Instant payments enable real-time fund transfers between bank accounts, ensuring immediate availability for both sender and receiver and enhancing transaction speed in everyday banking. Mobile payments utilize smartphones and apps to facilitate quick, secure transactions through digital wallets or contactless technology, offering convenience and accessibility on the go. Explore the benefits and differences between instant payments and mobile payments to optimize your financial transactions.

Why it is important

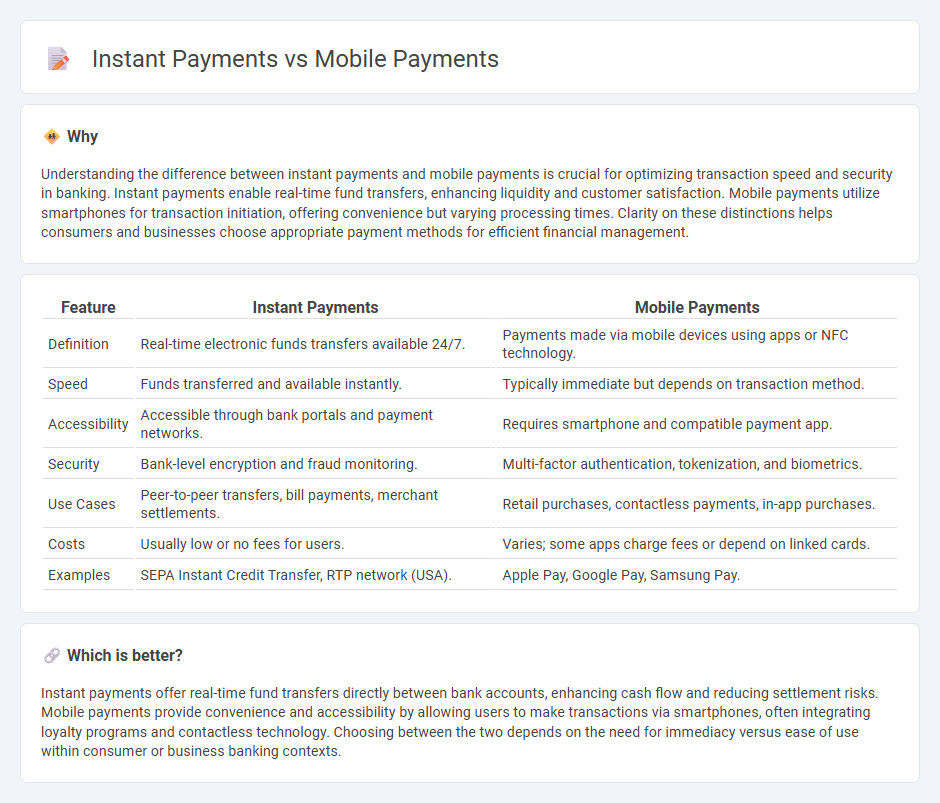

Understanding the difference between instant payments and mobile payments is crucial for optimizing transaction speed and security in banking. Instant payments enable real-time fund transfers, enhancing liquidity and customer satisfaction. Mobile payments utilize smartphones for transaction initiation, offering convenience but varying processing times. Clarity on these distinctions helps consumers and businesses choose appropriate payment methods for efficient financial management.

Comparison Table

| Feature | Instant Payments | Mobile Payments |

|---|---|---|

| Definition | Real-time electronic funds transfers available 24/7. | Payments made via mobile devices using apps or NFC technology. |

| Speed | Funds transferred and available instantly. | Typically immediate but depends on transaction method. |

| Accessibility | Accessible through bank portals and payment networks. | Requires smartphone and compatible payment app. |

| Security | Bank-level encryption and fraud monitoring. | Multi-factor authentication, tokenization, and biometrics. |

| Use Cases | Peer-to-peer transfers, bill payments, merchant settlements. | Retail purchases, contactless payments, in-app purchases. |

| Costs | Usually low or no fees for users. | Varies; some apps charge fees or depend on linked cards. |

| Examples | SEPA Instant Credit Transfer, RTP network (USA). | Apple Pay, Google Pay, Samsung Pay. |

Which is better?

Instant payments offer real-time fund transfers directly between bank accounts, enhancing cash flow and reducing settlement risks. Mobile payments provide convenience and accessibility by allowing users to make transactions via smartphones, often integrating loyalty programs and contactless technology. Choosing between the two depends on the need for immediacy versus ease of use within consumer or business banking contexts.

Connection

Instant payments and mobile payments are closely connected through real-time transaction capabilities that enable users to send and receive funds immediately via mobile devices. Mobile payment platforms, such as Apple Pay, Google Pay, and Samsung Pay, leverage instant payment networks like RTP and Faster Payments to facilitate seamless, secure, and convenient financial transactions. This integration enhances consumer experience by providing rapid access to funds and supporting contactless payments in retail, peer-to-peer transfers, and bill settlements.

Key Terms

Digital Wallets

Digital wallets enable seamless mobile payments by securely storing payment information and facilitating quick transactions via smartphones or wearable devices. Instant payments, often integrated within digital wallets, ensure real-time fund transfers, enhancing convenience and reducing transaction delays. Discover how digital wallets are transforming the payment landscape with speed and security.

Real-Time Settlement

Real-time settlement in mobile payments enables immediate fund transfers, enhancing transaction speed and convenience for users. Instant payments utilize advanced clearing systems to process and settle transactions within seconds, reducing settlement risk and improving liquidity management. Explore how real-time settlement transforms financial transactions and impacts consumer behavior.

Interoperability

Mobile payments and instant payments rely heavily on interoperability to ensure seamless transaction processing across different platforms and networks. Enhanced interoperability enables real-time fund transfers, reduces transaction friction, and supports a wider acceptance among various financial institutions and mobile wallet providers. Explore how interoperability is revolutionizing payment ecosystems and driving broader adoption.

Source and External Links

Shopify - Mobile Payments: What They Are & How To Use Them - Mobile payments are digital transactions using smartphones, tablets, or wearables, often via digital wallets, and include methods like NFC, direct carrier billing, and mobile wallet apps for convenience and security.

Stripe - Mobile Payments Explained: A Guide for Businesses - Mobile payments leverage technologies like NFC, QR codes, SMS, encryption, and biometrics to enable secure, fast, and flexible transactions for both online and in-person sales.

Square - Understanding the Mobile Payments Landscape - Mobile payments offer speed, convenience, and enhanced security compared to traditional payment methods, with contactless options like Apple Pay using biometric authentication and dynamic encryption.

dowidth.com

dowidth.com