Robo advisors use algorithm-driven platforms to manage investments with minimal human intervention, offering automated portfolio rebalancing and personalized asset allocation based on risk tolerance. Self-directed investing allows individuals to make their own trading decisions without relying on financial advisors, providing complete control over asset selection and strategy execution. Explore the advantages and considerations of robo advisors compared to self-directed investing to determine the best approach for your financial goals.

Why it is important

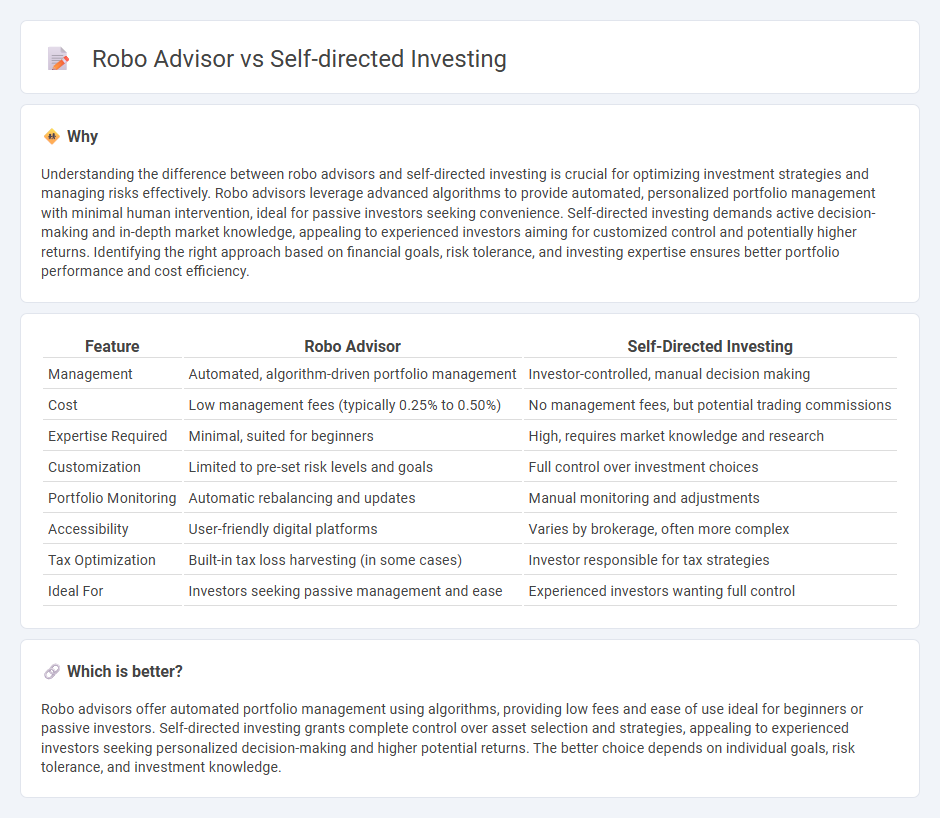

Understanding the difference between robo advisors and self-directed investing is crucial for optimizing investment strategies and managing risks effectively. Robo advisors leverage advanced algorithms to provide automated, personalized portfolio management with minimal human intervention, ideal for passive investors seeking convenience. Self-directed investing demands active decision-making and in-depth market knowledge, appealing to experienced investors aiming for customized control and potentially higher returns. Identifying the right approach based on financial goals, risk tolerance, and investing expertise ensures better portfolio performance and cost efficiency.

Comparison Table

| Feature | Robo Advisor | Self-Directed Investing |

|---|---|---|

| Management | Automated, algorithm-driven portfolio management | Investor-controlled, manual decision making |

| Cost | Low management fees (typically 0.25% to 0.50%) | No management fees, but potential trading commissions |

| Expertise Required | Minimal, suited for beginners | High, requires market knowledge and research |

| Customization | Limited to pre-set risk levels and goals | Full control over investment choices |

| Portfolio Monitoring | Automatic rebalancing and updates | Manual monitoring and adjustments |

| Accessibility | User-friendly digital platforms | Varies by brokerage, often more complex |

| Tax Optimization | Built-in tax loss harvesting (in some cases) | Investor responsible for tax strategies |

| Ideal For | Investors seeking passive management and ease | Experienced investors wanting full control |

Which is better?

Robo advisors offer automated portfolio management using algorithms, providing low fees and ease of use ideal for beginners or passive investors. Self-directed investing grants complete control over asset selection and strategies, appealing to experienced investors seeking personalized decision-making and higher potential returns. The better choice depends on individual goals, risk tolerance, and investment knowledge.

Connection

Robo advisors leverage advanced algorithms and artificial intelligence to offer automated, personalized investment management, which complements self-directed investing by providing data-driven insights and portfolio optimization tools. Self-directed investors benefit from robo advisors' ability to analyze market trends and financial goals, enabling more informed decision-making without relying solely on human advisors. This integration enhances investment efficiency and accessibility, democratizing wealth management in the banking sector.

Key Terms

Autonomy

Self-directed investing offers unparalleled autonomy by empowering individuals to make independent financial decisions and tailor portfolios without external control. Robo advisors leverage algorithms and automated tools to manage investments, reducing hands-on involvement but providing efficient, data-driven asset allocation. Explore the benefits and trade-offs of autonomy in investment strategies to determine which approach aligns best with your financial goals.

Algorithm

Self-directed investing offers complete control over investment choices, relying on individual research and decision-making skills, while robo advisors utilize sophisticated algorithms to automate portfolio management based on predetermined risk tolerance and financial goals. These algorithms analyze vast sets of market data, continuously optimizing asset allocation to maximize returns and minimize risks through diversification and rebalancing strategies. Discover how algorithm-driven robo advisors can complement or transform your investment approach with advanced technology.

Fees

Self-directed investing typically involves lower fees, primarily because investors manage their own trades without paying advisory costs, often resulting in reduced commission and expense ratios. Robo advisors charge an annual management fee ranging from 0.25% to 0.50%, which covers automated portfolio management and rebalancing services. Explore detailed comparisons to determine the best fee structure for your investment goals.

Source and External Links

Self-Directed Investing by First Citizens Investor Services - Commission-free online trading of US stocks and ETFs with no minimum balance required, offering full control and real-time investment management through a digital platform.

What is Self-Directed Investing? | U.S. Bancorp Investments - Self-directed investing lets you independently trade stocks, mutual funds, ETFs, and options online, choosing what, when, and how to buy or sell without relying on a financial advisor.

What is self-directed investing - and is it right for you? - Self-directed investing involves managing your own investment portfolio for flexibility and cost-efficiency, eliminating the need for a financial advisor's guidance.

dowidth.com

dowidth.com