Alternative credit data, including utility and rental payment histories, provides lenders with a broader view of a borrower's creditworthiness compared to traditional credit reports. Healthcare payment data, often overlooked, reveals patterns in medical bill payments that can indicate financial responsibility or distress. Explore how these datasets transform credit risk assessment and enhance lending decisions.

Why it is important

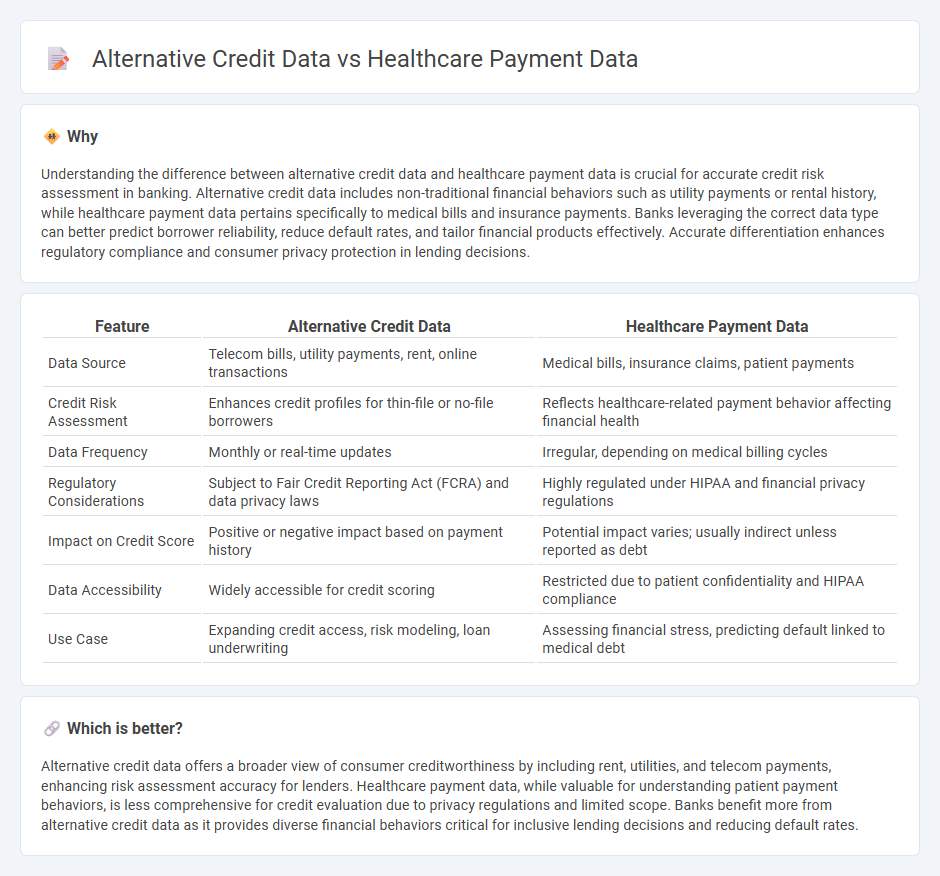

Understanding the difference between alternative credit data and healthcare payment data is crucial for accurate credit risk assessment in banking. Alternative credit data includes non-traditional financial behaviors such as utility payments or rental history, while healthcare payment data pertains specifically to medical bills and insurance payments. Banks leveraging the correct data type can better predict borrower reliability, reduce default rates, and tailor financial products effectively. Accurate differentiation enhances regulatory compliance and consumer privacy protection in lending decisions.

Comparison Table

| Feature | Alternative Credit Data | Healthcare Payment Data |

|---|---|---|

| Data Source | Telecom bills, utility payments, rent, online transactions | Medical bills, insurance claims, patient payments |

| Credit Risk Assessment | Enhances credit profiles for thin-file or no-file borrowers | Reflects healthcare-related payment behavior affecting financial health |

| Data Frequency | Monthly or real-time updates | Irregular, depending on medical billing cycles |

| Regulatory Considerations | Subject to Fair Credit Reporting Act (FCRA) and data privacy laws | Highly regulated under HIPAA and financial privacy regulations |

| Impact on Credit Score | Positive or negative impact based on payment history | Potential impact varies; usually indirect unless reported as debt |

| Data Accessibility | Widely accessible for credit scoring | Restricted due to patient confidentiality and HIPAA compliance |

| Use Case | Expanding credit access, risk modeling, loan underwriting | Assessing financial stress, predicting default linked to medical debt |

Which is better?

Alternative credit data offers a broader view of consumer creditworthiness by including rent, utilities, and telecom payments, enhancing risk assessment accuracy for lenders. Healthcare payment data, while valuable for understanding patient payment behaviors, is less comprehensive for credit evaluation due to privacy regulations and limited scope. Banks benefit more from alternative credit data as it provides diverse financial behaviors critical for inclusive lending decisions and reducing default rates.

Connection

Alternative credit data and healthcare payment data intersect by providing a comprehensive view of an individual's financial behavior beyond traditional credit reports. Healthcare payment data, including timely payments of medical bills, can be factored into alternative credit scoring models to assess creditworthiness, especially for individuals with limited credit history. Incorporating these data sources helps financial institutions deliver more inclusive lending decisions and reduce credit risk.

Key Terms

Claims Data

Healthcare payment data, particularly claims data, provides detailed records of patient interactions, diagnoses, and treatments, offering a comprehensive view of financial obligations and payment histories within the healthcare system. Alternative credit data, in contrast, sources non-traditional financial behaviors such as utility payments and rental histories to assess creditworthiness beyond standard credit reports. Explore the nuances of claims data and its impact on credit assessment to better understand its potential applications and limitations.

Electronic Health Records (EHR)

Healthcare payment data primarily captures transactions related to medical services, insurance claims, and patient billing, emphasizing financial flows within the healthcare ecosystem. Alternative credit data, including Electronic Health Records (EHR), offers a richer source of socioeconomic and behavioral information by documenting patient interactions, diagnoses, treatments, and health outcomes beyond mere payments. Exploring the integration and implications of EHR in credit assessments reveals innovative approaches to improving financial inclusion and risk prediction; discover more insights on this intersection.

Utility Payment Data

Utility payment data, a subset of alternative credit data, offers valuable insights into an individual's financial reliability beyond traditional healthcare payment records. Unlike healthcare payment data, which primarily reflects medical debt and insurance claims, utility payment data captures consistent, recurring payment behavior for essential services, serving as a predictive indicator of creditworthiness. Explore how integrating utility payment data can enhance risk assessment and credit evaluation strategies.

Source and External Links

Medical Payment Data - Medical payment data includes all information related to healthcare service payments, such as claims, reimbursements, patient payment histories, and collections, and is vital for revenue cycle management and financial compliance in healthcare.

Open Payments Data - Open Payments Data is a publicly accessible database mandated by the Sunshine Act, detailing payments and transfers of value from drug and medical device companies to physicians and teaching hospitals in the US to increase industry transparency.

Health Care Payments Data Program - Public Reporting - The HPD System collects and reports healthcare claims and encounter data from Medi-Cal, Medicare, and commercial payers in California, following national data standards to support research and transparency on healthcare payments and utilization.

dowidth.com

dowidth.com