Neo brokerages offer low-cost, technology-driven trading platforms with minimal fees and streamlined digital experiences, appealing primarily to self-directed investors. Full-service brokerages provide comprehensive financial advisory, in-depth market research, and personalized investment strategies, catering to clients seeking professional guidance. Explore the differences in services and costs to determine which brokerage suits your investment goals.

Why it is important

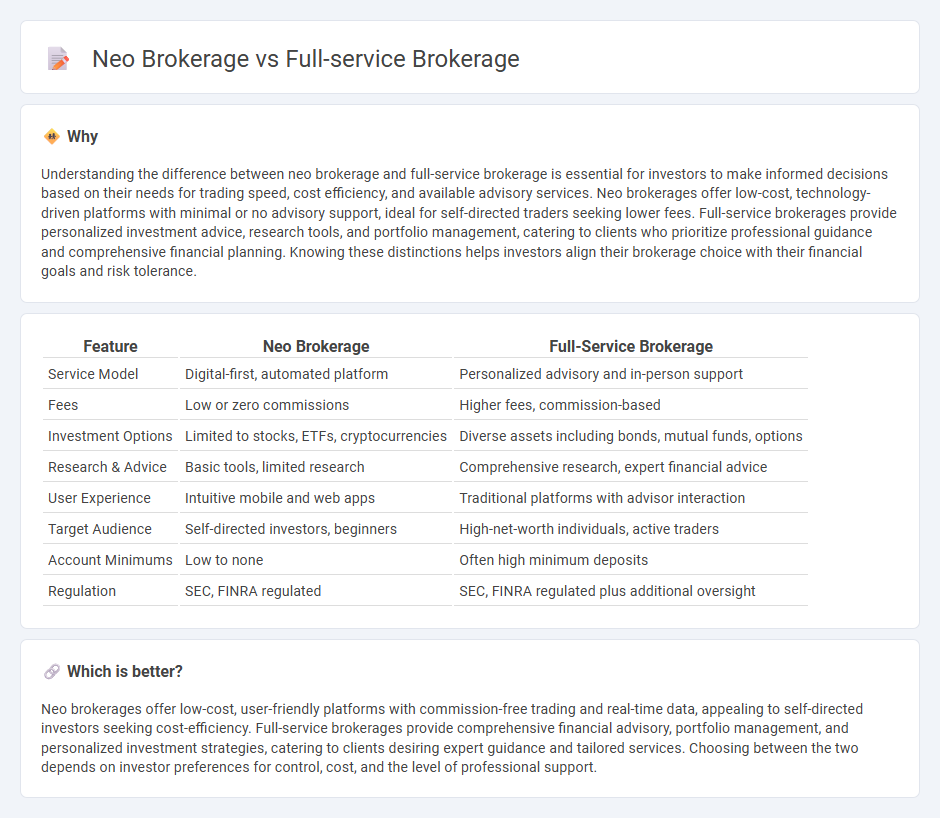

Understanding the difference between neo brokerage and full-service brokerage is essential for investors to make informed decisions based on their needs for trading speed, cost efficiency, and available advisory services. Neo brokerages offer low-cost, technology-driven platforms with minimal or no advisory support, ideal for self-directed traders seeking lower fees. Full-service brokerages provide personalized investment advice, research tools, and portfolio management, catering to clients who prioritize professional guidance and comprehensive financial planning. Knowing these distinctions helps investors align their brokerage choice with their financial goals and risk tolerance.

Comparison Table

| Feature | Neo Brokerage | Full-Service Brokerage |

|---|---|---|

| Service Model | Digital-first, automated platform | Personalized advisory and in-person support |

| Fees | Low or zero commissions | Higher fees, commission-based |

| Investment Options | Limited to stocks, ETFs, cryptocurrencies | Diverse assets including bonds, mutual funds, options |

| Research & Advice | Basic tools, limited research | Comprehensive research, expert financial advice |

| User Experience | Intuitive mobile and web apps | Traditional platforms with advisor interaction |

| Target Audience | Self-directed investors, beginners | High-net-worth individuals, active traders |

| Account Minimums | Low to none | Often high minimum deposits |

| Regulation | SEC, FINRA regulated | SEC, FINRA regulated plus additional oversight |

Which is better?

Neo brokerages offer low-cost, user-friendly platforms with commission-free trading and real-time data, appealing to self-directed investors seeking cost-efficiency. Full-service brokerages provide comprehensive financial advisory, portfolio management, and personalized investment strategies, catering to clients desiring expert guidance and tailored services. Choosing between the two depends on investor preferences for control, cost, and the level of professional support.

Connection

Neo brokerage and full-service brokerage intersect through their roles in facilitating investment transactions, with neo brokerages offering streamlined, technology-driven trading platforms that reduce costs and enhance accessibility. Full-service brokerages provide comprehensive financial advisory, portfolio management, and personalized wealth management services, often leveraging digital tools that neo brokerages develop. This synergy enables investors to benefit from both efficient execution and expert guidance, driving innovation and customer-centric solutions in modern banking and investment services.

Key Terms

Advisory Services

Full-service brokerages offer comprehensive advisory services with personalized investment strategies and in-depth market research, catering to clients seeking tailored financial planning. Neo brokerages provide streamlined advisory options, leveraging technology and algorithms for cost-effective, real-time portfolio insights ideal for tech-savvy investors. Explore our detailed comparison to understand which advisory model aligns best with your investment goals.

Commission Structure

Full-service brokerages typically charge higher commissions ranging from 1% to 2% per trade, reflecting their extensive advisory services and personalized financial planning. Neo brokerages offer a commission-free or low-commission structure, relying on alternative revenue streams such as payment for order flow and premium features. Explore the differences in commission models to determine which brokerage aligns with your investment strategy.

Trading Platform

Full-service brokerages offer comprehensive trading platforms with advanced research tools, personalized investment advice, and extensive asset coverage, catering to investors seeking a robust trading environment and professional support. Neo brokerages prioritize user-friendly, mobile-optimized platforms with zero or low commission fees, streamlined interfaces, and rapid trade execution, targeting cost-conscious and tech-savvy traders. Explore the differences in trading platforms to determine which brokerage model aligns best with your investment needs.

Source and External Links

Is a Full Service Broker Right For You? (Full Service vs ... - Full-service brokers like Morgan Stanley and Charles Schwab offer personalized portfolio management, financial advice, tax and estate planning, and access to alternative investments, but typically require high minimum balances and charge higher fees.

Types of Brokers: Full Service, Discount, Deep Discount - Full-service brokerages act as one-stop shops, providing clients with a personal broker, comprehensive market research, and a wide range of financial options, though these services come with higher commissions and fees.

Why should you use a full-service broker? - A full-service broker offers a broad array of financial services including financial, retirement, and estate planning, tax recommendations, and insurance solutions, making it a convenient option for investors seeking comprehensive support.

dowidth.com

dowidth.com