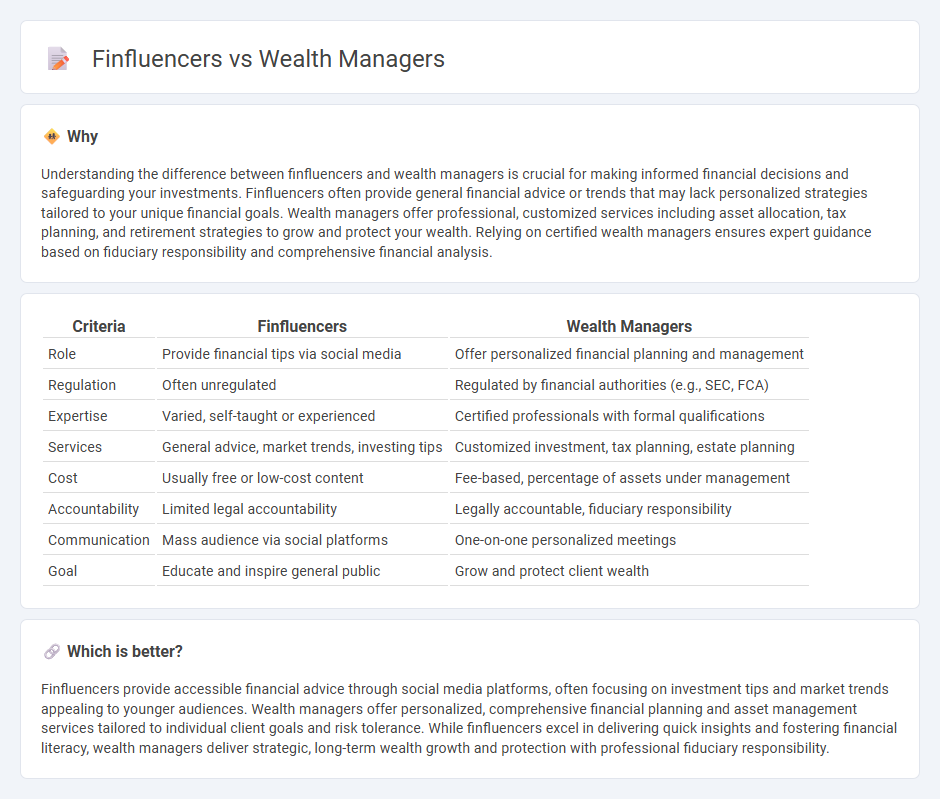

Understanding the difference between finfluencers and wealth managers is crucial for making informed financial decisions and safeguarding your investments. Finfluencers often provide general financial advice or trends that may lack personalized strategies tailored to your unique financial goals. Wealth managers offer professional, customized services including asset allocation, tax planning, and retirement strategies to grow and protect your wealth. Relying on certified wealth managers ensures expert guidance based on fiduciary responsibility and comprehensive financial analysis.

Comparison Table

| Criteria | Finfluencers | Wealth Managers |

|---|---|---|

| Role | Provide financial tips via social media | Offer personalized financial planning and management |

| Regulation | Often unregulated | Regulated by financial authorities (e.g., SEC, FCA) |

| Expertise | Varied, self-taught or experienced | Certified professionals with formal qualifications |

| Services | General advice, market trends, investing tips | Customized investment, tax planning, estate planning |

| Cost | Usually free or low-cost content | Fee-based, percentage of assets under management |

| Accountability | Limited legal accountability | Legally accountable, fiduciary responsibility |

| Communication | Mass audience via social platforms | One-on-one personalized meetings |

| Goal | Educate and inspire general public | Grow and protect client wealth |

Which is better?

Finfluencers provide accessible financial advice through social media platforms, often focusing on investment tips and market trends appealing to younger audiences. Wealth managers offer personalized, comprehensive financial planning and asset management services tailored to individual client goals and risk tolerance. While finfluencers excel in delivering quick insights and fostering financial literacy, wealth managers deliver strategic, long-term wealth growth and protection with professional fiduciary responsibility.

Connection

Finfluencers leverage social media platforms to educate audiences on personal finance, investment strategies, and wealth-building techniques, often influencing the decisions of retail investors. Wealth managers collaborate with or monitor finfluencers to gain insights into market trends and client sentiment, adapting their advisory approaches to remain competitive and relevant. The intersection of finfluencers and wealth managers is reshaping traditional banking by integrating digital engagement with personalized financial planning.

Key Terms

**Wealth Managers:**

Wealth managers provide personalized financial planning, asset allocation, tax strategies, and estate planning tailored to individual client goals and risk tolerance. They offer fiduciary advice backed by professional certifications and regulatory oversight, ensuring trust and accountability in managing significant assets. Discover how partnering with a wealth manager can secure your financial future with expert guidance.

Asset Allocation

Wealth managers employ tailored asset allocation strategies based on individual risk tolerance, investment goals, and market conditions to optimize long-term portfolio performance. Finfluencers often promote trending or high-yield assets without personalized diversification, risking concentrated exposure and volatility. Explore how professional asset allocation frameworks outperform social media hype to enhance financial stability.

Portfolio Diversification

Wealth managers leverage tailored portfolio diversification strategies by analyzing clients' risk tolerance, financial goals, and market conditions to balance assets across equities, bonds, real estate, and alternative investments. Finfluencers often share generalized advice on diversification through social media, emphasizing trending stocks and crypto without comprehensive risk assessment or personalized guidance. Explore how professional wealth managers provide in-depth diversification techniques that suit your financial objectives.

Source and External Links

What Is a Wealth Manager? - SmartAsset - A wealth manager is a specialized financial professional who provides comprehensive services including investment management, retirement planning, tax strategies, estate planning, and risk management to high-net-worth individuals, usually with assets of $1 million or more, offering personalized and holistic financial guidance.

What Do Private Wealth Managers Do? - CFA Institute - Private wealth managers advise high-net-worth clients on investing and financial planning, including portfolio management, estate and retirement planning, and tax services, focusing on navigating financial complexities to meet client goals.

Wealth Management: What It Is, Costs, Minimums - NerdWallet - Wealth management involves financial advice and services for affluent clients, with fees generally from 0.25% to 2% of assets, typically requiring millions in investable assets, and employs holistic strategies including access to a broad range of investments and integrated financial planning.

dowidth.com

dowidth.com