Alternative credit data offers a comprehensive view of an individual's financial behavior beyond traditional credit scores, incorporating utility payments, rental history, and mobile phone bills to assess creditworthiness. Public records, on the other hand, include court judgments, tax liens, and bankruptcies that provide formal legal insights into a person's financial stability. Explore how integrating alternative credit data with public records can enhance risk assessment and broaden lending opportunities.

Why it is important

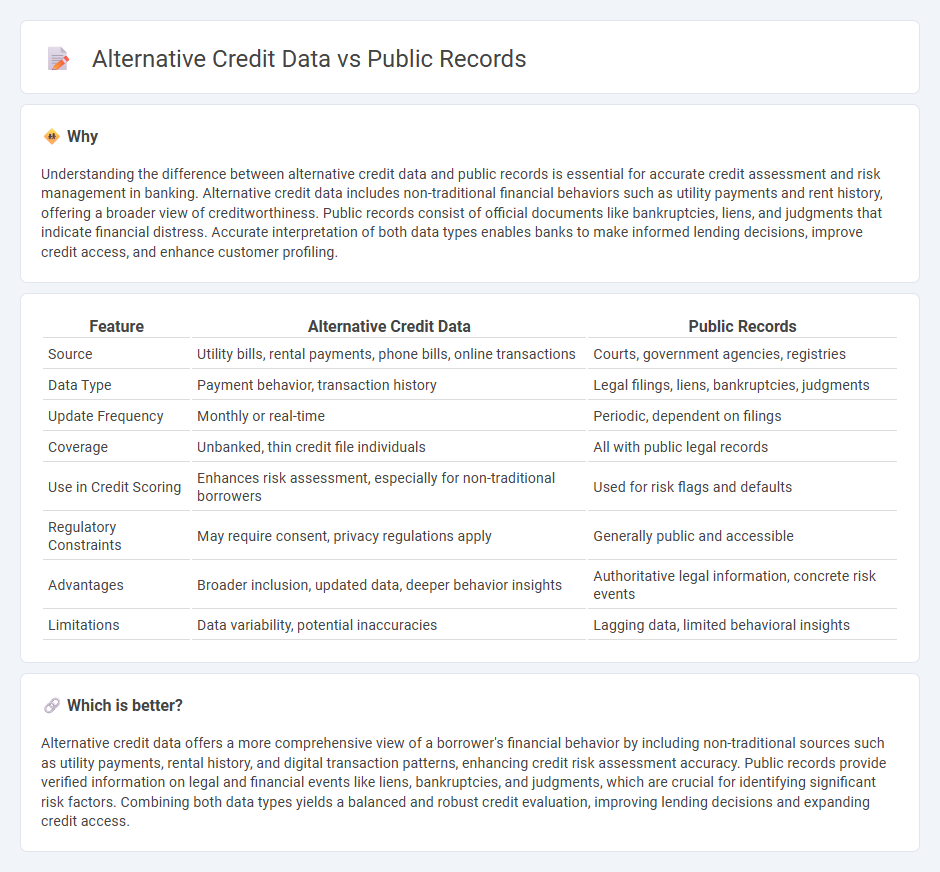

Understanding the difference between alternative credit data and public records is essential for accurate credit assessment and risk management in banking. Alternative credit data includes non-traditional financial behaviors such as utility payments and rent history, offering a broader view of creditworthiness. Public records consist of official documents like bankruptcies, liens, and judgments that indicate financial distress. Accurate interpretation of both data types enables banks to make informed lending decisions, improve credit access, and enhance customer profiling.

Comparison Table

| Feature | Alternative Credit Data | Public Records |

|---|---|---|

| Source | Utility bills, rental payments, phone bills, online transactions | Courts, government agencies, registries |

| Data Type | Payment behavior, transaction history | Legal filings, liens, bankruptcies, judgments |

| Update Frequency | Monthly or real-time | Periodic, dependent on filings |

| Coverage | Unbanked, thin credit file individuals | All with public legal records |

| Use in Credit Scoring | Enhances risk assessment, especially for non-traditional borrowers | Used for risk flags and defaults |

| Regulatory Constraints | May require consent, privacy regulations apply | Generally public and accessible |

| Advantages | Broader inclusion, updated data, deeper behavior insights | Authoritative legal information, concrete risk events |

| Limitations | Data variability, potential inaccuracies | Lagging data, limited behavioral insights |

Which is better?

Alternative credit data offers a more comprehensive view of a borrower's financial behavior by including non-traditional sources such as utility payments, rental history, and digital transaction patterns, enhancing credit risk assessment accuracy. Public records provide verified information on legal and financial events like liens, bankruptcies, and judgments, which are crucial for identifying significant risk factors. Combining both data types yields a balanced and robust credit evaluation, improving lending decisions and expanding credit access.

Connection

Alternative credit data, such as utility payments, rental history, and digital transaction records, complement traditional credit scores by providing a broader financial profile of borrowers. Public records, including court judgments and liens, offer crucial insights into a person's financial reliability and risk factors. Integrating these data sources enhances banks' risk assessment models, enabling more accurate credit decisions and improved financial inclusion.

Key Terms

Bankruptcy

Bankruptcy information in public records provides a legal snapshot of an individual's financial failure, typically accessible through court documents and government databases, offering lenders a standardized risk assessment tool. Alternative credit data, such as rent payments, utility bills, and subscription services, can supplement or partially offset the negative impact of bankruptcies by painting a broader, real-time picture of financial behavior and reliability. Discover how leveraging both public records and alternative credit data can create a fuller, more accurate credit profile.

Utility Payments

Utility payments serve as critical alternative credit data sources, offering lenders insight into consumer payment behavior beyond traditional public records like court judgments or tax liens. Incorporating utility payment history enhances credit scoring models by reflecting consistent financial responsibility, especially for thin-file or credit-invisible consumers. Explore how integrating utility payments can revolutionize credit assessments and expand credit access.

Tax Liens

Tax liens are crucial public records that indicate a government's legal claim against a property due to unpaid taxes, significantly impacting credit scores and lending decisions. Alternative credit data, including utility payments, rent history, and subscription services, often exclude tax liens but provide a broader financial behavior spectrum, especially for individuals with limited traditional credit history. Explore more to understand how integrating tax liens from public records with alternative credit data can enhance credit risk assessment.

Source and External Links

Public records - Wikipedia - Public records are non-confidential documents or information related to government conduct, including births, deaths, marriages, court proceedings, voter registrations, and more, historically maintained by governments for transparency and legal purposes.

Kentucky Public Records | KentuckyCourtRecords.us - In Kentucky, the Open Records Act mandates government agencies to provide public access to records such as criminal, bankruptcy, arrest, inmate, sex offender, and court records, including electronic and photographic records.

National Public Records Directory | PublicRecords.com - This site offers extensive resources for finding U.S. public records including court, criminal, marriage, birth, death, property, and business records aggregated from verified government sources.

dowidth.com

dowidth.com