Digital KYC leverages biometric verification and AI-driven document authentication to streamline customer onboarding, reducing fraud and enhancing user experience compared to traditional OTP-based KYC that relies on one-time passwords sent via SMS for identity confirmation. OTP-based KYC faces challenges like SIM swap fraud and delayed SMS delivery, impacting security and efficiency. Discover more about the evolving landscape of KYC solutions in banking to safeguard transactions and comply with regulatory standards.

Why it is important

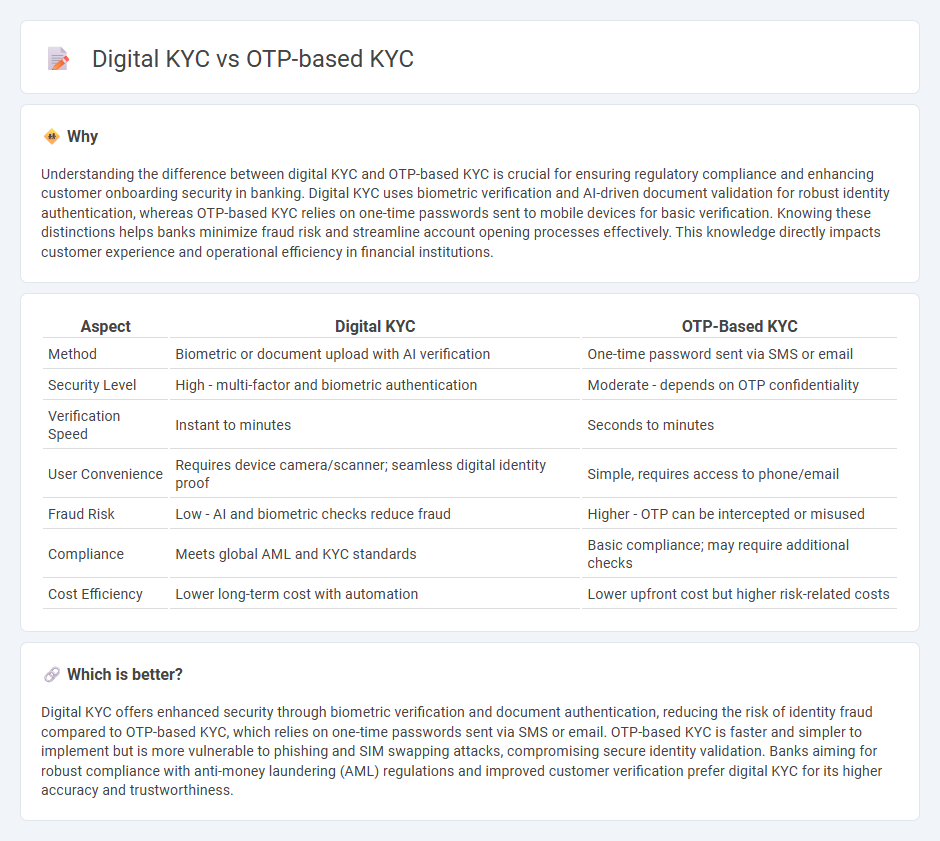

Understanding the difference between digital KYC and OTP-based KYC is crucial for ensuring regulatory compliance and enhancing customer onboarding security in banking. Digital KYC uses biometric verification and AI-driven document validation for robust identity authentication, whereas OTP-based KYC relies on one-time passwords sent to mobile devices for basic verification. Knowing these distinctions helps banks minimize fraud risk and streamline account opening processes effectively. This knowledge directly impacts customer experience and operational efficiency in financial institutions.

Comparison Table

| Aspect | Digital KYC | OTP-Based KYC |

|---|---|---|

| Method | Biometric or document upload with AI verification | One-time password sent via SMS or email |

| Security Level | High - multi-factor and biometric authentication | Moderate - depends on OTP confidentiality |

| Verification Speed | Instant to minutes | Seconds to minutes |

| User Convenience | Requires device camera/scanner; seamless digital identity proof | Simple, requires access to phone/email |

| Fraud Risk | Low - AI and biometric checks reduce fraud | Higher - OTP can be intercepted or misused |

| Compliance | Meets global AML and KYC standards | Basic compliance; may require additional checks |

| Cost Efficiency | Lower long-term cost with automation | Lower upfront cost but higher risk-related costs |

Which is better?

Digital KYC offers enhanced security through biometric verification and document authentication, reducing the risk of identity fraud compared to OTP-based KYC, which relies on one-time passwords sent via SMS or email. OTP-based KYC is faster and simpler to implement but is more vulnerable to phishing and SIM swapping attacks, compromising secure identity validation. Banks aiming for robust compliance with anti-money laundering (AML) regulations and improved customer verification prefer digital KYC for its higher accuracy and trustworthiness.

Connection

Digital KYC leverages biometric authentication and remote identity verification to streamline customer onboarding while ensuring regulatory compliance, whereas OTP-based KYC uses one-time passwords sent to a registered mobile number for real-time authentication. Both methods enhance security and reduce fraud by validating user identities through digital channels, integrating seamlessly within modern banking frameworks. This connection supports banks in achieving faster KYC processing with improved customer experience and regulatory adherence.

Key Terms

Authentication

OTP-based KYC relies on one-time passwords sent to users' registered mobile numbers or emails for authentication, offering a simple yet less secure verification method vulnerable to interception or SIM swapping. Digital KYC, on the other hand, employs biometric verification, facial recognition, and AI-driven identity checks to provide a higher level of security and reduce fraud risks. Explore the nuances of authentication in OTP-based versus digital KYC to better understand their impact on secure onboarding.

Real-time Verification

OTP-based KYC relies on sending a One-Time Password to the user's mobile for identity verification, offering quick but less secure authentication compared to digital KYC methods, which utilize biometric data and document verification in real-time to ensure higher accuracy and fraud prevention. Real-time verification in digital KYC processes is powered by AI and machine learning algorithms that instantly validate identity documents, detect anomalies, and enhance compliance with regulatory standards like AML and KYC directives. Explore deeper insights into how real-time verification is transforming identity authentication in financial services.

Aadhaar Integration

OTP-based KYC leverages a one-time password sent to the user's registered mobile number linked with Aadhaar, providing a quick and secure identity verification method. Digital KYC, enhanced by Aadhaar integration, employs biometric authentication and real-time validation of demographic data, ensuring higher accuracy and reducing fraud risks. Explore more about how Aadhaar-enabled KYC solutions transform digital identity verification.

Source and External Links

Lenders need OTP consent for KYC data access - From May 9, 2025, the Central KYC Registry mandates OTP-based consent to access customer KYC data, adding a security layer requiring customer approval through OTP to prevent data misuse in financial services.

Benefits of OTP-Based e-KYC for Opening a Savings Account - OTP-based e-KYC uses Aadhaar details and an OTP sent to the customer's registered mobile number to securely verify identity online, simplifying bank account opening without physical document submission.

How OTP based e-KYC is beneficial to open savings account - OTP-based e-KYC enhances security by ensuring only the genuine customer can complete KYC, reduces fraud, minimizes paperwork and human error, and allows customers to complete verification remotely with convenience.

dowidth.com

dowidth.com