Digital wealth management leverages advanced algorithms and AI to offer personalized investment strategies with minimal human intervention, ensuring efficiency and scalability in portfolio management. Hybrid advisory combines automated solutions with expert human advisors to provide tailored financial guidance, enhancing the client experience with personalized insights and emotional intelligence. Explore the benefits and differences of digital and hybrid advisory models to optimize your investment approach.

Why it is important

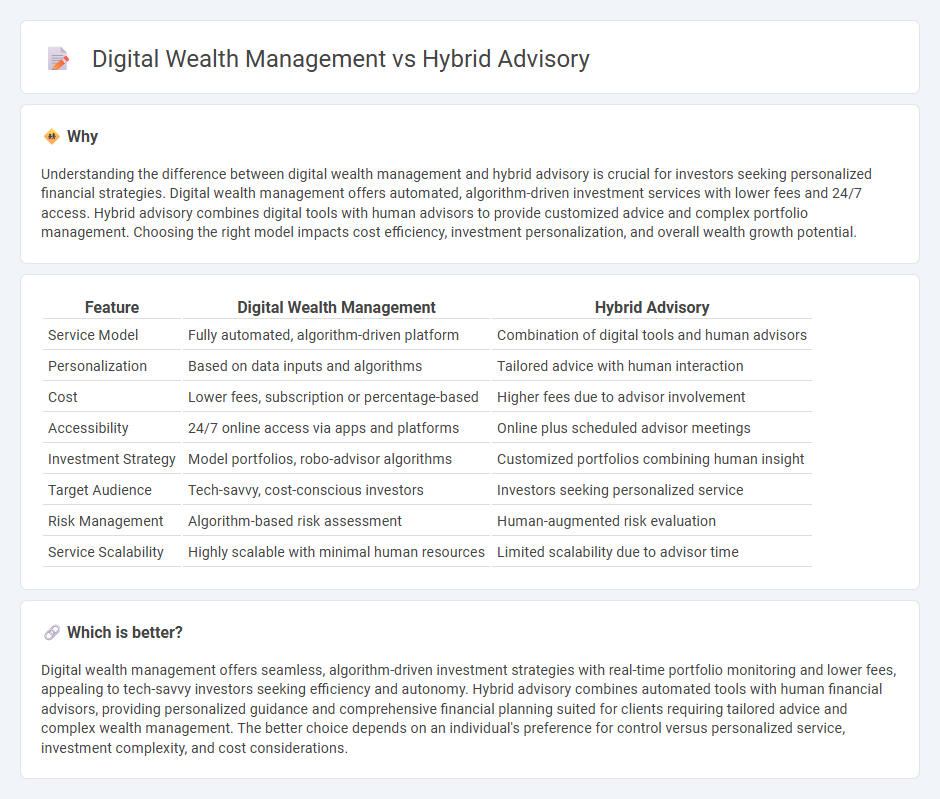

Understanding the difference between digital wealth management and hybrid advisory is crucial for investors seeking personalized financial strategies. Digital wealth management offers automated, algorithm-driven investment services with lower fees and 24/7 access. Hybrid advisory combines digital tools with human advisors to provide customized advice and complex portfolio management. Choosing the right model impacts cost efficiency, investment personalization, and overall wealth growth potential.

Comparison Table

| Feature | Digital Wealth Management | Hybrid Advisory |

|---|---|---|

| Service Model | Fully automated, algorithm-driven platform | Combination of digital tools and human advisors |

| Personalization | Based on data inputs and algorithms | Tailored advice with human interaction |

| Cost | Lower fees, subscription or percentage-based | Higher fees due to advisor involvement |

| Accessibility | 24/7 online access via apps and platforms | Online plus scheduled advisor meetings |

| Investment Strategy | Model portfolios, robo-advisor algorithms | Customized portfolios combining human insight |

| Target Audience | Tech-savvy, cost-conscious investors | Investors seeking personalized service |

| Risk Management | Algorithm-based risk assessment | Human-augmented risk evaluation |

| Service Scalability | Highly scalable with minimal human resources | Limited scalability due to advisor time |

Which is better?

Digital wealth management offers seamless, algorithm-driven investment strategies with real-time portfolio monitoring and lower fees, appealing to tech-savvy investors seeking efficiency and autonomy. Hybrid advisory combines automated tools with human financial advisors, providing personalized guidance and comprehensive financial planning suited for clients requiring tailored advice and complex wealth management. The better choice depends on an individual's preference for control versus personalized service, investment complexity, and cost considerations.

Connection

Digital wealth management integrates advanced algorithms and real-time data analytics to offer personalized investment strategies, while hybrid advisory combines automated tools with human financial advisors to enhance client experience. The connection between the two lies in their shared goal of optimizing portfolio management through technology-driven insights complemented by expert judgment. This synergy enables banks to deliver scalable, tailored wealth solutions that increase efficiency and client satisfaction.

Key Terms

Robo-advisors

Hybrid advisory combines automated Robo-advisor algorithms with personalized human financial guidance, offering a balanced approach to wealth management. Digital wealth management relies primarily on technology-driven platforms that provide algorithm-based portfolio management and investment strategies with minimal human intervention. Explore the evolving landscape of Robo-advisors to discover how technology enhances investment efficiency and client engagement.

Human financial advisors

Hybrid advisory combines the personalized expertise of human financial advisors with advanced technology to deliver tailored investment strategies, balancing emotional intelligence and data-driven insights. Digital wealth management relies primarily on algorithms and automated platforms to provide cost-effective, scalable portfolio management with minimal human interaction. Explore the benefits and differences to determine which approach best suits your financial goals and preferences.

Personalization

Hybrid advisory combines human financial advisors with automated digital tools, delivering tailored investment advice that adapts to individual client goals and market changes. Digital wealth management platforms leverage AI-driven algorithms to personalize portfolio management and risk assessment, ensuring efficient, data-backed investment decisions. Explore how personalization in hybrid advisory and digital wealth management can enhance your investment strategy.

Source and External Links

What is a Hybrid RIA? - Perennial Financial Services - A Hybrid Advisor is a financial professional registered as both a Registered Investment Advisor (RIA) and a Broker/Dealer (BD), enabling them to provide both fee-based fiduciary services and commission-based products, offering clients consolidated, comprehensive financial guidance with enhanced flexibility tailored to individual needs.

How hybrid advisory models are transforming the industry - Hybrid advisory models blend automated digital platforms (robo-advisors) with access to human financial advisors, combining technology-driven asset management with personalized advice to improve client engagement and reduce costs in wealth management.

Hybrid advisory for wealth management: is this the new revolution? - The hybrid-advisory model utilizes both digital innovation and traditional personal advisory, accelerated by the pandemic, to transform wealth management by delivering seamless, technology-augmented client experiences while preserving personal relationships.

dowidth.com

dowidth.com