Invisible payments leverage seamless technologies like contactless cards and mobile wallets to enable quick, frictionless transactions at the point of sale, enhancing consumer convenience. Bank transfers involve directly moving funds between accounts, often requiring more steps and time, but offer greater security and traceability for larger or recurring payments. Explore how these payment methods transform banking experiences and suit different financial needs.

Why it is important

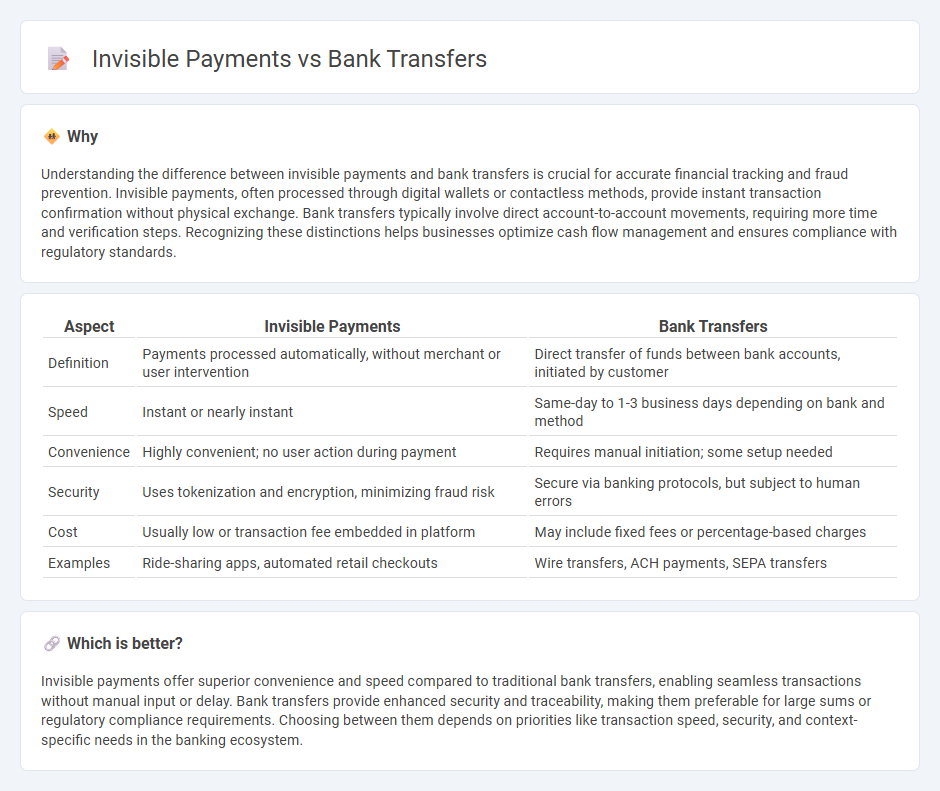

Understanding the difference between invisible payments and bank transfers is crucial for accurate financial tracking and fraud prevention. Invisible payments, often processed through digital wallets or contactless methods, provide instant transaction confirmation without physical exchange. Bank transfers typically involve direct account-to-account movements, requiring more time and verification steps. Recognizing these distinctions helps businesses optimize cash flow management and ensures compliance with regulatory standards.

Comparison Table

| Aspect | Invisible Payments | Bank Transfers |

|---|---|---|

| Definition | Payments processed automatically, without merchant or user intervention | Direct transfer of funds between bank accounts, initiated by customer |

| Speed | Instant or nearly instant | Same-day to 1-3 business days depending on bank and method |

| Convenience | Highly convenient; no user action during payment | Requires manual initiation; some setup needed |

| Security | Uses tokenization and encryption, minimizing fraud risk | Secure via banking protocols, but subject to human errors |

| Cost | Usually low or transaction fee embedded in platform | May include fixed fees or percentage-based charges |

| Examples | Ride-sharing apps, automated retail checkouts | Wire transfers, ACH payments, SEPA transfers |

Which is better?

Invisible payments offer superior convenience and speed compared to traditional bank transfers, enabling seamless transactions without manual input or delay. Bank transfers provide enhanced security and traceability, making them preferable for large sums or regulatory compliance requirements. Choosing between them depends on priorities like transaction speed, security, and context-specific needs in the banking ecosystem.

Connection

Invisible payments and bank transfers are interconnected through their reliance on seamless, real-time processing technologies that enable transactions without explicit user actions or visible steps. Banks employ APIs and secure authentication methods to facilitate automatic transfers in the background, enhancing customer convenience and operational efficiency. The integration of invisible payments within traditional bank transfer systems supports frictionless financial experiences across digital platforms and point-of-sale environments.

Key Terms

SWIFT

Bank transfers via SWIFT provide a secure and standardized method for cross-border payments, facilitating the exchange of financial messages between over 11,000 institutions in more than 200 countries and territories. Invisible payments, often relying on real-time API integrations, enhance user experience by streamlining transactions without requiring direct customer intervention or visible processing steps. Explore how SWIFT's evolving infrastructure supports both traditional bank transfers and the innovation of invisible payments to transform global finance.

Remittance

Bank transfers dominate global remittance flows due to their reliability, extensive network coverage, and regulatory compliance, facilitating cross-border fund transfers with clear transactional records. Invisible payments, including mobile wallets and integrated digital currencies, are gaining traction by offering seamless, instant remittances without explicit transaction visibility to end-users, enhancing user experience especially in underbanked regions. Explore how emerging invisible payment technologies are reshaping the remittance landscape and transforming financial inclusion worldwide.

Balance of Payments

Bank transfers significantly impact the Balance of Payments by directly recording cross-border financial flows and influencing the capital account through explicit transactions. Invisible payments, including services such as insurance, royalties, and remittances, affect the current account by capturing non-physical transactions that are vital for assessing economic relationships between countries. Explore more to understand how these components shape international economic stability and policy decisions.

Source and External Links

Wire transfer vs electronic transfer | Western Union ES - A bank transfer is an electronic payment that sends money directly from one bank account to another, often using the ACH network for domestic transfers, involving direct deposits or direct payments between bank accounts without needing to link accounts directly.

How a bank transfer, ACH transfer, or wire transfer works | Stripe - Bank transfers include various methods like ACH and wire transfers; ACH transfers typically take 1-2 business days, wire transfers process faster domestically but take longer internationally, and bank transfers are generally safe though wire transfer fraud exists.

How to make a bank transfer - MoneyHelper - Bank transfers usually happen instantly or within two hours but can take up to one working day, and customers should ensure sufficient funds to avoid fees or overdrafts; mistakes in transfers should be reported immediately for investigation.

dowidth.com

dowidth.com