Central bank digital currency (CBDC) represents a digital form of a country's official currency issued and regulated by the central bank, aiming to enhance payment efficiency and financial inclusion. E-money, on the other hand, refers to electronically stored monetary value issued by private entities, used primarily for online transactions and prepaid services. Explore the differences and implications of CBDC and e-money to understand their evolving roles in the financial ecosystem.

Why it is important

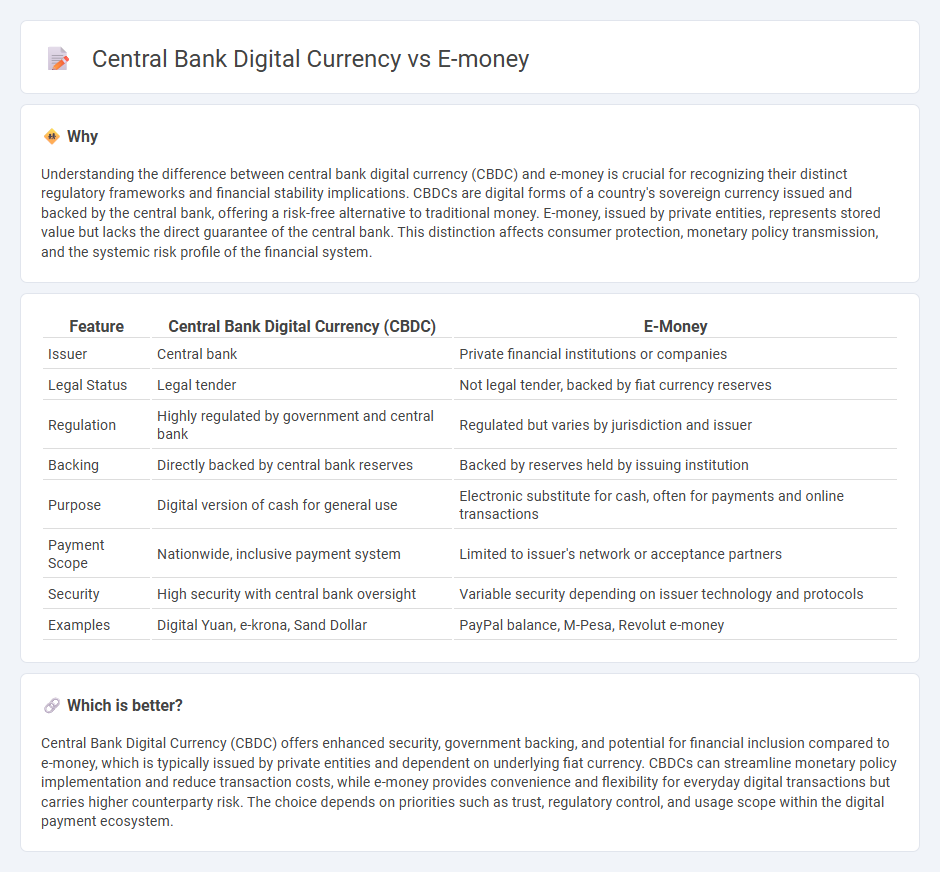

Understanding the difference between central bank digital currency (CBDC) and e-money is crucial for recognizing their distinct regulatory frameworks and financial stability implications. CBDCs are digital forms of a country's sovereign currency issued and backed by the central bank, offering a risk-free alternative to traditional money. E-money, issued by private entities, represents stored value but lacks the direct guarantee of the central bank. This distinction affects consumer protection, monetary policy transmission, and the systemic risk profile of the financial system.

Comparison Table

| Feature | Central Bank Digital Currency (CBDC) | E-Money |

|---|---|---|

| Issuer | Central bank | Private financial institutions or companies |

| Legal Status | Legal tender | Not legal tender, backed by fiat currency reserves |

| Regulation | Highly regulated by government and central bank | Regulated but varies by jurisdiction and issuer |

| Backing | Directly backed by central bank reserves | Backed by reserves held by issuing institution |

| Purpose | Digital version of cash for general use | Electronic substitute for cash, often for payments and online transactions |

| Payment Scope | Nationwide, inclusive payment system | Limited to issuer's network or acceptance partners |

| Security | High security with central bank oversight | Variable security depending on issuer technology and protocols |

| Examples | Digital Yuan, e-krona, Sand Dollar | PayPal balance, M-Pesa, Revolut e-money |

Which is better?

Central Bank Digital Currency (CBDC) offers enhanced security, government backing, and potential for financial inclusion compared to e-money, which is typically issued by private entities and dependent on underlying fiat currency. CBDCs can streamline monetary policy implementation and reduce transaction costs, while e-money provides convenience and flexibility for everyday digital transactions but carries higher counterparty risk. The choice depends on priorities such as trust, regulatory control, and usage scope within the digital payment ecosystem.

Connection

Central bank digital currency (CBDC) and e-money both represent digital forms of money that facilitate online transactions and financial inclusion, yet CBDC is issued and regulated directly by a nation's central bank, ensuring sovereign backing and stability. E-money, typically issued by private institutions, functions as a digital representation of fiat currency for payments and transfers but lacks central bank issuance, leading to differences in legal status and risk profiles. The connection lies in their roles within the digital payment ecosystem, as CBDCs can enhance the efficiency and trustworthiness of digital payments while e-money drives innovation and accessibility in everyday digital transactions.

Key Terms

Digital Wallet

E-money, typically issued by private companies, facilitates digital transactions stored in digital wallets, offering convenience and broad merchant acceptance but relying on underlying fiat currency reserves. Central Bank Digital Currency (CBDC) is government-backed digital money directly issued by the central bank, designed to enhance financial stability and provide secure, real-time settlement within digital wallets. Explore the evolving role of digital wallets in bridging e-money and CBDC ecosystems to understand their future impact on digital finance.

Issuer

E-money is typically issued by private financial institutions and stored electronically on prepaid cards or digital wallets, facilitating quick transactions without involving the central bank directly. Central Bank Digital Currency (CBDC), on the other hand, is issued and regulated exclusively by the nation's central bank, ensuring sovereign control over digital legal tender. Explore the differences in issuer roles and regulatory frameworks to understand their distinct impacts on the financial ecosystem.

Legal Tender

E-money, issued by private entities, functions as a digital representation of fiat currency but lacks the status of legal tender, meaning it is not compulsory for creditors to accept it for debt settlement. Central Bank Digital Currency (CBDC), issued by a nation's central bank, holds legal tender status, guaranteeing its acceptance for all forms of payment within the sovereignty. Explore the legal implications and distinctions further to understand how these digital currencies impact financial systems and regulatory frameworks.

Source and External Links

E-money - Finance - European Commission - Electronic money (e-money) is a digital alternative to cash used for cashless payments with money stored digitally on cards, phones, or online, with EU regulations promoting innovation, competition, and secure service access.

EMoney: The Most Powerful Financial Product Suite in the Industry - EMoney offers comprehensive, PCI compliant payment processing solutions for businesses, including point-of-sale, financial reporting, and customer engagement tools with flat pricing and 24/7 support.

E-Money and Monetary Policy Transmission - IMF Working Paper - E-money development can strengthen monetary policy transmission and financial inclusion, especially in countries with limited banking infrastructure, by improving financial services accessibility.

dowidth.com

dowidth.com