Alternative credit data encompasses non-traditional financial information such as utility payments, rental histories, and mobile phone bills, expanding credit access beyond standard credit reports. Psychometric data evaluates behavioral and personality traits through tailored assessments to predict creditworthiness in underserved populations. Explore how integrating these innovative data sources transforms lending decisions and financial inclusion.

Why it is important

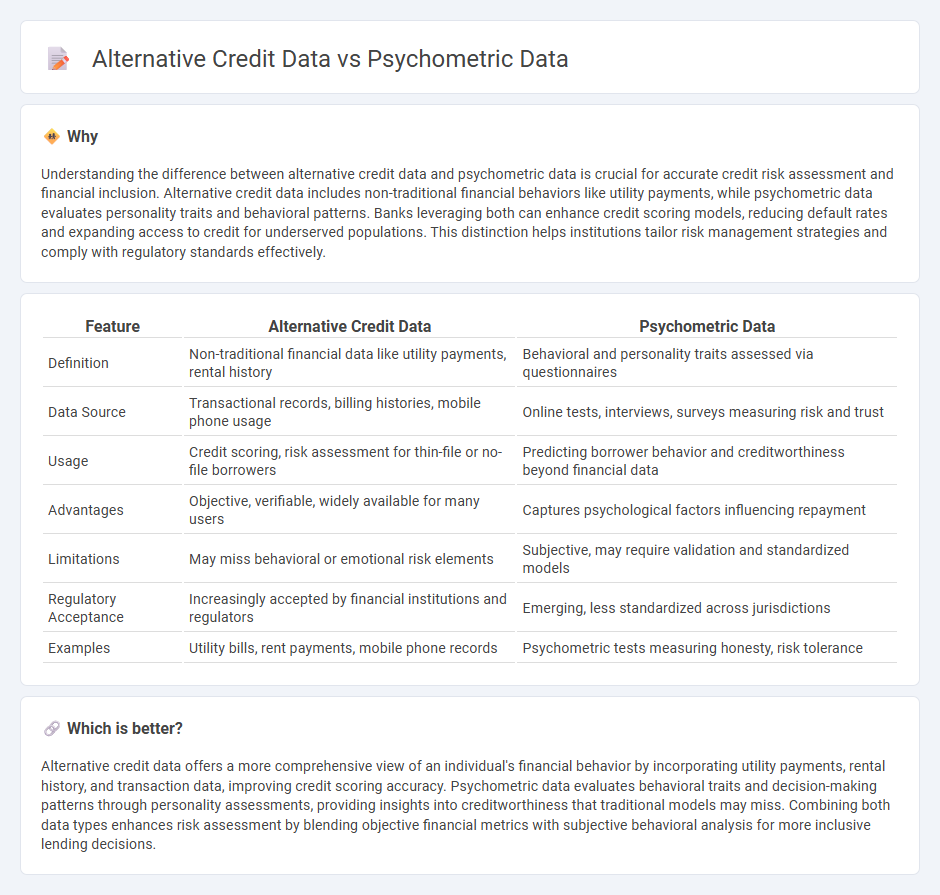

Understanding the difference between alternative credit data and psychometric data is crucial for accurate credit risk assessment and financial inclusion. Alternative credit data includes non-traditional financial behaviors like utility payments, while psychometric data evaluates personality traits and behavioral patterns. Banks leveraging both can enhance credit scoring models, reducing default rates and expanding access to credit for underserved populations. This distinction helps institutions tailor risk management strategies and comply with regulatory standards effectively.

Comparison Table

| Feature | Alternative Credit Data | Psychometric Data |

|---|---|---|

| Definition | Non-traditional financial data like utility payments, rental history | Behavioral and personality traits assessed via questionnaires |

| Data Source | Transactional records, billing histories, mobile phone usage | Online tests, interviews, surveys measuring risk and trust |

| Usage | Credit scoring, risk assessment for thin-file or no-file borrowers | Predicting borrower behavior and creditworthiness beyond financial data |

| Advantages | Objective, verifiable, widely available for many users | Captures psychological factors influencing repayment |

| Limitations | May miss behavioral or emotional risk elements | Subjective, may require validation and standardized models |

| Regulatory Acceptance | Increasingly accepted by financial institutions and regulators | Emerging, less standardized across jurisdictions |

| Examples | Utility bills, rent payments, mobile phone records | Psychometric tests measuring honesty, risk tolerance |

Which is better?

Alternative credit data offers a more comprehensive view of an individual's financial behavior by incorporating utility payments, rental history, and transaction data, improving credit scoring accuracy. Psychometric data evaluates behavioral traits and decision-making patterns through personality assessments, providing insights into creditworthiness that traditional models may miss. Combining both data types enhances risk assessment by blending objective financial metrics with subjective behavioral analysis for more inclusive lending decisions.

Connection

Alternative credit data and psychometric data enhance traditional banking credit assessments by providing deeper insights into a borrower's creditworthiness. Alternative credit data includes non-traditional sources such as utility payments and rental history, while psychometric data analyzes behavioral traits and personality through tailored assessments. Integrating these data types enables banks to more accurately evaluate risk and extend credit to underserved or thin-file customers.

Key Terms

Personality Assessment

Psychometric data involves measuring personality traits, cognitive abilities, and behavioral tendencies to predict creditworthiness, providing a nuanced understanding beyond traditional financial histories. Alternative credit data, such as utility payments and rental histories, offers supplementary insights but lacks the predictive depth found in personality assessments. Explore how integrating psychometric profiling can revolutionize credit scoring accuracy and inclusivity.

Social Media Analysis

Psychometric data evaluates creditworthiness by analyzing personality traits and behavioral patterns through standardized tests, whereas alternative credit data harnesses non-traditional sources such as social media analysis to assess financial reliability. Social media analysis examines users' online interactions, sentiments, and network influence to predict credit risk, providing lenders with richer insights beyond conventional financial records. Explore how integrating psychometric and social media data transforms credit assessment models for more inclusive lending.

Utility Payment Records

Utility payment records provide valuable alternative credit data by capturing consistent, on-time payment behavior often missed by traditional credit reports. Psychometric data, derived from behavioral assessments and personal traits, complements this by predicting creditworthiness based on decision-making patterns. Explore how integrating utility payment history with psychometric insights enhances credit evaluation accuracy.

Source and External Links

Guide: 4 Main Types of Psychometric Data (B, I, S, L) - Psychometric data consists of four major types--behavioral (B), informants' (I), self-report (S), and life (L) data--that serve different research purposes and help predict behavior and decisions by quantifying psychological attributes.

What is Psychometrics? - Psychometrics is a scientific discipline focused on creating and validating measurement tools and models to assess latent psychological attributes using statistical methods applicable in fields like education, clinical psychology, and organizational behavior.

Psychometrics: Exploring the key concepts and models - Psychometric data measures psychological traits such as intelligence, personality, and attitudes, with quality assessments relying on principles like reliability, validity, standardization, and fairness for accurate, objective decision-making.

dowidth.com

dowidth.com