Social trading enables investors to follow and interact with a community of traders, sharing insights and strategies for collective market success. Copy trading allows individuals to automatically replicate the trades of experienced investors, minimizing the need for in-depth market knowledge. Explore the differences and benefits of both to enhance your banking and investment decisions.

Why it is important

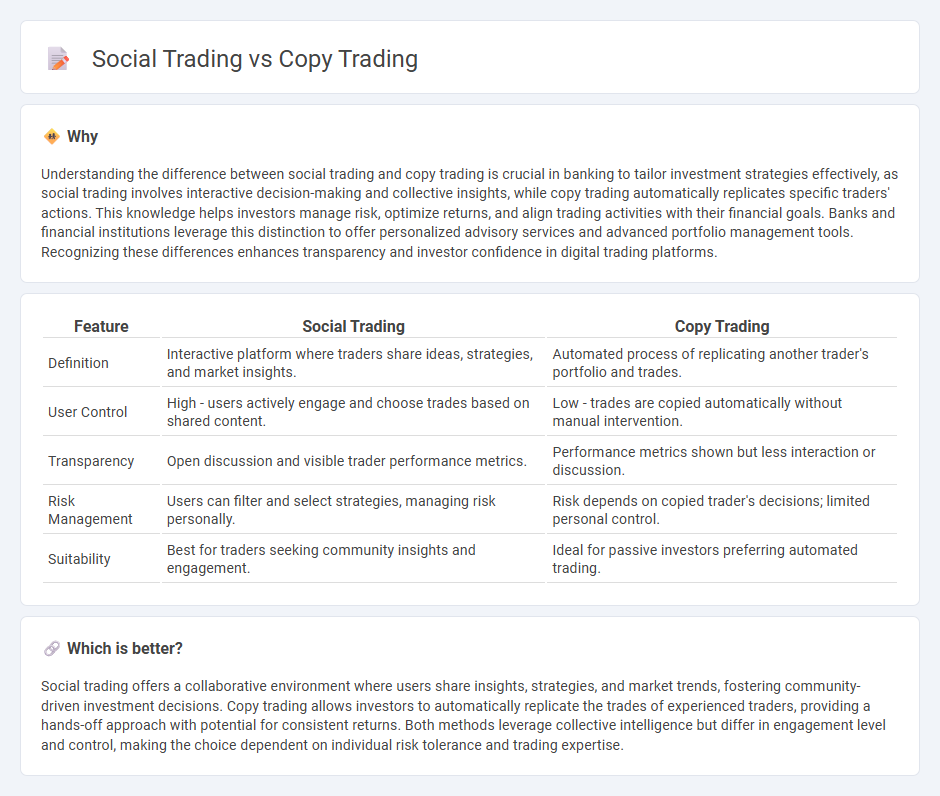

Understanding the difference between social trading and copy trading is crucial in banking to tailor investment strategies effectively, as social trading involves interactive decision-making and collective insights, while copy trading automatically replicates specific traders' actions. This knowledge helps investors manage risk, optimize returns, and align trading activities with their financial goals. Banks and financial institutions leverage this distinction to offer personalized advisory services and advanced portfolio management tools. Recognizing these differences enhances transparency and investor confidence in digital trading platforms.

Comparison Table

| Feature | Social Trading | Copy Trading |

|---|---|---|

| Definition | Interactive platform where traders share ideas, strategies, and market insights. | Automated process of replicating another trader's portfolio and trades. |

| User Control | High - users actively engage and choose trades based on shared content. | Low - trades are copied automatically without manual intervention. |

| Transparency | Open discussion and visible trader performance metrics. | Performance metrics shown but less interaction or discussion. |

| Risk Management | Users can filter and select strategies, managing risk personally. | Risk depends on copied trader's decisions; limited personal control. |

| Suitability | Best for traders seeking community insights and engagement. | Ideal for passive investors preferring automated trading. |

Which is better?

Social trading offers a collaborative environment where users share insights, strategies, and market trends, fostering community-driven investment decisions. Copy trading allows investors to automatically replicate the trades of experienced traders, providing a hands-off approach with potential for consistent returns. Both methods leverage collective intelligence but differ in engagement level and control, making the choice dependent on individual risk tolerance and trading expertise.

Connection

Social trading and copy trading are interconnected as social trading platforms enable investors to observe and interact with experienced traders, while copy trading allows them to automatically replicate those traders' strategies in real time. By leveraging the collective knowledge and insights shared within the social trading community, copy trading minimizes decision-making effort and helps investors diversify portfolios with proven techniques. This synergy enhances market accessibility, especially for novice traders seeking to benefit from expert strategies without extensive research.

Key Terms

Mirror Trading

Mirror trading enables investors to automatically replicate the trades of experienced traders by copying their strategies in real-time, offering a hands-off approach to market participation. Unlike broader social trading, which emphasizes community interaction and idea sharing, mirror trading strictly focuses on duplicating specific trade executions to align portfolio performance. Explore the nuances between copy trading, social platforms, and mirror trading to optimize your investment strategy effectively.

Signal Provider

Signal providers play a crucial role in both copy trading and social trading by offering trade signals that guide investors' decisions. In copy trading, the focus is on automatically replicating the exact trades of a signal provider, ensuring seamless execution and consistency. Explore more to understand how selecting the right signal provider can impact your trading success.

Investment Network

Copy trading enables investors to automatically replicate the trades of experienced traders within an investment network, providing a hands-off approach to portfolio management. Social trading incorporates broader community interaction, allowing users to share insights, strategies, and market analyses while participating in collaborative decision-making. Explore the nuances of investment networks to enhance your trading strategy and optimize returns.

Source and External Links

Copy trading - Wikipedia - Copy trading allows individuals to automatically replicate the trades of selected investors, linking a portion of their funds to the copied trader's account so that all subsequent trades are mirrored in proportion.

Copy Trading | Copy the Best Traders in 2025 | AvaTrade - Copy trading enables less experienced traders to automatically duplicate the trades of more seasoned investors, offering a hands-off, accessible entry into the financial markets.

What is Copy Trading, How Does it Work and How to ... - PrimeXBT - With copy trading, you can automatically follow and replicate the trades of profitable traders without needing to conduct your own market analysis, adjusting risk and allocation as desired.

dowidth.com

dowidth.com