Regulatory sandboxes provide a controlled environment where banks and fintech firms can test innovative financial products under regulatory supervision, minimizing risks while ensuring compliance. Proof of concept (PoC) focuses on validating the feasibility and functionality of a banking technology or service before full-scale development and deployment. Explore more about how these frameworks accelerate innovation in the banking sector.

Why it is important

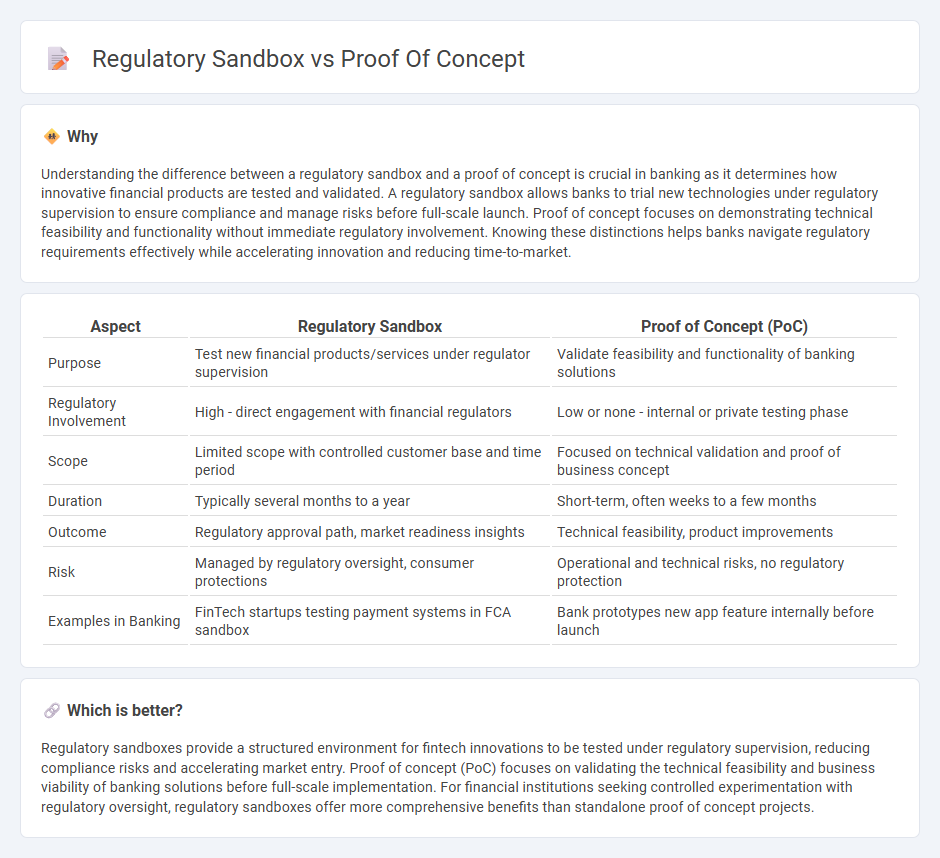

Understanding the difference between a regulatory sandbox and a proof of concept is crucial in banking as it determines how innovative financial products are tested and validated. A regulatory sandbox allows banks to trial new technologies under regulatory supervision to ensure compliance and manage risks before full-scale launch. Proof of concept focuses on demonstrating technical feasibility and functionality without immediate regulatory involvement. Knowing these distinctions helps banks navigate regulatory requirements effectively while accelerating innovation and reducing time-to-market.

Comparison Table

| Aspect | Regulatory Sandbox | Proof of Concept (PoC) |

|---|---|---|

| Purpose | Test new financial products/services under regulator supervision | Validate feasibility and functionality of banking solutions |

| Regulatory Involvement | High - direct engagement with financial regulators | Low or none - internal or private testing phase |

| Scope | Limited scope with controlled customer base and time period | Focused on technical validation and proof of business concept |

| Duration | Typically several months to a year | Short-term, often weeks to a few months |

| Outcome | Regulatory approval path, market readiness insights | Technical feasibility, product improvements |

| Risk | Managed by regulatory oversight, consumer protections | Operational and technical risks, no regulatory protection |

| Examples in Banking | FinTech startups testing payment systems in FCA sandbox | Bank prototypes new app feature internally before launch |

Which is better?

Regulatory sandboxes provide a structured environment for fintech innovations to be tested under regulatory supervision, reducing compliance risks and accelerating market entry. Proof of concept (PoC) focuses on validating the technical feasibility and business viability of banking solutions before full-scale implementation. For financial institutions seeking controlled experimentation with regulatory oversight, regulatory sandboxes offer more comprehensive benefits than standalone proof of concept projects.

Connection

Regulatory sandboxes provide a controlled environment where financial institutions can test innovative banking technologies with reduced regulatory constraints. Proof of concept (PoC) allows banks to validate the feasibility and effectiveness of new financial products or services within these sandboxes. This connection accelerates innovation while ensuring compliance with banking regulations and risk management protocols.

Key Terms

Testing Environment

Proof of concept (PoC) primarily serves as an initial testing environment to validate the feasibility and functionality of a new technology or business idea, often limited in scope and duration. Regulatory sandbox offers a controlled, real-world testing environment where companies can experiment with innovative financial products under regulatory supervision, balancing innovation with consumer protection and compliance. Explore the nuances of these testing environments to understand how they drive innovation and regulatory compliance.

Compliance Assessment

Regulatory sandboxes facilitate compliance assessment by allowing fintech firms to test innovative products under a regulator's supervision, ensuring adherence to legal and regulatory requirements in a controlled environment. Proof of concept (PoC), however, primarily focuses on validating technical feasibility and market potential without direct regulatory oversight. Explore how integrating sandbox environments can streamline compliance processes and accelerate innovation.

Innovation Validation

Proof of concept (PoC) validates the feasibility and potential of innovative ideas by testing functionality in controlled environments, often with limited scope and internal resources. Regulatory sandboxes provide a structured framework for startups and companies to experiment with new products or services under regulatory supervision, facilitating real-world testing while ensuring compliance and safety. Explore how both approaches accelerate innovation validation and reduce market entry risks.

Source and External Links

Proof of Concept: Definition, Guide, and Examples - Workamajig - A proof of concept (POC) is a tool used to demonstrate the feasibility or viability of an idea by collecting evidence of its practical or business potential to determine if it is worth investing in a full project; it is distinct from prototypes and MVPs in its purpose and scale.

Proof of Concept (POC): Definition, Steps and Examples - Upsilon - A proof of concept is a feasibility study done early in a project to confirm an idea's credibility, showing it can solve real-world problems using current technologies, often conducted right after ideation before deeper development begins.

Proof of concept - Wikipedia - A proof of concept (POC) is an incomplete but functional demonstration designed to confirm the practical potential and feasibility of an idea or method without needing to fully develop it, historically used since the 1960s in technology and engineering contexts.

dowidth.com

dowidth.com