Predictive analytics in banking leverages historical data and machine learning algorithms to forecast customer behavior, fraud risks, and creditworthiness, enhancing decision-making accuracy. Personalized marketing uses customer insights derived from data analysis to tailor financial products and services, increasing engagement and satisfaction. Explore how integrating these strategies transforms banking performance and customer experiences.

Why it is important

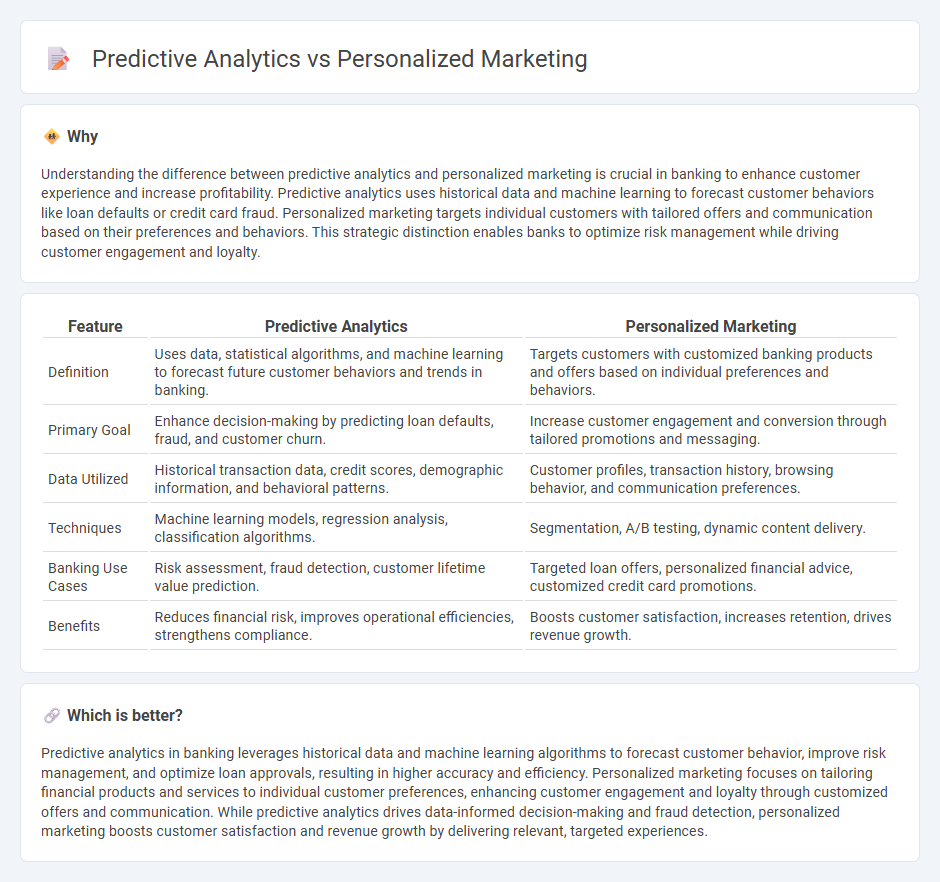

Understanding the difference between predictive analytics and personalized marketing is crucial in banking to enhance customer experience and increase profitability. Predictive analytics uses historical data and machine learning to forecast customer behaviors like loan defaults or credit card fraud. Personalized marketing targets individual customers with tailored offers and communication based on their preferences and behaviors. This strategic distinction enables banks to optimize risk management while driving customer engagement and loyalty.

Comparison Table

| Feature | Predictive Analytics | Personalized Marketing |

|---|---|---|

| Definition | Uses data, statistical algorithms, and machine learning to forecast future customer behaviors and trends in banking. | Targets customers with customized banking products and offers based on individual preferences and behaviors. |

| Primary Goal | Enhance decision-making by predicting loan defaults, fraud, and customer churn. | Increase customer engagement and conversion through tailored promotions and messaging. |

| Data Utilized | Historical transaction data, credit scores, demographic information, and behavioral patterns. | Customer profiles, transaction history, browsing behavior, and communication preferences. |

| Techniques | Machine learning models, regression analysis, classification algorithms. | Segmentation, A/B testing, dynamic content delivery. |

| Banking Use Cases | Risk assessment, fraud detection, customer lifetime value prediction. | Targeted loan offers, personalized financial advice, customized credit card promotions. |

| Benefits | Reduces financial risk, improves operational efficiencies, strengthens compliance. | Boosts customer satisfaction, increases retention, drives revenue growth. |

Which is better?

Predictive analytics in banking leverages historical data and machine learning algorithms to forecast customer behavior, improve risk management, and optimize loan approvals, resulting in higher accuracy and efficiency. Personalized marketing focuses on tailoring financial products and services to individual customer preferences, enhancing customer engagement and loyalty through customized offers and communication. While predictive analytics drives data-informed decision-making and fraud detection, personalized marketing boosts customer satisfaction and revenue growth by delivering relevant, targeted experiences.

Connection

Predictive analytics in banking utilizes data mining and machine learning algorithms to forecast customer behavior, enabling highly targeted personalized marketing campaigns. By analyzing transaction history, credit scores, and digital interactions, banks can tailor product recommendations and promotional offers that increase customer engagement and conversion rates. This data-driven approach enhances customer experience while improving marketing ROI and reducing churn in the competitive financial services sector.

Key Terms

Customer Segmentation

Personalized marketing leverages customer demographics, behavior, and preferences to create tailored messages that enhance engagement and conversion rates. Predictive analytics uses historical data and machine learning models to forecast customer behavior and segment users based on predicted outcomes like purchase likelihood or churn risk. Explore how integrating these strategies can elevate your customer segmentation effectiveness and drive sustained business growth.

Behavior Prediction

Personalized marketing leverages customer data to create tailored content and offers, enhancing engagement by delivering relevant experiences. Predictive analytics uses statistical models and machine learning algorithms to forecast future customer behaviors, enabling proactive campaign adjustments. Explore how integrating behavior prediction can revolutionize your marketing strategies.

Targeted Offers

Personalized marketing leverages customer data to craft targeted offers tailored to individual preferences, driving higher engagement and conversion rates. Predictive analytics uses historical and real-time data models to identify potential customer behaviors and optimize the timing and content of these offers. Explore how combining these strategies can enhance precision in targeted marketing campaigns.

Source and External Links

What Is Personalized Marketing? - Monetate - Personalized marketing is a strategy using data and analytics to deliver individualized experiences that speak directly to customers' interests, aiming to boost engagement, loyalty, and revenue.

14 Useful Examples of Personalized Marketing Tactics | Indeed.com - Personalized marketing creates customized buying experiences by recognizing customers as unique, improving conversion rates, loyalty, customer experience, and providing consistent engagement across channels.

What Is Personalized Marketing? | Mailchimp - Personalized marketing uses data about interests, purchase history, and preferences to send the right message to the right person at the right time, optimizing customer targeting and driving revenue.

dowidth.com

dowidth.com