Neo banking offers digital-first financial services with streamlined mobile platforms, targeting tech-savvy customers seeking quick, low-fee transactions. Credit unions provide member-owned, community-focused banking with personalized services and competitive rates for savings and loans. Explore the key differences to determine which banking option suits your financial needs best.

Why it is important

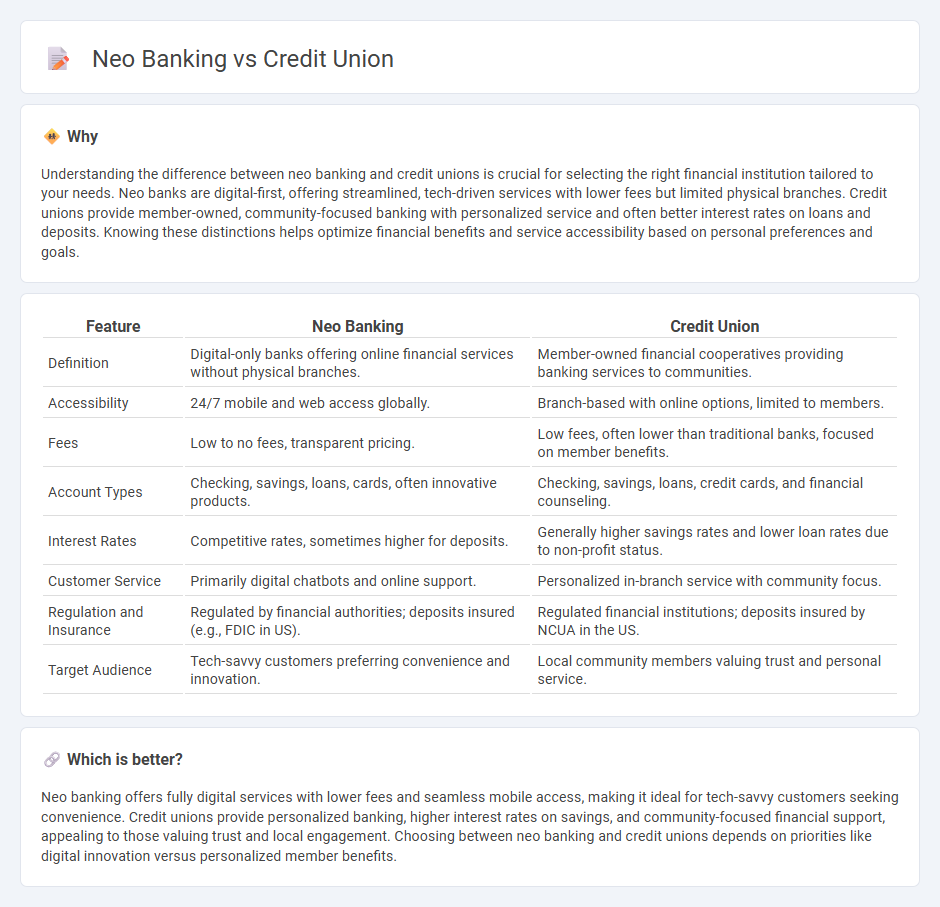

Understanding the difference between neo banking and credit unions is crucial for selecting the right financial institution tailored to your needs. Neo banks are digital-first, offering streamlined, tech-driven services with lower fees but limited physical branches. Credit unions provide member-owned, community-focused banking with personalized service and often better interest rates on loans and deposits. Knowing these distinctions helps optimize financial benefits and service accessibility based on personal preferences and goals.

Comparison Table

| Feature | Neo Banking | Credit Union |

|---|---|---|

| Definition | Digital-only banks offering online financial services without physical branches. | Member-owned financial cooperatives providing banking services to communities. |

| Accessibility | 24/7 mobile and web access globally. | Branch-based with online options, limited to members. |

| Fees | Low to no fees, transparent pricing. | Low fees, often lower than traditional banks, focused on member benefits. |

| Account Types | Checking, savings, loans, cards, often innovative products. | Checking, savings, loans, credit cards, and financial counseling. |

| Interest Rates | Competitive rates, sometimes higher for deposits. | Generally higher savings rates and lower loan rates due to non-profit status. |

| Customer Service | Primarily digital chatbots and online support. | Personalized in-branch service with community focus. |

| Regulation and Insurance | Regulated by financial authorities; deposits insured (e.g., FDIC in US). | Regulated financial institutions; deposits insured by NCUA in the US. |

| Target Audience | Tech-savvy customers preferring convenience and innovation. | Local community members valuing trust and personal service. |

Which is better?

Neo banking offers fully digital services with lower fees and seamless mobile access, making it ideal for tech-savvy customers seeking convenience. Credit unions provide personalized banking, higher interest rates on savings, and community-focused financial support, appealing to those valuing trust and local engagement. Choosing between neo banking and credit unions depends on priorities like digital innovation versus personalized member benefits.

Connection

Neo banking and credit unions share a common goal of enhancing financial accessibility through digital innovation and member-focused services, leveraging advanced technology to streamline account management and personalized banking solutions. Credit unions, traditionally community-based and member-owned, are increasingly adopting neo banking platforms to offer seamless mobile and online financial services that compete with conventional banks. This integration empowers credit unions to attract younger tech-savvy members while maintaining their cooperative values and lower fees compared to traditional banking institutions.

Key Terms

Member-owned (Credit Union)

Credit unions are member-owned financial cooperatives that prioritize personalized service and community-centric financial solutions, differentiating them from neo banks which operate digitally without ownership stakes from customers. The member-ownership model in credit unions allows members to have voting rights and share in profits through lower fees and better interest rates. Explore how member ownership drives credit union benefits compared to neo banks.

Digital-only platform (Neo Banking)

Neo banking operates exclusively on digital platforms, offering seamless, real-time banking services without physical branches, which contrasts with traditional credit unions that maintain brick-and-mortar locations alongside digital options. Neo banks leverage advanced technology for instant account openings, AI-driven financial insights, and lower fees due to reduced overhead costs. Discover how digital-only platforms revolutionize banking experiences and empower users with cutting-edge financial tools.

Regulatory structure

Credit unions operate as member-owned financial cooperatives regulated by state or federal agencies, emphasizing consumer protection and community development. Neo banks are digital-only institutions often functioning under partnerships with traditional banks, subject to fintech-specific regulatory frameworks that prioritize innovation and cybersecurity. Explore the evolving regulatory landscape to understand how these differences impact your banking experience.

Source and External Links

What is a Credit Union? - MyCreditUnion.gov - A credit union is a not-for-profit, member-owned financial institution that provides banking services with profits returned to members via better rates and lower fees, often serving members who share a common bond.

Welcome to Service Credit Union - Banking Services - Service Credit Union offers a range of banking products including savings, checking, auto and personal loans, emphasizing personalized service and competitive rates.

St. Mary's Bank: NHs First Credit Union Since 1908 - St. Mary's Bank, the nation's first credit union, is a member-owned, not-for-profit institution providing digital banking and various loans, committed to member financial well-being since 1908.

dowidth.com

dowidth.com