Alternative credit data, such as utility payments and rental history, provides a broader view of an individual's creditworthiness compared to traditional employment verification data, which primarily focuses on job status and income stability. Incorporating alternative credit data enables financial institutions to assess risk more accurately, especially for individuals with limited credit histories. Discover how leveraging these data sources can transform credit decisions and expand access to banking services.

Why it is important

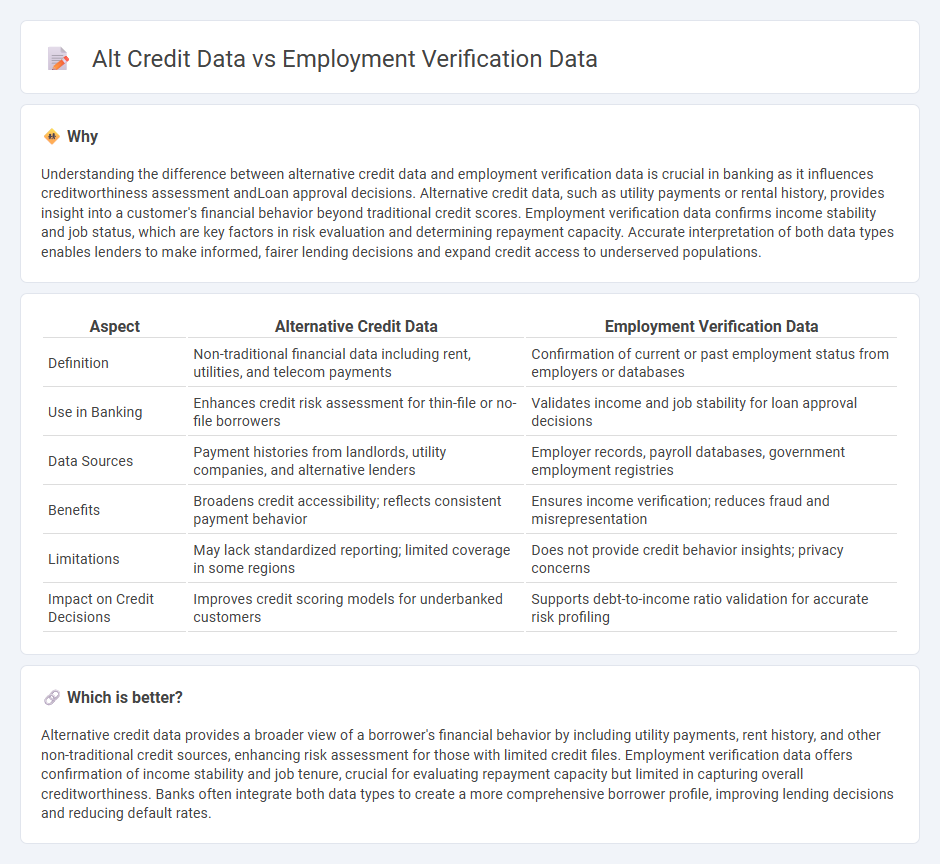

Understanding the difference between alternative credit data and employment verification data is crucial in banking as it influences creditworthiness assessment andLoan approval decisions. Alternative credit data, such as utility payments or rental history, provides insight into a customer's financial behavior beyond traditional credit scores. Employment verification data confirms income stability and job status, which are key factors in risk evaluation and determining repayment capacity. Accurate interpretation of both data types enables lenders to make informed, fairer lending decisions and expand credit access to underserved populations.

Comparison Table

| Aspect | Alternative Credit Data | Employment Verification Data |

|---|---|---|

| Definition | Non-traditional financial data including rent, utilities, and telecom payments | Confirmation of current or past employment status from employers or databases |

| Use in Banking | Enhances credit risk assessment for thin-file or no-file borrowers | Validates income and job stability for loan approval decisions |

| Data Sources | Payment histories from landlords, utility companies, and alternative lenders | Employer records, payroll databases, government employment registries |

| Benefits | Broadens credit accessibility; reflects consistent payment behavior | Ensures income verification; reduces fraud and misrepresentation |

| Limitations | May lack standardized reporting; limited coverage in some regions | Does not provide credit behavior insights; privacy concerns |

| Impact on Credit Decisions | Improves credit scoring models for underbanked customers | Supports debt-to-income ratio validation for accurate risk profiling |

Which is better?

Alternative credit data provides a broader view of a borrower's financial behavior by including utility payments, rent history, and other non-traditional credit sources, enhancing risk assessment for those with limited credit files. Employment verification data offers confirmation of income stability and job tenure, crucial for evaluating repayment capacity but limited in capturing overall creditworthiness. Banks often integrate both data types to create a more comprehensive borrower profile, improving lending decisions and reducing default rates.

Connection

Alternative credit data, including rental payments, utility bills, and other non-traditional financial behaviors, enhances a bank's ability to assess creditworthiness beyond standard credit reports. Employment verification data provides real-time confirmation of an applicant's current job status and income stability, crucial for evaluating repayment capacity. Combining alt credit data with employment verification enables lenders to create a more comprehensive risk profile, improving loan approval accuracy and reducing default rates.

Key Terms

Income verification

Employment verification data provides direct confirmation of an individual's job title, employer, and tenure, crucial for assessing employment stability. Alternative credit data, on the other hand, leverages non-traditional financial information such as utility payments and rental history to estimate income reliability when traditional employment records are unavailable. Explore the differences and benefits of each method to optimize income verification processes.

Alternative data sources

Employment verification data provides confirmed records of a borrower's job status and income, serving as a traditional cornerstone in credit risk assessment. Alternative credit data includes non-traditional information such as rental payments, utility bills, and mobile phone payments, expanding the credit profile for individuals with limited or no conventional credit history. Explore how integrating these alternative data sources can improve credit decisions and financial inclusion.

Creditworthiness assessment

Employment verification data offers concrete evidence of a borrower's income stability and job tenure, which directly impacts creditworthiness by reducing default risk. Alternative credit data, such as utility payments, rental history, and mobile phone bills, provides a broader financial behavior spectrum, especially useful for thin-file or no-credit consumers. Explore deeper insights into how these data types enhance credit assessment models.

Source and External Links

E-Verify Employer Search - This tool provides detailed employment verification data such as employer name, doing business as name, account status, enrollment and termination dates, workforce size, and hiring site locations for employers enrolled in E-Verify.

I-9, Employment Eligibility Verification - Form I-9 is used by U.S. employers to verify identity and employment authorization of all individuals hired for work in the United States, requiring both employee attestation and employer document examination.

The Work Number Employment and Income Verification - The Work Number is an employment and income verification system used by many organizations, enabling employees to provide verifiers with employment and income information, with options to dispute inaccurate data through human resources.

dowidth.com

dowidth.com