Predictive analytics in banking uses historical data and machine learning algorithms to anticipate customer behavior, credit risks, and market trends, enhancing decision-making accuracy. Liquidity forecasting focuses on projecting a bank's cash flow needs to ensure sufficient funds for operational and regulatory requirements, mitigating financial stress. Explore how integrating these techniques optimizes risk management and strengthens financial stability.

Why it is important

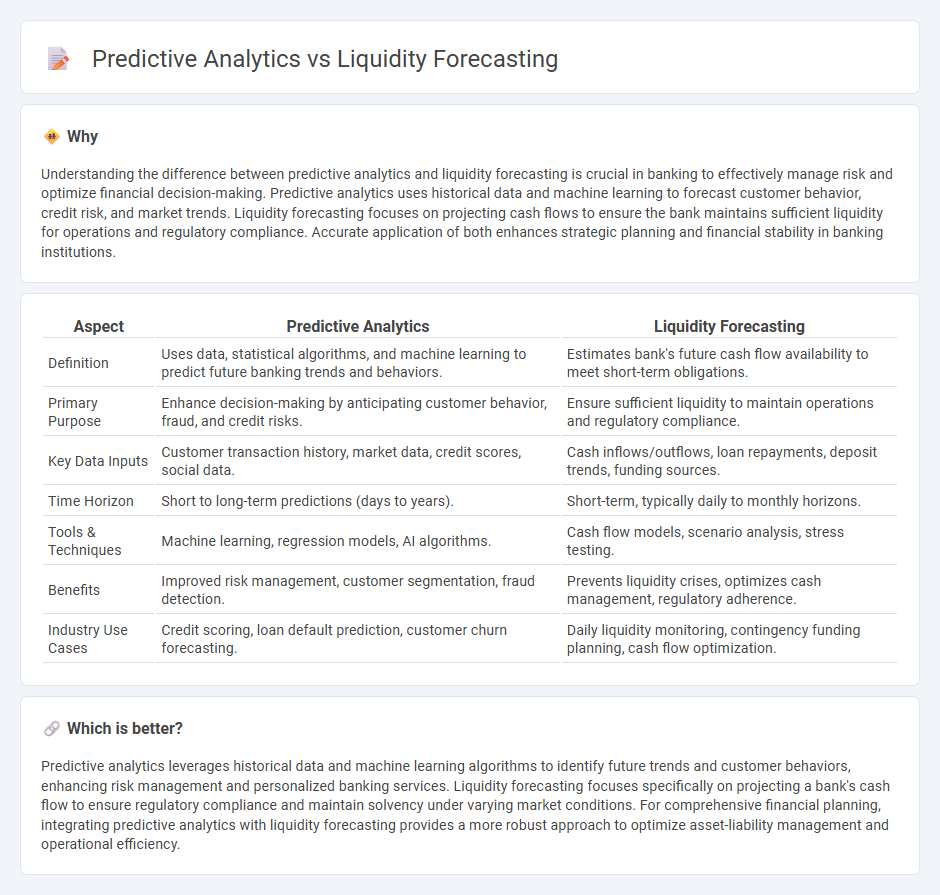

Understanding the difference between predictive analytics and liquidity forecasting is crucial in banking to effectively manage risk and optimize financial decision-making. Predictive analytics uses historical data and machine learning to forecast customer behavior, credit risk, and market trends. Liquidity forecasting focuses on projecting cash flows to ensure the bank maintains sufficient liquidity for operations and regulatory compliance. Accurate application of both enhances strategic planning and financial stability in banking institutions.

Comparison Table

| Aspect | Predictive Analytics | Liquidity Forecasting |

|---|---|---|

| Definition | Uses data, statistical algorithms, and machine learning to predict future banking trends and behaviors. | Estimates bank's future cash flow availability to meet short-term obligations. |

| Primary Purpose | Enhance decision-making by anticipating customer behavior, fraud, and credit risks. | Ensure sufficient liquidity to maintain operations and regulatory compliance. |

| Key Data Inputs | Customer transaction history, market data, credit scores, social data. | Cash inflows/outflows, loan repayments, deposit trends, funding sources. |

| Time Horizon | Short to long-term predictions (days to years). | Short-term, typically daily to monthly horizons. |

| Tools & Techniques | Machine learning, regression models, AI algorithms. | Cash flow models, scenario analysis, stress testing. |

| Benefits | Improved risk management, customer segmentation, fraud detection. | Prevents liquidity crises, optimizes cash management, regulatory adherence. |

| Industry Use Cases | Credit scoring, loan default prediction, customer churn forecasting. | Daily liquidity monitoring, contingency funding planning, cash flow optimization. |

Which is better?

Predictive analytics leverages historical data and machine learning algorithms to identify future trends and customer behaviors, enhancing risk management and personalized banking services. Liquidity forecasting focuses specifically on projecting a bank's cash flow to ensure regulatory compliance and maintain solvency under varying market conditions. For comprehensive financial planning, integrating predictive analytics with liquidity forecasting provides a more robust approach to optimize asset-liability management and operational efficiency.

Connection

Predictive analytics in banking leverages historical financial data and machine learning algorithms to anticipate future cash flows, enabling accurate liquidity forecasting. This connection allows financial institutions to proactively manage assets and liabilities, ensuring regulatory compliance and optimal capital allocation. Enhanced forecasting accuracy reduces liquidity risk and supports strategic decision-making in dynamic market conditions.

Key Terms

**Liquidity Forecasting:**

Liquidity forecasting involves predicting a company's cash flow to ensure sufficient funds for operational needs and debt obligations, leveraging historical financial data and market trends. It enables businesses to anticipate liquidity shortages, optimize working capital management, and make informed financial decisions. Discover how advanced liquidity forecasting techniques can safeguard your company's financial stability and enhance cash management efficiency.

Cash Flow Projections

Liquidity forecasting centers on projecting an organization's ability to meet short-term obligations by estimating cash inflows and outflows, ensuring sufficient liquidity for operational stability. Predictive analytics leverages historical financial data and advanced algorithms to identify patterns and anticipate future cash flow trends more accurately. Explore deeper insights into how these methods enhance cash flow projections and financial planning strategies.

Liquidity Coverage Ratio (LCR)

Liquidity forecasting for the Liquidity Coverage Ratio (LCR) involves projecting short-term cash inflows and outflows to ensure adequate liquid assets cover net cash outflows over a 30-day stress period. Predictive analytics employs advanced statistical models and machine learning to analyze historical financial data, identify patterns, and forecast future liquidity needs with higher precision. Explore how integrating predictive analytics enhances LCR management and regulatory compliance.

Source and External Links

Liquidity forecast | Autonomous Finance | A/R Management Software - A liquidity forecast is a financial management tool projecting a company's ability to meet short-term financial obligations, helping avoid cash shortfalls and enabling proactive risk management through rolling, long-term, and scenario-based forecasts.

Liquidity Budget and Liquidity Forecast | Hypergene - Liquidity forecasting measures a company's short-term payment ability by predicting cash flow future states and involves aligning forecast goals with business objectives, choosing appropriate methods, and ensuring clear data visibility and management.

11 Reasons to Implement a Cash and Liquidity Forecasting Solution - Liquidity forecasting reduces liquidity risk by identifying cash flow gaps early and helps optimize surplus cash investments to maximize returns, supporting better financial planning and resilience against seasonal or market fluctuations.

dowidth.com

dowidth.com