Wealthtech focuses on leveraging technology to optimize investment management, portfolio analysis, and financial planning, providing personalized wealth growth solutions. Insurtech revolutionizes the insurance sector by employing data analytics, AI, and automation to enhance risk assessment, claims processing, and customer engagement. Explore how these financial technology innovations are shaping the future of banking services.

Why it is important

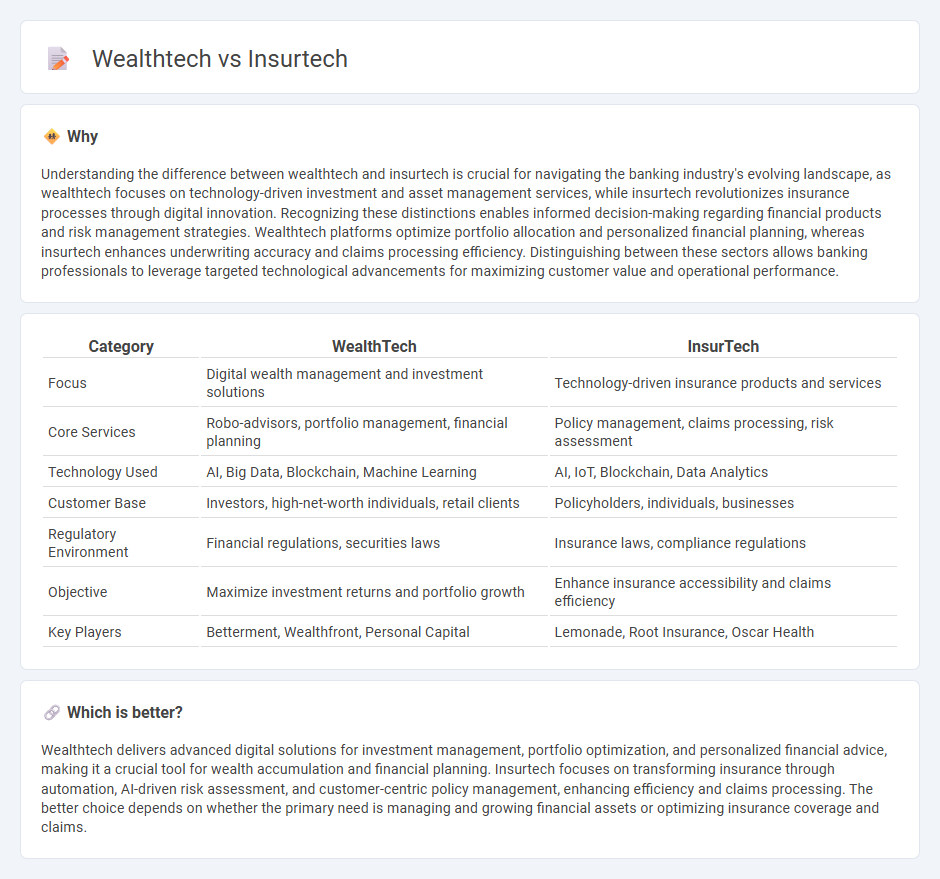

Understanding the difference between wealthtech and insurtech is crucial for navigating the banking industry's evolving landscape, as wealthtech focuses on technology-driven investment and asset management services, while insurtech revolutionizes insurance processes through digital innovation. Recognizing these distinctions enables informed decision-making regarding financial products and risk management strategies. Wealthtech platforms optimize portfolio allocation and personalized financial planning, whereas insurtech enhances underwriting accuracy and claims processing efficiency. Distinguishing between these sectors allows banking professionals to leverage targeted technological advancements for maximizing customer value and operational performance.

Comparison Table

| Category | WealthTech | InsurTech |

|---|---|---|

| Focus | Digital wealth management and investment solutions | Technology-driven insurance products and services |

| Core Services | Robo-advisors, portfolio management, financial planning | Policy management, claims processing, risk assessment |

| Technology Used | AI, Big Data, Blockchain, Machine Learning | AI, IoT, Blockchain, Data Analytics |

| Customer Base | Investors, high-net-worth individuals, retail clients | Policyholders, individuals, businesses |

| Regulatory Environment | Financial regulations, securities laws | Insurance laws, compliance regulations |

| Objective | Maximize investment returns and portfolio growth | Enhance insurance accessibility and claims efficiency |

| Key Players | Betterment, Wealthfront, Personal Capital | Lemonade, Root Insurance, Oscar Health |

Which is better?

Wealthtech delivers advanced digital solutions for investment management, portfolio optimization, and personalized financial advice, making it a crucial tool for wealth accumulation and financial planning. Insurtech focuses on transforming insurance through automation, AI-driven risk assessment, and customer-centric policy management, enhancing efficiency and claims processing. The better choice depends on whether the primary need is managing and growing financial assets or optimizing insurance coverage and claims.

Connection

Wealthtech and insurtech intersect through their shared use of advanced technologies like AI, big data analytics, and blockchain to enhance financial services and risk management. Both sectors leverage personalized algorithms and automation to optimize asset management, insurance underwriting, and claims processing, thereby improving efficiency and customer experience. Collaboration between wealthtech firms and insurtech companies drives innovation in integrated financial planning and comprehensive risk solutions.

Key Terms

Digital Underwriting

Digital underwriting in insurtech leverages AI and big data to assess risk faster and more accurately, reducing the time from application to policy issuance. In wealthtech, digital underwriting focuses on evaluating investor profiles and financial risk tolerance to customize investment strategies and portfolio management. Explore how these industries transform risk assessment through digital underwriting innovations.

Robo-Advisory

Robo-advisory in insurtech revolutionizes insurance by automating risk assessment and personalized policy recommendations, while wealthtech leverages robo-advisors for optimized portfolio management and automated investment strategies. Insurtech robo-advisors enhance underwriting efficiency and customer engagement, whereas wealthtech focuses on asset allocation and financial planning through AI-driven analytics. Explore how robo-advisory transforms financial services by visiting our detailed insights.

Risk Assessment

Insurtech leverages advanced data analytics and AI to enhance risk assessment by predicting insurance claims, optimizing underwriting processes, and detecting fraud with precision. Wealthtech utilizes risk assessment tools to evaluate portfolio volatility, individual investor risk tolerance, and market trends, enabling personalized investment strategies. Explore the latest innovations in insurtech and wealthtech to understand how risk assessment drives smarter financial decisions.

Source and External Links

What Is Insurtech? A Guide For Brokers and Carriers | Salesforce US - Insurtech modernizes insurance through digital innovation, AI, and automation, benefiting underwriters, brokers, and policyholders by enabling faster policy processes, smarter claims handling, and better customer experience.

Insurtech Insights | World's Largest Insurtech Community - Insurtech Insights connects global insurance technology entrepreneurs, investors, and incumbents via conferences and webinars, promoting AI-driven advances like automated claims to improve efficiency and customer satisfaction.

InsurTech NY - The #1 resource for the InsurTech community - InsurTech NY fosters innovation in insurance by linking carriers, brokers, startups, and investors, offering events, matchmaking, and resources to accelerate adoption of cutting-edge insurance technologies and business models.

dowidth.com

dowidth.com