Banking as a Service (BaaS) enables third-party providers to offer banking products through APIs, streamlining financial services integration. Banking marketplaces act as centralized platforms where consumers can compare and access various financial products from multiple institutions. Explore the distinctions to understand which solution best fits your business needs.

Why it is important

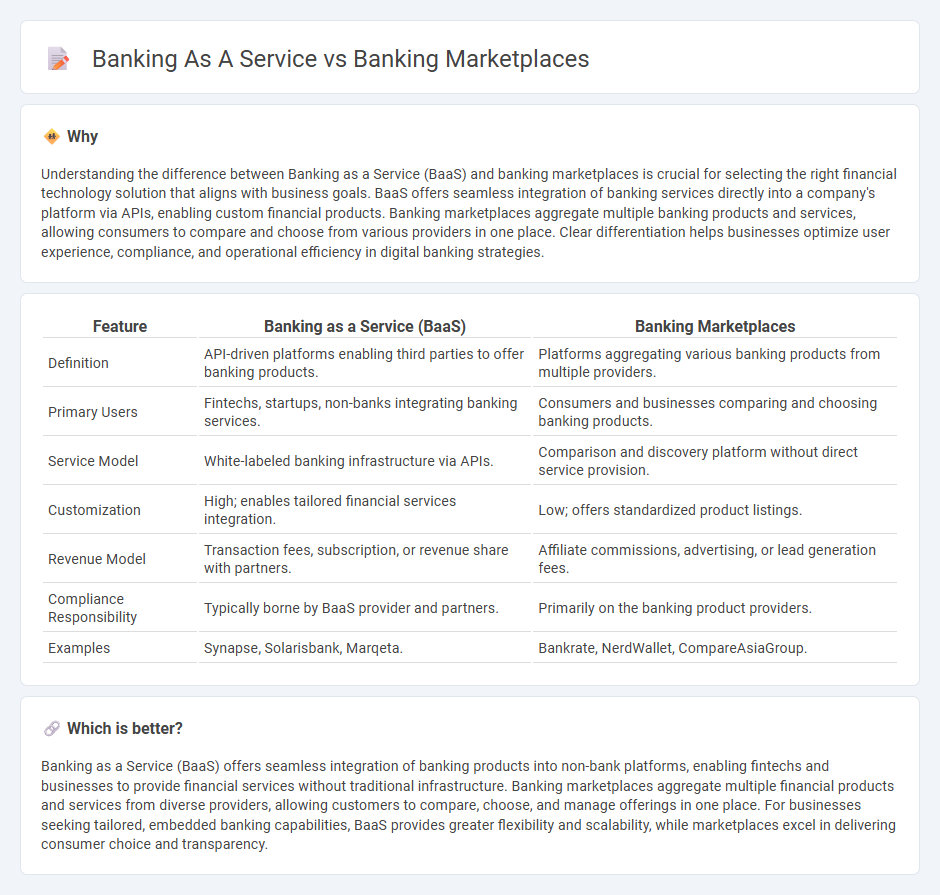

Understanding the difference between Banking as a Service (BaaS) and banking marketplaces is crucial for selecting the right financial technology solution that aligns with business goals. BaaS offers seamless integration of banking services directly into a company's platform via APIs, enabling custom financial products. Banking marketplaces aggregate multiple banking products and services, allowing consumers to compare and choose from various providers in one place. Clear differentiation helps businesses optimize user experience, compliance, and operational efficiency in digital banking strategies.

Comparison Table

| Feature | Banking as a Service (BaaS) | Banking Marketplaces |

|---|---|---|

| Definition | API-driven platforms enabling third parties to offer banking products. | Platforms aggregating various banking products from multiple providers. |

| Primary Users | Fintechs, startups, non-banks integrating banking services. | Consumers and businesses comparing and choosing banking products. |

| Service Model | White-labeled banking infrastructure via APIs. | Comparison and discovery platform without direct service provision. |

| Customization | High; enables tailored financial services integration. | Low; offers standardized product listings. |

| Revenue Model | Transaction fees, subscription, or revenue share with partners. | Affiliate commissions, advertising, or lead generation fees. |

| Compliance Responsibility | Typically borne by BaaS provider and partners. | Primarily on the banking product providers. |

| Examples | Synapse, Solarisbank, Marqeta. | Bankrate, NerdWallet, CompareAsiaGroup. |

Which is better?

Banking as a Service (BaaS) offers seamless integration of banking products into non-bank platforms, enabling fintechs and businesses to provide financial services without traditional infrastructure. Banking marketplaces aggregate multiple financial products and services from diverse providers, allowing customers to compare, choose, and manage offerings in one place. For businesses seeking tailored, embedded banking capabilities, BaaS provides greater flexibility and scalability, while marketplaces excel in delivering consumer choice and transparency.

Connection

Banking-as-a-Service (BaaS) platforms provide the technological infrastructure and APIs that enable third-party providers to embed banking services directly into their products, facilitating seamless financial transactions. Banking marketplaces leverage BaaS to aggregate diverse financial products from multiple banks and fintechs, offering customers a wide range of customizable options in a single digital environment. This integration drives innovation, enhances customer experience, and expands access to personalized banking solutions.

Key Terms

Platform Integration

Banking marketplaces aggregate multiple financial products and services from various providers into a single platform, facilitating seamless comparison and selection for users through comprehensive API integrations. Banking as a Service (BaaS) enables third-party developers to embed complete banking functionalities within their applications via robust platform integration, allowing for customized financial solutions and streamlined user experiences. Explore further to understand how these platform integration strategies drive innovation and scalability in the financial sector.

White-Label Solutions

Banking marketplaces aggregate diverse financial products from multiple providers, offering customers a broad choice within a single platform, while Banking as a Service (BaaS) enables third-party firms to embed banking features directly into their own products using white-label solutions. White-label banking solutions in BaaS empower businesses to offer fully branded financial services such as accounts, payments, and loans without developing infrastructure, accelerating time-to-market and enhancing customer experience. Explore more insights on how white-label banking transforms fintech innovation and scalability.

Regulatory Compliance

Banking marketplaces serve as platforms connecting multiple financial service providers and customers while ensuring adherence to diverse regulatory frameworks such as GDPR and PSD2. Banking as a Service (BaaS) models offer embedded banking functionalities through APIs, with providers shouldering compliance responsibilities like anti-money laundering (AML) and Know Your Customer (KYC) protocols. Explore how each model navigates regulatory complexities to optimize operational efficiency and customer trust.

Source and External Links

The rise of banking marketplaces - Sopra Banking Software - Banking marketplaces are digital ecosystems where banks offer their own financial products alongside third-party solutions, using models like Banking-as-a-Service and Banking-as-a-Platform to create seamless, customizable one-stop platforms that meet diverse customer needs.

BANKING MARKETPLACE - Accenture - Marketplaces enable banks to meet evolving customer expectations by onboarding partners and delivering services through digital platforms, positioning banks to grow revenue and compete effectively in the platform economy.

Marketplace Banking: a Roadmap for Digital Banks - Marketplace banking transforms banks into digital hubs connecting customers with broad ecosystems of financial and third-party services, enhancing customer experience through real-time data analytics and enabling banks to become central players in a technological network.

dowidth.com

dowidth.com