Core banking modernization focuses on upgrading legacy systems and infrastructure to enhance reliability, scalability, and regulatory compliance, enabling banks to process transactions efficiently and securely. Digital transformation encompasses a broader shift incorporating innovative technologies like AI, cloud computing, and customer-centric platforms to redefine banking experiences and business models. Explore how integrating both strategies can drive competitive advantage and future-proof your financial institution.

Why it is important

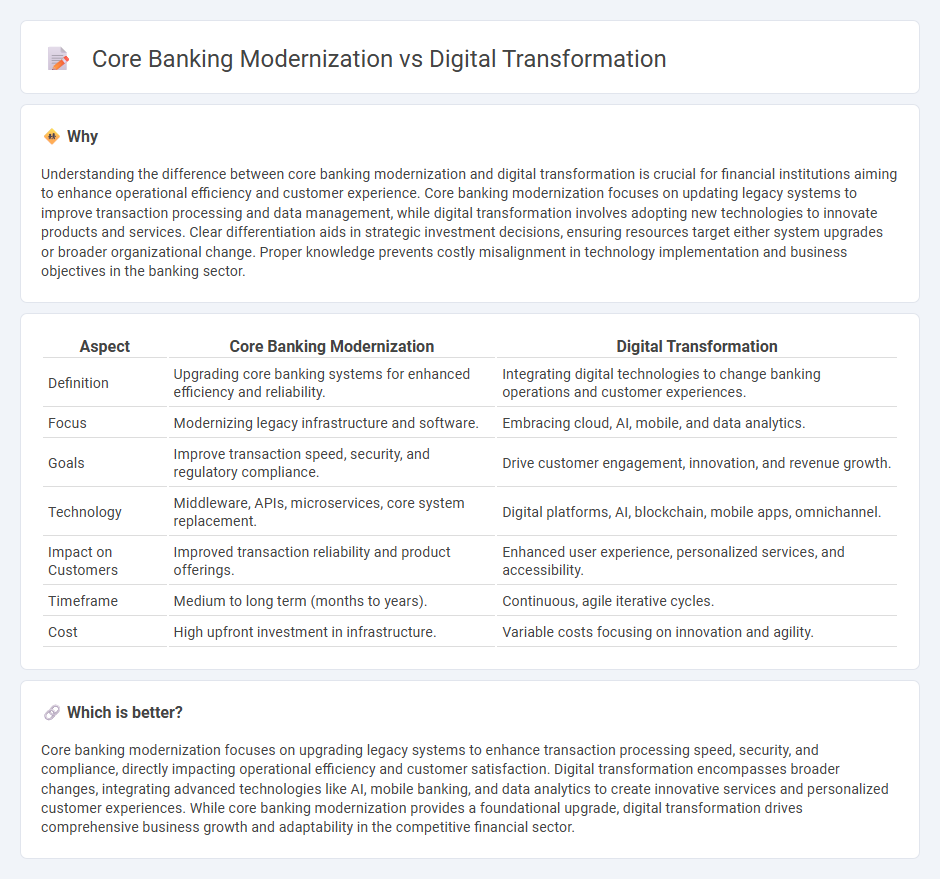

Understanding the difference between core banking modernization and digital transformation is crucial for financial institutions aiming to enhance operational efficiency and customer experience. Core banking modernization focuses on updating legacy systems to improve transaction processing and data management, while digital transformation involves adopting new technologies to innovate products and services. Clear differentiation aids in strategic investment decisions, ensuring resources target either system upgrades or broader organizational change. Proper knowledge prevents costly misalignment in technology implementation and business objectives in the banking sector.

Comparison Table

| Aspect | Core Banking Modernization | Digital Transformation |

|---|---|---|

| Definition | Upgrading core banking systems for enhanced efficiency and reliability. | Integrating digital technologies to change banking operations and customer experiences. |

| Focus | Modernizing legacy infrastructure and software. | Embracing cloud, AI, mobile, and data analytics. |

| Goals | Improve transaction speed, security, and regulatory compliance. | Drive customer engagement, innovation, and revenue growth. |

| Technology | Middleware, APIs, microservices, core system replacement. | Digital platforms, AI, blockchain, mobile apps, omnichannel. |

| Impact on Customers | Improved transaction reliability and product offerings. | Enhanced user experience, personalized services, and accessibility. |

| Timeframe | Medium to long term (months to years). | Continuous, agile iterative cycles. |

| Cost | High upfront investment in infrastructure. | Variable costs focusing on innovation and agility. |

Which is better?

Core banking modernization focuses on upgrading legacy systems to enhance transaction processing speed, security, and compliance, directly impacting operational efficiency and customer satisfaction. Digital transformation encompasses broader changes, integrating advanced technologies like AI, mobile banking, and data analytics to create innovative services and personalized customer experiences. While core banking modernization provides a foundational upgrade, digital transformation drives comprehensive business growth and adaptability in the competitive financial sector.

Connection

Core banking modernization streamlines legacy systems, enabling real-time processing and seamless integration with digital platforms critical for digital transformation. Digital transformation leverages these modernized core systems to deliver personalized customer experiences, enhanced security, and agile product offerings through mobile and online banking channels. Together, they drive operational efficiency, regulatory compliance, and innovation in the financial services industry.

Key Terms

Cloud Computing

Digital transformation in banking leverages Cloud Computing to enhance agility, scalability, and customer experience, enabling seamless integration of digital services. Core banking modernization centers on migrating legacy systems to cloud platforms, improving processing speed, operational efficiency, and security compliance. Explore detailed strategies to harness cloud technologies for banking innovation and competitive advantage.

API Integration

Digital transformation in banking often entails comprehensive technological overhauls, while core banking modernization specifically targets upgrading legacy systems for enhanced efficiency and scalability. API integration plays a pivotal role in both strategies by enabling seamless connectivity between disparate software, thus accelerating innovation and improving customer experiences. Explore the critical impact of API integration on modern banking infrastructures to understand its transformative potential.

Legacy System Migration

Core banking modernization involves updating legacy systems to improve efficiency, security, and customer experience, while digital transformation encompasses a broader shift that integrates digital technologies across all banking operations. Legacy system migration is a critical process in core banking modernization, ensuring minimal disruption while enabling scalability, cloud adoption, and enhanced data analytics capabilities. Explore in-depth strategies and benefits of legacy system migration to stay competitive in evolving financial landscapes.

Source and External Links

What Is Digital Transformation? - IBM - Digital transformation is a business strategy initiative that integrates digital technology across all organizational areas to modernize processes, products, and operations, aiming to meet evolving customer expectations and enable continuous innovation.

20+ Most Mind-Blowing Examples of Digital Transformation in 2025 - Digital transformation involves using technology to drastically improve business operations, customer experience, and growth strategies, and is essential for staying competitive in today's market landscape.

What Is Digital Transformation? Overview, Why, & How - Whatfix - Key drivers of digital transformation include cloud adoption, culture change, privacy, augmented intelligence, and product management, with cloud migration being a critical component for operational improvement and resilience.

dowidth.com

dowidth.com