Hyperpersonalization in banking leverages real-time customer data and advanced AI algorithms to tailor financial products, services, and experiences uniquely to individual clients. Prescriptive analytics goes beyond prediction by recommending optimal decisions and strategies based on complex data models, enabling banks to enhance operational efficiency and risk management. Explore the distinctions and benefits of hyperpersonalization and prescriptive analytics in transforming the future of banking.

Why it is important

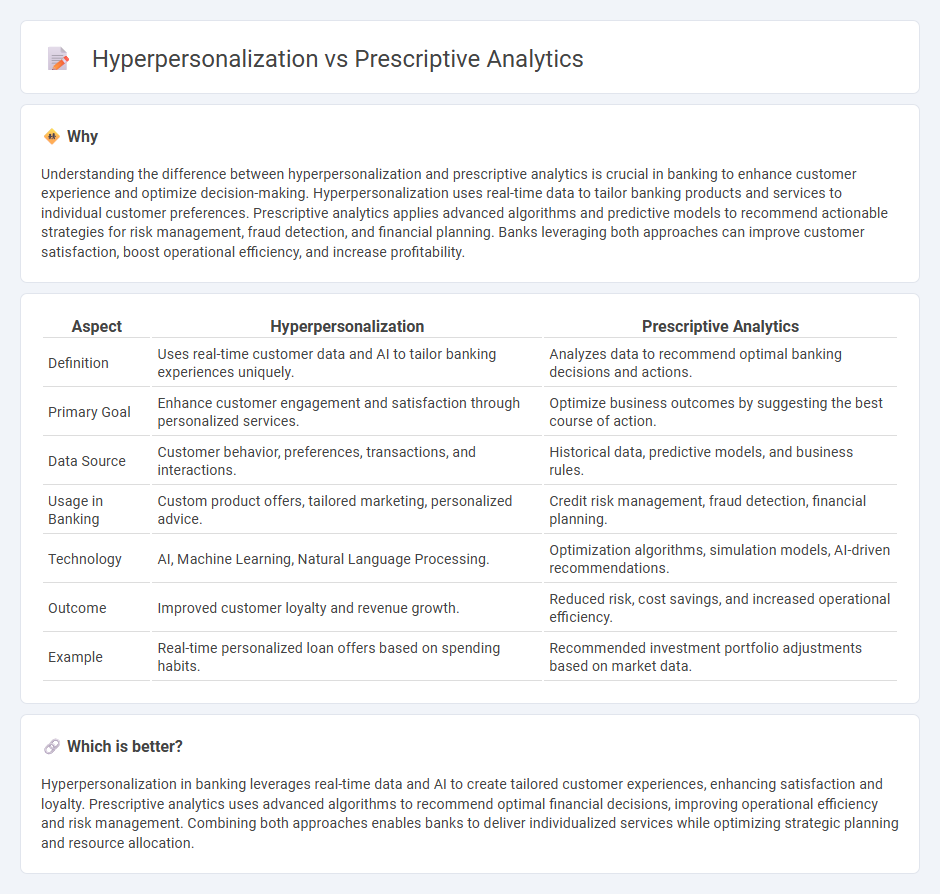

Understanding the difference between hyperpersonalization and prescriptive analytics is crucial in banking to enhance customer experience and optimize decision-making. Hyperpersonalization uses real-time data to tailor banking products and services to individual customer preferences. Prescriptive analytics applies advanced algorithms and predictive models to recommend actionable strategies for risk management, fraud detection, and financial planning. Banks leveraging both approaches can improve customer satisfaction, boost operational efficiency, and increase profitability.

Comparison Table

| Aspect | Hyperpersonalization | Prescriptive Analytics |

|---|---|---|

| Definition | Uses real-time customer data and AI to tailor banking experiences uniquely. | Analyzes data to recommend optimal banking decisions and actions. |

| Primary Goal | Enhance customer engagement and satisfaction through personalized services. | Optimize business outcomes by suggesting the best course of action. |

| Data Source | Customer behavior, preferences, transactions, and interactions. | Historical data, predictive models, and business rules. |

| Usage in Banking | Custom product offers, tailored marketing, personalized advice. | Credit risk management, fraud detection, financial planning. |

| Technology | AI, Machine Learning, Natural Language Processing. | Optimization algorithms, simulation models, AI-driven recommendations. |

| Outcome | Improved customer loyalty and revenue growth. | Reduced risk, cost savings, and increased operational efficiency. |

| Example | Real-time personalized loan offers based on spending habits. | Recommended investment portfolio adjustments based on market data. |

Which is better?

Hyperpersonalization in banking leverages real-time data and AI to create tailored customer experiences, enhancing satisfaction and loyalty. Prescriptive analytics uses advanced algorithms to recommend optimal financial decisions, improving operational efficiency and risk management. Combining both approaches enables banks to deliver individualized services while optimizing strategic planning and resource allocation.

Connection

Hyperpersonalization in banking leverages prescriptive analytics to deliver tailored financial products and services based on individual customer behaviors and preferences. By analyzing vast amounts of transactional data and customer interactions, prescriptive analytics recommends optimal actions that enhance customer satisfaction and loyalty. This connection enables banks to predict customer needs accurately and offer real-time, personalized solutions that drive engagement and profitability.

Key Terms

Decision Optimization

Prescriptive analytics leverages advanced algorithms and data models to recommend specific actions that optimize decision-making processes, enhancing efficiency and outcomes. Hyperpersonalization utilizes real-time data and AI to tailor experiences and communications at an individual level, driving engagement and customer satisfaction. Explore how integrating prescriptive analytics with hyperpersonalization strategies can transform decision optimization in your business.

Real-time Personalization

Prescriptive analytics leverages advanced algorithms and real-time data to recommend specific actions that optimize customer experiences and business outcomes. Hyperpersonalization uses real-time personalization techniques driven by AI and behavioral data to deliver highly tailored content and offers at the individual level. Explore how these technologies converge to transform customer engagement in dynamic environments.

Customer Journey Mapping

Prescriptive analytics uses data-driven algorithms to recommend optimal actions throughout the customer journey, enhancing decision-making processes and improving overall experience. Hyperpersonalization leverages real-time data and AI to tailor interactions uniquely to each customer at every touchpoint, increasing engagement and loyalty. Explore how integrating these strategies can revolutionize your customer journey mapping for superior outcomes.

Source and External Links

What Is Prescriptive Analytics? Definition and Examples - Prescriptive analytics uses advanced algorithms, often powered by machine learning, to synthesize insights from descriptive, diagnostic, and predictive analytics and provide specific recommendations on what actions to take next.

What Is Prescriptive Analytics? | IBM - Prescriptive analytics analyzes data to identify patterns, make predictions, and determine optimal courses of action, answering the question "What should we do next?" to achieve desired outcomes or prevent undesirable ones.

Prescriptive Analytics: Definitions, Benefits, Challenges - Prescriptive analytics is a statistical method that uses data from descriptive and predictive analytics to recommend the best possible actions for a scenario, focusing on actionable insights rather than just monitoring data.

dowidth.com

dowidth.com