Open banking enables secure data sharing between banks and third-party providers through APIs, fostering innovative financial services. Fintech integration leverages this data to deliver personalized solutions, improve customer experience, and streamline operations. Explore the differences and synergies between open banking and fintech integration to unlock new opportunities in the financial sector.

Why it is important

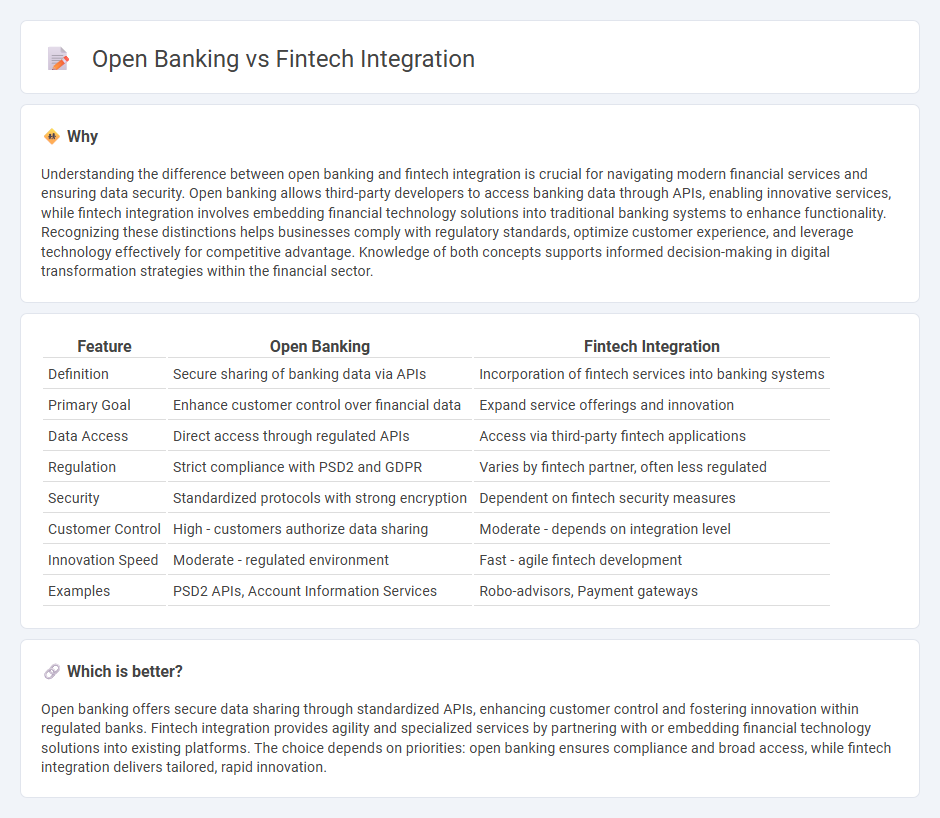

Understanding the difference between open banking and fintech integration is crucial for navigating modern financial services and ensuring data security. Open banking allows third-party developers to access banking data through APIs, enabling innovative services, while fintech integration involves embedding financial technology solutions into traditional banking systems to enhance functionality. Recognizing these distinctions helps businesses comply with regulatory standards, optimize customer experience, and leverage technology effectively for competitive advantage. Knowledge of both concepts supports informed decision-making in digital transformation strategies within the financial sector.

Comparison Table

| Feature | Open Banking | Fintech Integration |

|---|---|---|

| Definition | Secure sharing of banking data via APIs | Incorporation of fintech services into banking systems |

| Primary Goal | Enhance customer control over financial data | Expand service offerings and innovation |

| Data Access | Direct access through regulated APIs | Access via third-party fintech applications |

| Regulation | Strict compliance with PSD2 and GDPR | Varies by fintech partner, often less regulated |

| Security | Standardized protocols with strong encryption | Dependent on fintech security measures |

| Customer Control | High - customers authorize data sharing | Moderate - depends on integration level |

| Innovation Speed | Moderate - regulated environment | Fast - agile fintech development |

| Examples | PSD2 APIs, Account Information Services | Robo-advisors, Payment gateways |

Which is better?

Open banking offers secure data sharing through standardized APIs, enhancing customer control and fostering innovation within regulated banks. Fintech integration provides agility and specialized services by partnering with or embedding financial technology solutions into existing platforms. The choice depends on priorities: open banking ensures compliance and broad access, while fintech integration delivers tailored, rapid innovation.

Connection

Open banking enables secure data sharing between financial institutions and third-party fintech developers through APIs, fostering innovation in digital banking services. Fintech integration leverages this data exchange to create personalized financial products, improve payment processing, and enhance customer experience. Together, they drive a collaborative ecosystem that promotes financial inclusion and real-time access to financial information.

Key Terms

APIs

Fintech integration relies on APIs to connect diverse financial services, enabling seamless data sharing and enhanced user experiences, whereas open banking mandates standardized APIs for regulated access to customer banking data by third parties. APIs in fintech integration often prioritize innovation and flexibility, while open banking APIs emphasize security, compliance with data privacy regulations like PSD2, and customer consent management. Explore deeper insights into how API strategies shape the future of financial services and customer empowerment.

Data Sharing

Fintech integration streamlines financial services by connecting multiple platforms through APIs, enhancing user experience and operational efficiency in data sharing. Open banking mandates regulated and secure access to customer financial data via standardized APIs, empowering third-party providers to develop innovative applications while ensuring data privacy. Explore the nuances of data sharing in fintech integration and open banking to unlock new opportunities in financial technology.

Third-Party Providers (TPPs)

Fintech integration leverages Third-Party Providers (TPPs) to enhance financial services by connecting fintech platforms directly with banking systems, enabling seamless payment processing, account aggregation, and personalized financial products. Open banking regulations mandate banks to provide secure API access to TPPs, fostering innovation and competition by allowing authorized external providers to initiate payments and access customer data with consent. Explore further insights on how TPPs drive transformation in fintech integration and open banking ecosystems.

Source and External Links

Financial Technology (Fintech) Integration - Salsify - Fintech integration is the process of embedding finance-oriented solutions like payment or banking features into existing ecommerce systems to improve customer experience and streamline operations.

Future of Fintech & Banking: Partnerships & Collaboration - Collaboration between banks and fintechs simplifies integration, reduces manual work, and enables better data insights within enterprise systems like ERP and treasury management.

A guide to fintech innovation | Stripe - Fintech integration facilitates closer alignment of financial services with other sectors, enabling smoother transactions, personalized services, and expanded financial accessibility through technology.

dowidth.com

dowidth.com