RegTech, focused on regulatory compliance through advanced technology, streamlines risk management and enhances transparency in the banking sector. FinTech leverages innovation to transform financial services, improving customer experience and operational efficiency. Discover how RegTech and FinTech are reshaping the future of banking.

Why it is important

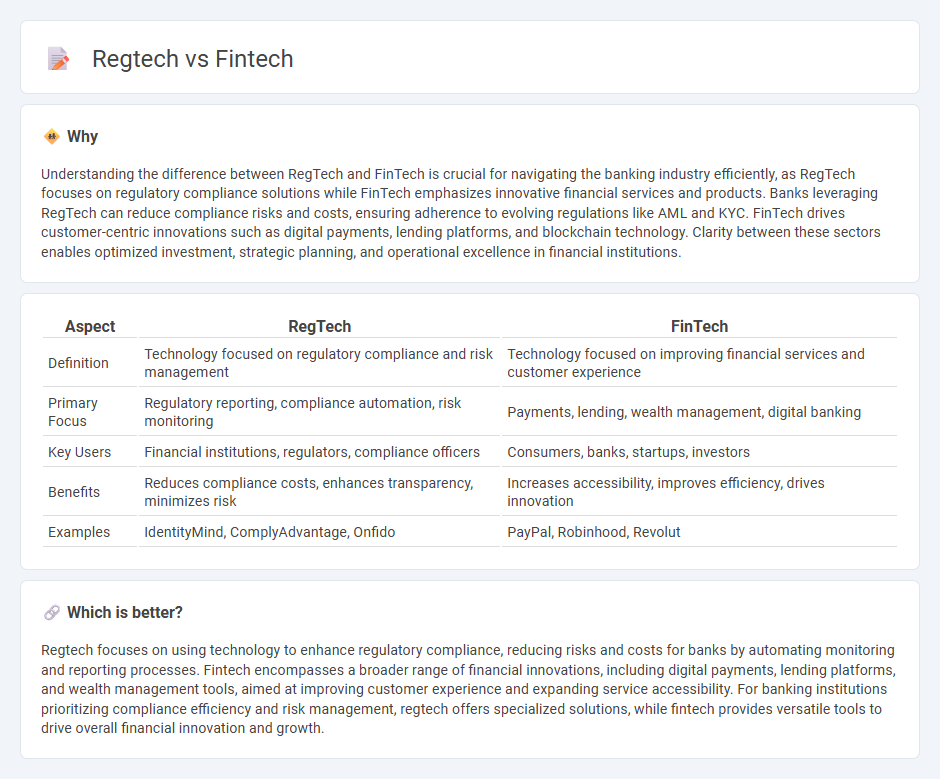

Understanding the difference between RegTech and FinTech is crucial for navigating the banking industry efficiently, as RegTech focuses on regulatory compliance solutions while FinTech emphasizes innovative financial services and products. Banks leveraging RegTech can reduce compliance risks and costs, ensuring adherence to evolving regulations like AML and KYC. FinTech drives customer-centric innovations such as digital payments, lending platforms, and blockchain technology. Clarity between these sectors enables optimized investment, strategic planning, and operational excellence in financial institutions.

Comparison Table

| Aspect | RegTech | FinTech |

|---|---|---|

| Definition | Technology focused on regulatory compliance and risk management | Technology focused on improving financial services and customer experience |

| Primary Focus | Regulatory reporting, compliance automation, risk monitoring | Payments, lending, wealth management, digital banking |

| Key Users | Financial institutions, regulators, compliance officers | Consumers, banks, startups, investors |

| Benefits | Reduces compliance costs, enhances transparency, minimizes risk | Increases accessibility, improves efficiency, drives innovation |

| Examples | IdentityMind, ComplyAdvantage, Onfido | PayPal, Robinhood, Revolut |

Which is better?

Regtech focuses on using technology to enhance regulatory compliance, reducing risks and costs for banks by automating monitoring and reporting processes. Fintech encompasses a broader range of financial innovations, including digital payments, lending platforms, and wealth management tools, aimed at improving customer experience and expanding service accessibility. For banking institutions prioritizing compliance efficiency and risk management, regtech offers specialized solutions, while fintech provides versatile tools to drive overall financial innovation and growth.

Connection

Regtech and fintech converge by leveraging advanced technologies such as artificial intelligence, big data, and blockchain to enhance financial services while ensuring regulatory compliance. Regtech platforms automate regulatory reporting, risk management, and fraud detection, directly supporting fintech innovations in payment processing, lending, and digital banking. This integration streamlines operations, reduces costs, and improves transparency across the financial ecosystem.

Key Terms

Innovation

Fintech drives innovation by leveraging cutting-edge technologies such as artificial intelligence, blockchain, and big data to transform financial services and enhance customer experiences. Regtech focuses on using similar technologies to improve regulatory compliance, risk management, and reporting efficiency within the financial sector. Explore the evolving landscape of fintech and regtech innovations to understand their impact on the future of finance.

Compliance

Fintech revolutionizes financial services through innovative technologies, while regtech specifically targets regulatory compliance by leveraging automation and advanced data analytics to manage risks and ensure adherence to legal standards. The integration of regtech solutions within fintech ecosystems enhances real-time monitoring, reporting accuracy, and fraud detection, reducing compliance costs and regulatory breaches. Explore how these technologies transform compliance strategies in financial institutions.

Automation

Fintech leverages automation to enhance financial services such as payments, lending, and wealth management by using AI, machine learning, and robotic process automation to increase efficiency and reduce costs. Regtech focuses on automating regulatory compliance tasks, including risk management, transaction monitoring, and reporting, to help financial institutions adhere to complex legal requirements swiftly and accurately. Explore how automation transforms both fintech and regtech sectors to drive innovation and compliance in modern finance.

Source and External Links

What is Fintech? | IBM - Fintech, or financial technology, refers to mobile apps, software, and other technologies enabling users and enterprises to access, manage, and innovate financial services, including personal finance, investing, and lending, increasingly powered by AI and machine learning.

What is fintech? 6 main types of fintech and how they work - Fintech encompasses a broad range of technologies that digitally transform financial services like neobanking, payments, lending, investing, and business financial management across B2B, B2C, and P2P markets.

Financial technology - Fintech applies innovative technologies to financial products and services across multiple categories such as digital banking, payments, investing, blockchain, regtech, and infrastructure platforms supporting the financial ecosystem.

dowidth.com

dowidth.com