Banking as a Service (BaaS) enables third-party providers to offer comprehensive financial services by integrating with licensed banks' infrastructure, facilitating products like digital accounts and payment solutions. Embedded finance integrates these banking capabilities directly into non-financial platforms, such as e-commerce or ride-sharing apps, creating seamless user experiences without requiring customers to visit traditional banks. Explore how these models transform financial accessibility and innovation in various industries.

Why it is important

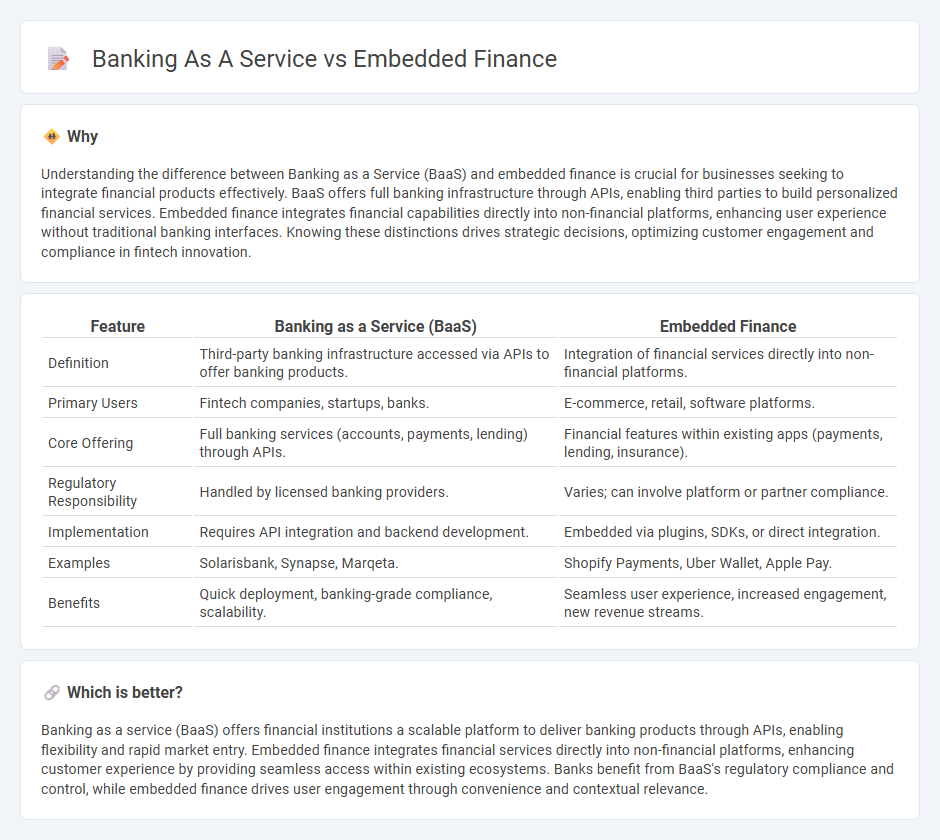

Understanding the difference between Banking as a Service (BaaS) and embedded finance is crucial for businesses seeking to integrate financial products effectively. BaaS offers full banking infrastructure through APIs, enabling third parties to build personalized financial services. Embedded finance integrates financial capabilities directly into non-financial platforms, enhancing user experience without traditional banking interfaces. Knowing these distinctions drives strategic decisions, optimizing customer engagement and compliance in fintech innovation.

Comparison Table

| Feature | Banking as a Service (BaaS) | Embedded Finance |

|---|---|---|

| Definition | Third-party banking infrastructure accessed via APIs to offer banking products. | Integration of financial services directly into non-financial platforms. |

| Primary Users | Fintech companies, startups, banks. | E-commerce, retail, software platforms. |

| Core Offering | Full banking services (accounts, payments, lending) through APIs. | Financial features within existing apps (payments, lending, insurance). |

| Regulatory Responsibility | Handled by licensed banking providers. | Varies; can involve platform or partner compliance. |

| Implementation | Requires API integration and backend development. | Embedded via plugins, SDKs, or direct integration. |

| Examples | Solarisbank, Synapse, Marqeta. | Shopify Payments, Uber Wallet, Apple Pay. |

| Benefits | Quick deployment, banking-grade compliance, scalability. | Seamless user experience, increased engagement, new revenue streams. |

Which is better?

Banking as a service (BaaS) offers financial institutions a scalable platform to deliver banking products through APIs, enabling flexibility and rapid market entry. Embedded finance integrates financial services directly into non-financial platforms, enhancing customer experience by providing seamless access within existing ecosystems. Banks benefit from BaaS's regulatory compliance and control, while embedded finance drives user engagement through convenience and contextual relevance.

Connection

Banking as a Service (BaaS) provides the underlying financial infrastructure that enables Embedded Finance by allowing non-financial companies to integrate banking services directly into their platforms. Embedded Finance leverages BaaS APIs to offer seamless payment processing, lending, and account management within third-party applications. This integration enhances customer experience and drives innovation by embedding financial products into everyday digital interactions.

Key Terms

Embedded finance:

Embedded finance integrates financial services directly into non-financial platforms, allowing businesses to offer payment, lending, or insurance solutions seamlessly within their own user experiences. This approach enhances customer convenience and drives new revenue streams by embedding financial products into everyday applications and workflows. Explore how embedded finance transforms customer engagement and creates innovative business opportunities.

API integration

Embedded finance seamlessly integrates financial services into non-financial platforms via APIs, enabling companies to offer payments, lending, or insurance without traditional banks. Banking as a Service (BaaS) provides a full banking backend through API integration, allowing fintechs and businesses to launch complete banking products under their branding. Explore how API integration transforms financial service delivery and accelerates innovation.

Non-financial platforms

Non-financial platforms leverage embedded finance to integrate financial services directly into their user experience, enabling seamless payments, loans, or insurance without redirecting users to traditional banks. Banking as a Service (BaaS) provides these platforms with backend banking infrastructure through APIs, allowing them to offer fully regulated financial products under their brand. Explore how embedded finance and BaaS transform customer engagement and revenue streams for non-financial businesses.

Source and External Links

What is embedded finance? 4 ways it will change fintech - Plaid - Embedded finance integrates financial services like payments, lending, and banking directly into non-financial apps and platforms, enabling users to access these services seamlessly without leaving the app environment.

What does embedded finance mean for business? - PwC - Embedded finance allows non-financial companies to monetize new revenue streams, deepen customer loyalty, and offer more personalized experiences by embedding digital banking and financial products into their own ecosystems.

Embedded finance: Who will lead the next payments revolution? - McKinsey - The rise of digital interfaces and open banking is driving embedded finance, transforming how consumers and businesses access financial services as a natural extension of everyday activities like shopping or business management.

dowidth.com

dowidth.com