Income streaming in banking involves generating consistent revenue through diversified financial products and services, while syndication fees arise from banks collaborating to jointly finance large loans, sharing both risks and profits. Syndication fees provide banks with income from arranging and managing syndicated loans, whereas income streaming focuses on steady cash flow from ongoing banking operations. Explore the differences between these revenue models to optimize your financial strategy.

Why it is important

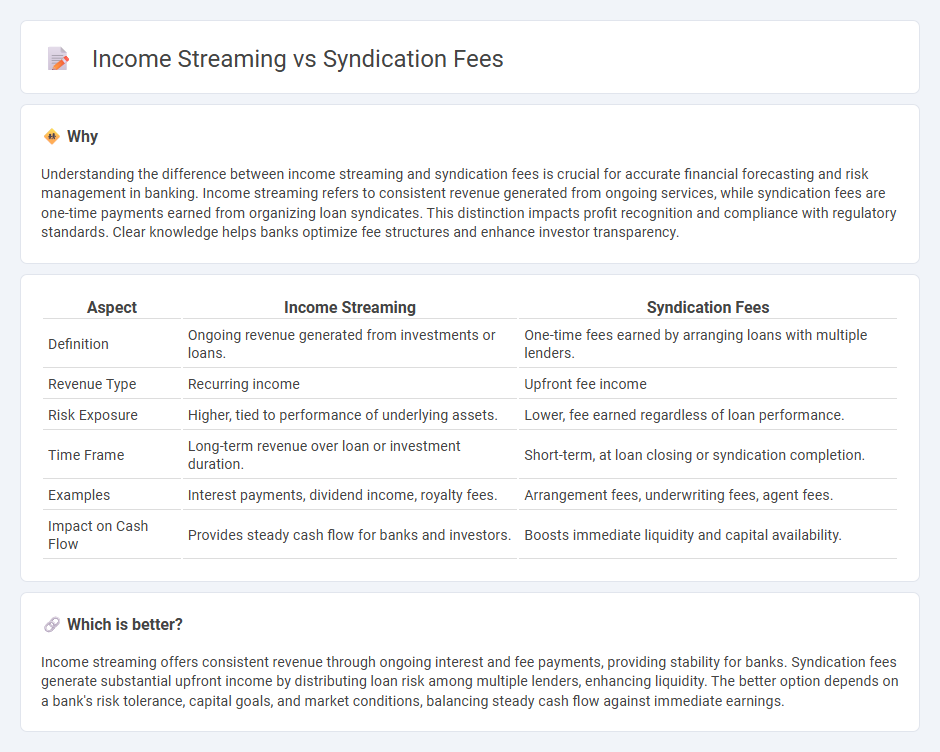

Understanding the difference between income streaming and syndication fees is crucial for accurate financial forecasting and risk management in banking. Income streaming refers to consistent revenue generated from ongoing services, while syndication fees are one-time payments earned from organizing loan syndicates. This distinction impacts profit recognition and compliance with regulatory standards. Clear knowledge helps banks optimize fee structures and enhance investor transparency.

Comparison Table

| Aspect | Income Streaming | Syndication Fees |

|---|---|---|

| Definition | Ongoing revenue generated from investments or loans. | One-time fees earned by arranging loans with multiple lenders. |

| Revenue Type | Recurring income | Upfront fee income |

| Risk Exposure | Higher, tied to performance of underlying assets. | Lower, fee earned regardless of loan performance. |

| Time Frame | Long-term revenue over loan or investment duration. | Short-term, at loan closing or syndication completion. |

| Examples | Interest payments, dividend income, royalty fees. | Arrangement fees, underwriting fees, agent fees. |

| Impact on Cash Flow | Provides steady cash flow for banks and investors. | Boosts immediate liquidity and capital availability. |

Which is better?

Income streaming offers consistent revenue through ongoing interest and fee payments, providing stability for banks. Syndication fees generate substantial upfront income by distributing loan risk among multiple lenders, enhancing liquidity. The better option depends on a bank's risk tolerance, capital goals, and market conditions, balancing steady cash flow against immediate earnings.

Connection

Income streaming in banking involves the continuous generation of revenue through financial products and services, while syndication fees arise from the collaborative underwriting and distribution of large loans or securities among multiple financial institutions. These fees contribute to income streaming by providing banks with recurring income from syndicated deals, enhancing profitability and risk-sharing. Effective management of syndication fees directly impacts the stability and predictability of income streams within corporate banking operations.

Key Terms

Loan syndication

Loan syndication generates income through syndication fees, which lenders earn by organizing and distributing portions of large loans to multiple participants, spreading the risk and enhancing capital efficiency. Syndication fees typically include upfront fees, management fees, and agency fees, constituting a vital revenue stream distinct from ongoing interest income derived from the loan itself. Explore detailed insights on loan syndication's fee structures and income strategies to optimize your financial operations.

Upfront fees

Syndication fees often require upfront fees paid by investors or participants to cover initial costs and administrative expenses, whereas income streaming emphasizes ongoing revenue generated over time without significant initial payments. Upfront syndication fees provide immediate capital inflow for project development but can reduce investors' initial liquidity compared to income streaming, which offers gradual earnings distribution. Explore more about the financial structures and benefits of syndication fees versus income streaming to make informed investment decisions.

Interest margin

Syndication fees generate immediate revenue through one-time payments from participating lenders, while income streaming focuses on recurring interest margin earned from ongoing loan portfolios. Interest margin, the difference between the interest earned on loans and the cost of funds, plays a critical role in income streaming by providing sustainable profitability over time. Explore the advantages of each approach and how interest margin impacts overall financial performance.

Source and External Links

Real Estate Syndication Fees - Syndication fees in real estate typically include asset management fees (1-2% of gross property revenue or net operating income), acquisition/disposition fees (1-3% of property value), and finance fees, with asset management fees often paid monthly or annually.

Real Estate Syndication Fees - Common fees include organization and offering fees (about 1% of capital raised), acquisition or due diligence fees (1-3% of property purchase price), and recurring asset management fees (1-2% of total capital raised or property value, usually paid monthly).

Syndication Fee Definition - The syndication fee is the amount paid to the general partner for services like forming the partnership, securing investors, and finalizing agreements, sometimes defined as a flat fee (e.g., $10,000) or a percentage of gross proceeds (e.g., 3%).

dowidth.com

dowidth.com