Neo brokerages leverage advanced technology platforms to offer commission-free or low-cost trades with streamlined digital interfaces, appealing to tech-savvy investors seeking convenience. Discount brokerages provide reduced commission fees compared to traditional brokers while often maintaining access to extensive research tools and customer support. Explore the differences in fees, features, and user experience to determine the best fit for your investment needs.

Why it is important

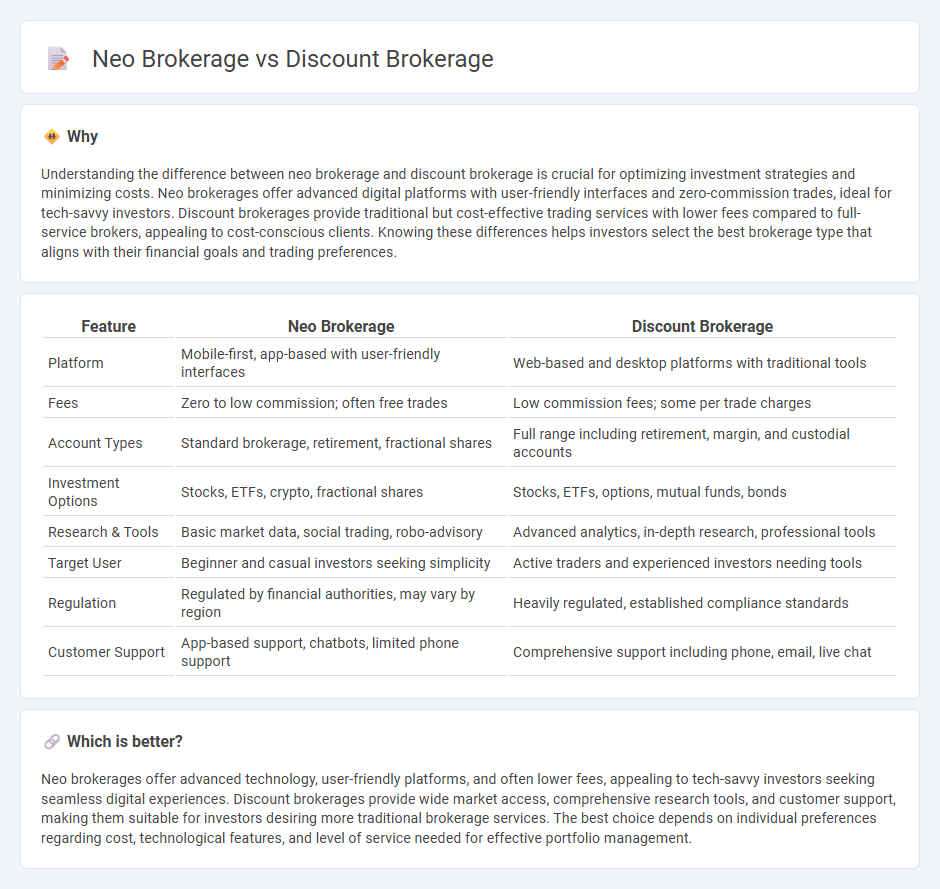

Understanding the difference between neo brokerage and discount brokerage is crucial for optimizing investment strategies and minimizing costs. Neo brokerages offer advanced digital platforms with user-friendly interfaces and zero-commission trades, ideal for tech-savvy investors. Discount brokerages provide traditional but cost-effective trading services with lower fees compared to full-service brokers, appealing to cost-conscious clients. Knowing these differences helps investors select the best brokerage type that aligns with their financial goals and trading preferences.

Comparison Table

| Feature | Neo Brokerage | Discount Brokerage |

|---|---|---|

| Platform | Mobile-first, app-based with user-friendly interfaces | Web-based and desktop platforms with traditional tools |

| Fees | Zero to low commission; often free trades | Low commission fees; some per trade charges |

| Account Types | Standard brokerage, retirement, fractional shares | Full range including retirement, margin, and custodial accounts |

| Investment Options | Stocks, ETFs, crypto, fractional shares | Stocks, ETFs, options, mutual funds, bonds |

| Research & Tools | Basic market data, social trading, robo-advisory | Advanced analytics, in-depth research, professional tools |

| Target User | Beginner and casual investors seeking simplicity | Active traders and experienced investors needing tools |

| Regulation | Regulated by financial authorities, may vary by region | Heavily regulated, established compliance standards |

| Customer Support | App-based support, chatbots, limited phone support | Comprehensive support including phone, email, live chat |

Which is better?

Neo brokerages offer advanced technology, user-friendly platforms, and often lower fees, appealing to tech-savvy investors seeking seamless digital experiences. Discount brokerages provide wide market access, comprehensive research tools, and customer support, making them suitable for investors desiring more traditional brokerage services. The best choice depends on individual preferences regarding cost, technological features, and level of service needed for effective portfolio management.

Connection

Neo brokerage and discount brokerage share a common goal of reducing trading costs and increasing accessibility to financial markets through technology-driven platforms. Both models leverage digital tools to offer lower commissions compared to traditional brokerages, though neo brokerages often incorporate advanced user interfaces and educational resources to attract modern investors. This synergy enhances market participation by blending affordability with convenience and innovation in trading services.

Key Terms

Commission Fees

Discount brokerages typically charge low commission fees per trade, often a flat rate or a small percentage, making them cost-effective for frequent traders. Neo brokerages, leveraging digital platforms and automation, often provide zero-commission trades but may generate revenue through payment for order flow or premium services. Explore how commission fees impact overall investment costs and service quality by learning more about each brokerage model.

Trading Platform

Discount brokerages offer traditional trading platforms with comprehensive market data and research tools, suitable for experienced investors seeking low-cost trades. Neo brokerages provide intuitive, app-based platforms emphasizing ease of use and real-time trading features, targeting millennial and tech-savvy traders. Explore the differences in platform capabilities to decide which trading environment best fits your investment style.

Regulatory Structure

Discount brokerages operate under traditional regulatory frameworks established by authorities like the SEC and FINRA, ensuring comprehensive investor protection and compliance requirements. Neo brokerages, often leveraging app-based platforms, might be subject to evolving regulations tailored to digital financial services, sometimes offering more flexible but less regulated environments. Explore the differences in regulatory structures to make an informed choice between discount and neo brokerage services.

Source and External Links

What Are Discount Brokers? What to Look for in a Broker - Discount brokers provide low-cost, self-directed online trading for stocks, ETFs, and other securities with minimal or no commissions and low account minimums, making investing accessible to a wider audience.

What are Discount Brokerages? - In real estate, discount brokerages offer basic services for a flat fee or reduced commission, focusing on volume and leveraging technology, but may provide fewer personalized services compared to full-service firms.

8 Best Discount Brokers of July 2025 - Leading discount brokers like Webull, Public, and SoFi Active Investing charge no commissions, have no account minimums, and often offer promotions for new customers, prioritizing affordability and ease of access for investors.

dowidth.com

dowidth.com