Crypto custody services provide secure storage solutions for digital assets, using advanced encryption and multi-signature technology to protect against theft and loss. Escrow services act as trusted intermediaries that hold funds or assets during transactions, ensuring compliance and reducing risk for both parties. Explore the key differences and benefits of crypto custody versus escrow services for your financial security.

Why it is important

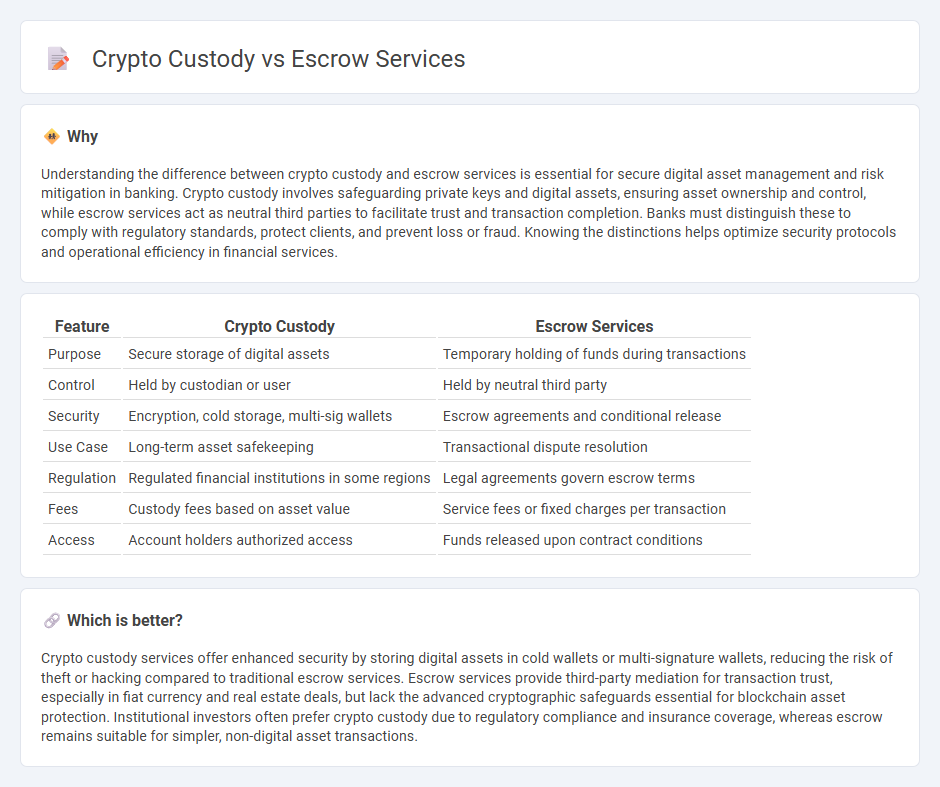

Understanding the difference between crypto custody and escrow services is essential for secure digital asset management and risk mitigation in banking. Crypto custody involves safeguarding private keys and digital assets, ensuring asset ownership and control, while escrow services act as neutral third parties to facilitate trust and transaction completion. Banks must distinguish these to comply with regulatory standards, protect clients, and prevent loss or fraud. Knowing the distinctions helps optimize security protocols and operational efficiency in financial services.

Comparison Table

| Feature | Crypto Custody | Escrow Services |

|---|---|---|

| Purpose | Secure storage of digital assets | Temporary holding of funds during transactions |

| Control | Held by custodian or user | Held by neutral third party |

| Security | Encryption, cold storage, multi-sig wallets | Escrow agreements and conditional release |

| Use Case | Long-term asset safekeeping | Transactional dispute resolution |

| Regulation | Regulated financial institutions in some regions | Legal agreements govern escrow terms |

| Fees | Custody fees based on asset value | Service fees or fixed charges per transaction |

| Access | Account holders authorized access | Funds released upon contract conditions |

Which is better?

Crypto custody services offer enhanced security by storing digital assets in cold wallets or multi-signature wallets, reducing the risk of theft or hacking compared to traditional escrow services. Escrow services provide third-party mediation for transaction trust, especially in fiat currency and real estate deals, but lack the advanced cryptographic safeguards essential for blockchain asset protection. Institutional investors often prefer crypto custody due to regulatory compliance and insurance coverage, whereas escrow remains suitable for simpler, non-digital asset transactions.

Connection

Crypto custody and escrow services are interconnected through their roles in securing digital assets and facilitating trust in transactions. Custody services provide secure storage solutions for cryptocurrencies, protecting assets from theft or loss, while escrow services hold funds or cryptocurrencies in a neutral account until agreed-upon conditions are met. Together, they enable secure, transparent, and risk-mitigated exchanges in the banking and financial sectors involving digital currencies.

Key Terms

Third-party holding

Escrow services involve a trusted third-party holding funds or assets until contractual conditions are met, ensuring security and reducing transaction risks in traditional and digital finance. Crypto custody, on the other hand, specifically focuses on the secure storage and management of cryptocurrency assets by third-party custodians, utilizing advanced encryption and multi-signature wallets to protect against theft and loss. Explore the key differences and benefits of escrow services and crypto custody for secure asset management.

Private keys management

Escrow services facilitate secure transactions by holding assets temporarily until contract conditions are met, whereas crypto custody specializes in safeguarding private keys essential for accessing and managing cryptocurrency assets. Effective private key management involves advanced encryption, multi-signature protocols, and hardware security modules to prevent unauthorized access and loss. Explore our detailed comparison to understand optimal strategies for protecting digital assets through escrow services and crypto custody solutions.

Settlement assurance

Escrow services offer settlement assurance by securely holding funds or assets until predefined conditions are met, minimizing counterparty risk during transactions. Crypto custody solutions focus on safeguarding digital assets with advanced cryptographic security and multi-signature protocols, ensuring asset protection rather than conditional settlement. Explore how these services enhance transaction integrity and asset security to choose the right solution for your needs.

Source and External Links

Escrow Services - Trust Gateway Portal - U.S. Bank - U.S. Bank offers comprehensive escrow services including document review, payment and disbursement handling, investment options, and detailed reporting across various escrow types such as real estate, mergers and acquisitions, and government projects.

Online Escrow Companies - DFPI - CA.gov - This California government page lists licensed online escrow companies like Upwork Escrow Inc. and Internet Escrow Services, Inc., and provides warnings about fraudulent escrow operators and resources to avoid online escrow fraud.

Escrow.com | Never buy or sell online without using Escrow - Escrow.com is a leading online escrow service facilitating secure payments where funds are held in trust until the buyer approves delivery of goods or services, protecting both parties in the transaction with a transparent, multi-step process.

dowidth.com

dowidth.com