Super apps integrate multiple financial services, including payments, loans, investments, and insurance, within a single platform, enhancing user convenience and engagement. Mobile banking apps primarily focus on core banking functions such as account management, fund transfers, and bill payments, offering streamlined and secure financial transactions. Explore the evolving landscape of digital finance by understanding the distinctions and advantages of super apps versus mobile banking apps.

Why it is important

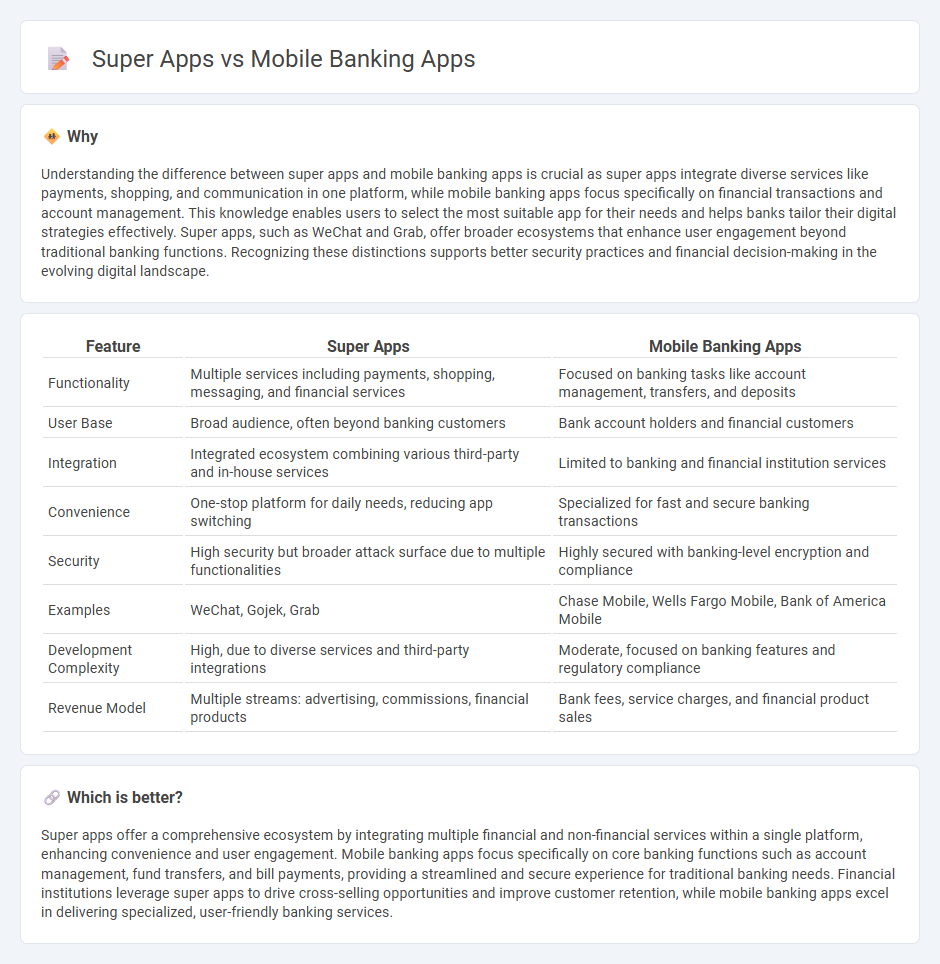

Understanding the difference between super apps and mobile banking apps is crucial as super apps integrate diverse services like payments, shopping, and communication in one platform, while mobile banking apps focus specifically on financial transactions and account management. This knowledge enables users to select the most suitable app for their needs and helps banks tailor their digital strategies effectively. Super apps, such as WeChat and Grab, offer broader ecosystems that enhance user engagement beyond traditional banking functions. Recognizing these distinctions supports better security practices and financial decision-making in the evolving digital landscape.

Comparison Table

| Feature | Super Apps | Mobile Banking Apps |

|---|---|---|

| Functionality | Multiple services including payments, shopping, messaging, and financial services | Focused on banking tasks like account management, transfers, and deposits |

| User Base | Broad audience, often beyond banking customers | Bank account holders and financial customers |

| Integration | Integrated ecosystem combining various third-party and in-house services | Limited to banking and financial institution services |

| Convenience | One-stop platform for daily needs, reducing app switching | Specialized for fast and secure banking transactions |

| Security | High security but broader attack surface due to multiple functionalities | Highly secured with banking-level encryption and compliance |

| Examples | WeChat, Gojek, Grab | Chase Mobile, Wells Fargo Mobile, Bank of America Mobile |

| Development Complexity | High, due to diverse services and third-party integrations | Moderate, focused on banking features and regulatory compliance |

| Revenue Model | Multiple streams: advertising, commissions, financial products | Bank fees, service charges, and financial product sales |

Which is better?

Super apps offer a comprehensive ecosystem by integrating multiple financial and non-financial services within a single platform, enhancing convenience and user engagement. Mobile banking apps focus specifically on core banking functions such as account management, fund transfers, and bill payments, providing a streamlined and secure experience for traditional banking needs. Financial institutions leverage super apps to drive cross-selling opportunities and improve customer retention, while mobile banking apps excel in delivering specialized, user-friendly banking services.

Connection

Super apps integrate multiple financial services including mobile banking apps, facilitating seamless access to banking features such as payments, transfers, and loans within a single platform. Mobile banking apps act as specialized modules within super apps, enhancing user convenience by embedding banking capabilities alongside other services like shopping and communication. This interconnectedness drives user engagement and streamlines the digital financial ecosystem by combining banking functions with diverse everyday activities.

Key Terms

User Experience (UX)

Mobile banking apps prioritize streamlined financial transactions with intuitive navigation, enhanced security features, and personalized account management, ensuring users can efficiently access banking services. Super apps integrate multiple services beyond banking, such as messaging, shopping, and ride-hailing, creating a multifunctional platform that offers convenience but may complicate the user interface. Explore the evolving UX design strategies that balance simplicity and functionality in both app types to understand their impact on user satisfaction.

Ecosystem Integration

Mobile banking apps primarily offer financial services such as account management, fund transfers, and bill payments within a secure digital environment. Super apps integrate multiple services including mobile banking, ride-hailing, e-commerce, and social media, creating a seamless ecosystem that enhances user convenience and engagement. Explore how ecosystem integration transforms digital experiences by merging banking with everyday lifestyle services.

Financial Services Scope

Mobile banking apps specialize in core financial services such as account management, fund transfers, bill payments, and loan applications with a primary focus on banking functionalities. Super apps offer a broader ecosystem integrating financial services with lifestyle features including e-commerce, ride-hailing, food delivery, and social media, enabling users to perform multiple tasks within a single platform. Explore how the expanding scope of financial services in super apps is reshaping user engagement and convenience.

Source and External Links

Huntington Mobile Banking App - This app allows users to transfer money, deposit checks via mobile, pay bills, order checks, and receive real-time alerts securely with features like Touch ID and Face ID login.

Bank of America Mobile Banking 4+ - App Store - Offers account management, secure transfers, bill pay, check deposit via photos, and a virtual assistant Erica for financial help, with robust security features including Touch ID/Face ID.

Mobile Banking App Features and Tools from Bank of America - Provides streamlined access to banking and Merrill investment accounts, tools like Zelle money transfers, Bill Pay, FICO score monitoring, and a security center for fraud prevention all within one app.

dowidth.com

dowidth.com