Finfluencers are financial influencers who leverage social media to provide investment advice, market insights, and personal finance tips, reaching millions of users seeking accessible banking knowledge. Digital banking platforms offer seamless online services such as mobile banking, instant payments, and AI-driven financial management tools, catering to the growing demand for convenience and efficiency in banking. Explore how finfluencers and digital banking platforms transform traditional banking landscapes and empower modern consumers.

Why it is important

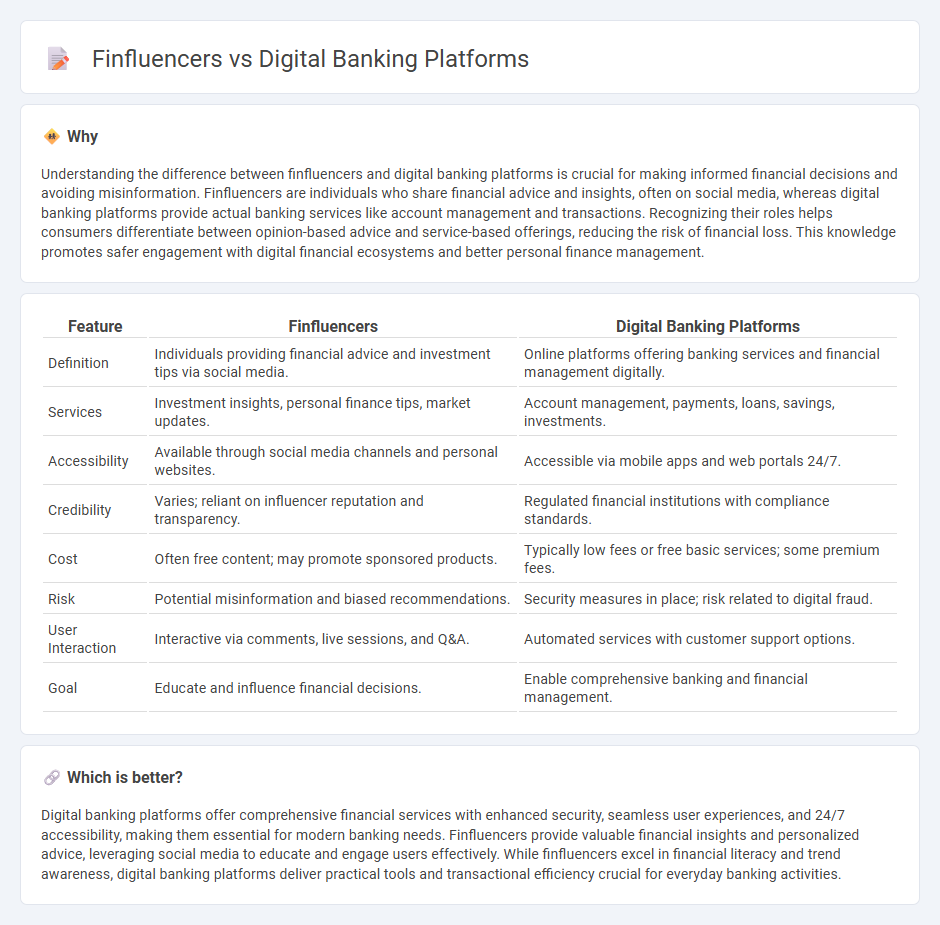

Understanding the difference between finfluencers and digital banking platforms is crucial for making informed financial decisions and avoiding misinformation. Finfluencers are individuals who share financial advice and insights, often on social media, whereas digital banking platforms provide actual banking services like account management and transactions. Recognizing their roles helps consumers differentiate between opinion-based advice and service-based offerings, reducing the risk of financial loss. This knowledge promotes safer engagement with digital financial ecosystems and better personal finance management.

Comparison Table

| Feature | Finfluencers | Digital Banking Platforms |

|---|---|---|

| Definition | Individuals providing financial advice and investment tips via social media. | Online platforms offering banking services and financial management digitally. |

| Services | Investment insights, personal finance tips, market updates. | Account management, payments, loans, savings, investments. |

| Accessibility | Available through social media channels and personal websites. | Accessible via mobile apps and web portals 24/7. |

| Credibility | Varies; reliant on influencer reputation and transparency. | Regulated financial institutions with compliance standards. |

| Cost | Often free content; may promote sponsored products. | Typically low fees or free basic services; some premium fees. |

| Risk | Potential misinformation and biased recommendations. | Security measures in place; risk related to digital fraud. |

| User Interaction | Interactive via comments, live sessions, and Q&A. | Automated services with customer support options. |

| Goal | Educate and influence financial decisions. | Enable comprehensive banking and financial management. |

Which is better?

Digital banking platforms offer comprehensive financial services with enhanced security, seamless user experiences, and 24/7 accessibility, making them essential for modern banking needs. Finfluencers provide valuable financial insights and personalized advice, leveraging social media to educate and engage users effectively. While finfluencers excel in financial literacy and trend awareness, digital banking platforms deliver practical tools and transactional efficiency crucial for everyday banking activities.

Connection

Finfluencers leverage digital banking platforms to provide real-time financial guidance and personalized banking solutions, enhancing user engagement and financial literacy. Digital banking platforms integrate social media analytics and influencer marketing to expand their customer base while promoting innovative financial products. This symbiotic relationship accelerates the adoption of digital banking services and empowers consumers through accessible, influencer-driven financial education.

Key Terms

API Integration

Digital banking platforms leverage API integration to enable seamless connectivity with third-party services, enhancing user experience through real-time data exchange and personalized financial tools. Finfluencers, by contrast, utilize APIs to access financial data, enabling them to provide tailored advice, analyze market trends, and offer interactive content to their audience. Discover how API integration is revolutionizing financial ecosystems and driving innovation by exploring more insights.

User Engagement

Digital banking platforms leverage personalized interfaces and seamless transaction capabilities to enhance user engagement, driving customer loyalty and retention. Finfluencers utilize social media channels and interactive content to educate and motivate audiences, fostering community and trust around financial topics. Discover how these approaches redefine user experiences and influence financial decision-making in today's digital landscape.

Financial Literacy

Digital banking platforms provide user-friendly tools and resources that enhance financial literacy by offering real-time insights, budgeting features, and personalized financial advice. Finfluencers leverage social media to simplify complex financial concepts, engage diverse audiences, and promote smart money management tips that complement traditional banking education. Explore the evolving role of both to master effective financial literacy strategies.

Source and External Links

Top 8 Digital Banking Platforms in 2025 - Creatio - Presents leading platforms like Oracle, Sopra, and nCino, highlighting features such as Oracle's modular SaaS solutions, Sopra's cloud-based payment processing, and nCino's AI-powered loan and account management systems.

Best Digital Banking Platforms Reviews 2025 | Gartner Peer Insights - Reviews several platforms including ebankIT for omnichannel experiences, Intellect Digital Face for API-based banking products, and Temenos for universal banking solutions targeting banks and fintechs.

Digital Banking: 2025 Market Overview, Trends & Insights - Discusses SDK.finance's white-label digital banking software enabling rapid market entry with features like digital wallets, payment processing, KYC, AML compliance, and extensive back-office tools.

dowidth.com

dowidth.com