Synthetic identity fraud involves creating fake identities using fabricated personal information to open fraudulent accounts and conduct illicit financial activities. Money laundering is the process of disguising the origins of illegally obtained money, often by means of complex financial transactions through banks and other institutions. Explore how banks detect and prevent synthetic identity fraud and money laundering to protect financial systems.

Why it is important

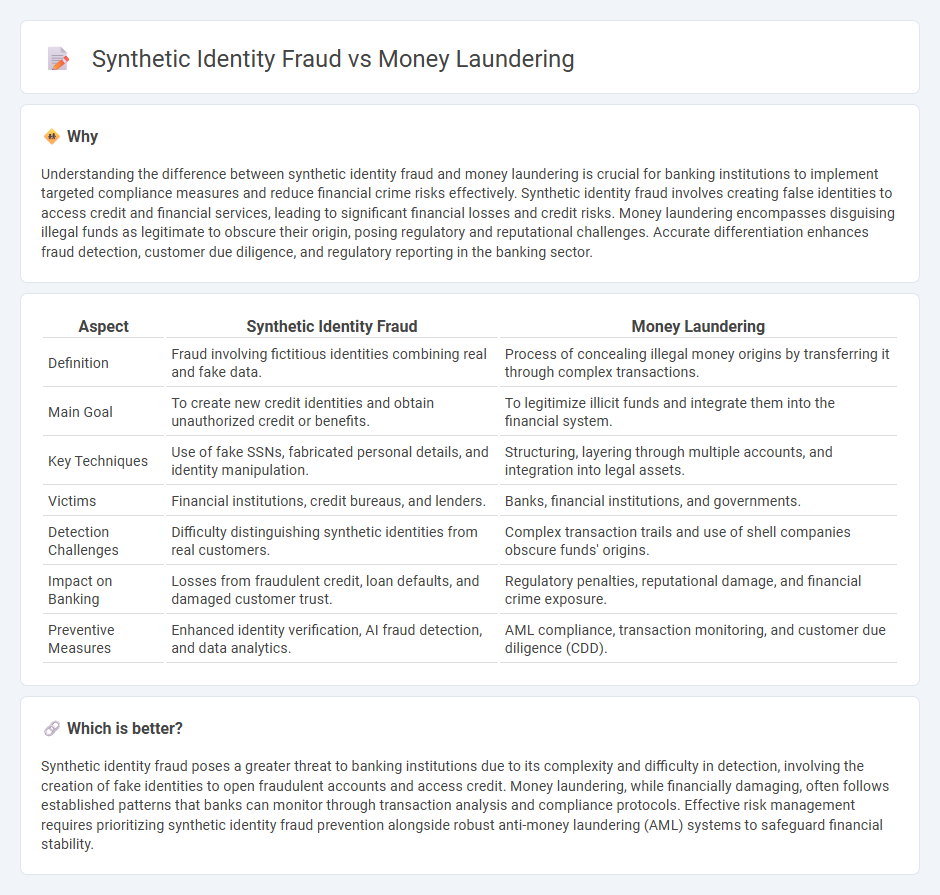

Understanding the difference between synthetic identity fraud and money laundering is crucial for banking institutions to implement targeted compliance measures and reduce financial crime risks effectively. Synthetic identity fraud involves creating false identities to access credit and financial services, leading to significant financial losses and credit risks. Money laundering encompasses disguising illegal funds as legitimate to obscure their origin, posing regulatory and reputational challenges. Accurate differentiation enhances fraud detection, customer due diligence, and regulatory reporting in the banking sector.

Comparison Table

| Aspect | Synthetic Identity Fraud | Money Laundering |

|---|---|---|

| Definition | Fraud involving fictitious identities combining real and fake data. | Process of concealing illegal money origins by transferring it through complex transactions. |

| Main Goal | To create new credit identities and obtain unauthorized credit or benefits. | To legitimize illicit funds and integrate them into the financial system. |

| Key Techniques | Use of fake SSNs, fabricated personal details, and identity manipulation. | Structuring, layering through multiple accounts, and integration into legal assets. |

| Victims | Financial institutions, credit bureaus, and lenders. | Banks, financial institutions, and governments. |

| Detection Challenges | Difficulty distinguishing synthetic identities from real customers. | Complex transaction trails and use of shell companies obscure funds' origins. |

| Impact on Banking | Losses from fraudulent credit, loan defaults, and damaged customer trust. | Regulatory penalties, reputational damage, and financial crime exposure. |

| Preventive Measures | Enhanced identity verification, AI fraud detection, and data analytics. | AML compliance, transaction monitoring, and customer due diligence (CDD). |

Which is better?

Synthetic identity fraud poses a greater threat to banking institutions due to its complexity and difficulty in detection, involving the creation of fake identities to open fraudulent accounts and access credit. Money laundering, while financially damaging, often follows established patterns that banks can monitor through transaction analysis and compliance protocols. Effective risk management requires prioritizing synthetic identity fraud prevention alongside robust anti-money laundering (AML) systems to safeguard financial stability.

Connection

Synthetic identity fraud and money laundering are interconnected through the exploitation of fake identities to move and disguise illicit funds within the banking system. Criminals create synthetic identities by combining real and fabricated information, enabling them to open bank accounts or credit lines that facilitate the layering and integration stages of money laundering. Financial institutions face increased risks as these synthetic accounts evade traditional detection methods, complicating efforts to trace and prevent illegal financial activities.

Key Terms

**Money Laundering:**

Money laundering involves disguising the origins of illegally obtained money by processing it through complex financial systems to make it appear legitimate. This financial crime poses significant risks to economic stability and is typically executed through layered transactions, shell companies, and offshore accounts. Explore the methods and detection strategies to understand money laundering in greater depth.

Placement

Placement in money laundering involves the initial introduction of illicit funds into the financial system, often through methods like cash deposits, purchase of assets, or smurfing to avoid detection. In synthetic identity fraud, placement occurs when fabricated identities are used to open fraudulent accounts or apply for credit, enabling criminals to inject illicit gains into legitimate financial channels. Explore the nuances of placement strategies to strengthen anti-fraud and anti-money laundering measures.

Layering

Money laundering layering involves complex financial transactions to obscure the origin of illicit funds, often using multiple accounts, transfers, and conversions to make tracking difficult. Synthetic identity fraud layering manipulates false identities with fabricated or stolen information to create financial profiles for unauthorized access and blending fraudulent activities into legitimate systems. Explore detailed strategies and detection techniques to enhance security against these sophisticated financial crimes.

Source and External Links

Money Laundering - Wikipedia - Money laundering is the process of concealing the origin of money obtained from illicit activities by converting it into a legitimate source, often through front organizations.

Money-Laundering Overview - UNODC - Money laundering involves disguising the illegal origin of funds through processes like conversion or transfer, typically in three stages: placement, layering, and integration.

Chinese Groups Launder $580M in India - Hackread - Chinese cyber syndicates are using fake apps and mule accounts to launder over $580 million annually in India, posing a significant threat to the country's financial security.

dowidth.com

dowidth.com